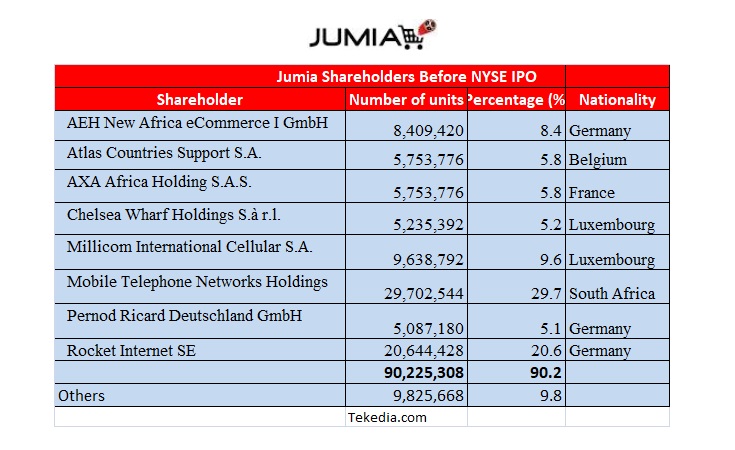

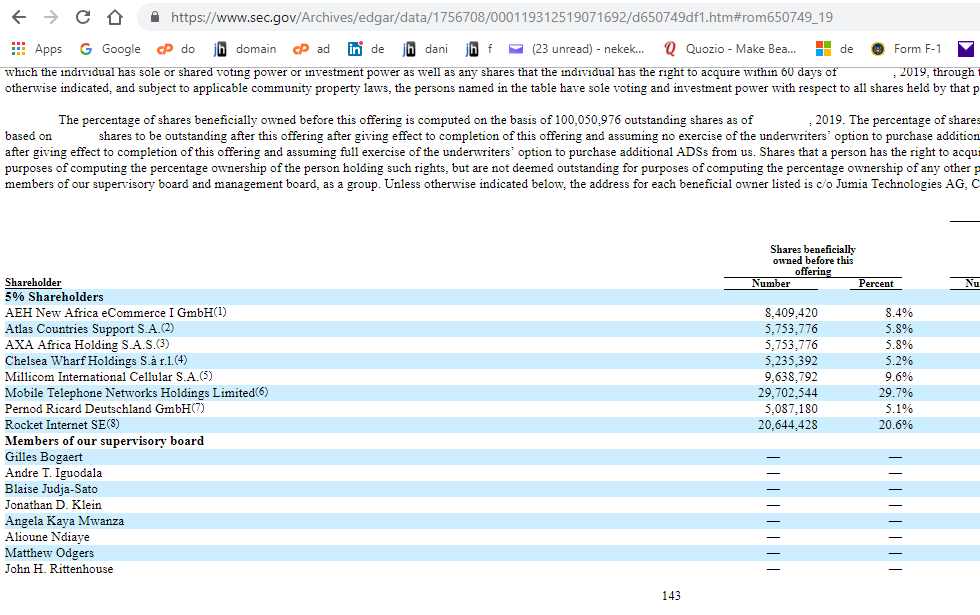

Before listing on the NYSE, Jumia had 100,050,976 outstanding shares. The breakdown is as follows:

| Shareholder | Number of units | Percentage (%) | Nationality |

| AEH New Africa eCommerce I GmbH | 8,409,420 | 8.4 | Germany |

| Atlas Countries Support S.A. | 5,753,776 | 5.8 | Belgium |

| AXA Africa Holding S.A.S. | 5,753,776 | 5.8 | France |

| Chelsea Wharf Holdings S.à r.l. | 5,235,392 | 5.2 | Luxembourg |

| Millicom International Cellular S.A. | 9,638,792 | 9.6 | Luxembourg |

| Mobile Telephone Networks Holdings Limited | 29,702,544 | 29.7 | South Africa |

| Pernod Ricard Deutschland GmbH | 5,087,180 | 5.1 | Germany |

| Rocket Internet SE | 20,644,428 | 20.6 | Germany |

| 90,225,308 | 90.2 | ||

| Others | 9,825,668 | 9.8 |

Shares beneficially owned before this offering

MTN Holdings (Mobile Telephone Networks Holdings) had the largest share at 29.7%. At Friday’s valuation of $3.9 billion in the NYSE, the “Others”, at 9.8%, will translate to about $380 million. I expect a big component of that to be employee-controlled. Largely, there are a couple of millionaires therein. They will need bodyguards in many Jumia offices (lol).

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Source of numbers: Jumia NYSE filing.

Jumia is making its money, some of us will help people understand it and get our own. My first presentation on Jumia Playbook is scheduled May 2, 2019 in Lagos. Our slides are updated because there is a real market validation of many hypotheses. Yes, for the first time, the world had agreed that an African operating entity with no profit can be given opportunities to rise!

LinkedIn Comment on Feed

So, by nationality, Germans and South Africans are competing for largest shareholders position, while Nigerians seem to be interested in buying lands and closing water to build new estates…

There are many ways to create massive wealth, but we have remained traditional in our approach, largely putting money on things with linear growth models anyway. It is this lack of foresight that make locals to believe that foreign companies are here to “rip them off”, but when you invest heavily in these entities, and somehow the “rip off” begins, big chunks will obviously find their way to your bank account.

As long as money remains a global citizen, you must explore ways to grow yours bigger, now Jumia has led the way; African based businesses can now rub shoulders with the big boys!

Jumia Surged 75%, Hits $3.9 Billion Cap on First Trading Day on NYSE

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube