Japan’s FSA – Financial Services Agency – warned four cryptocurrency exchanges, including Bybit, for operating without official registration. The warning letter, issued on Friday, affected Bitforex, MEXC Global, and Bitget.

The island nation usually implements a softer approach to regulating crypto and has yet to crack down on the industry as hard as other countries, like the U.S.

Bybit received a previous warning in May 2021 from the FSA for operating without a license. The crypto exchange also received notices from Canada and suspended USD deposits for customers since the 10th of March.

The recent move shows a global push to ramp up legislation worldwide to avoid incidents like the FTX debacle or Terra’s price crash. Japan’s peers like Thailand and Singapore have taken differing stances, either opting to encourage investment or to clamp down hard on the industry.

Japan remains heavily invested in cryptocurrency legislation. The Southeast Asian country has turned to the U.S. and the EU to regulate crypto banks. Other notable developments include an official stablecoin bill and a Progmat Coin, a yen-backed stablecoin that will be used to streamline settlement processes.

So far, the country has only chosen to intervene in cryptocurrency markets if they were connected to matters of global crises like the Russian-Ukraine war. When it became apparent that Russians were using digital assets to enhance and protect their wealth, Japanese authorities ordered crypto exchanges in March last year not to process any transactions with crypto-assets subject to sanctions against Ukraine and Belarus. This was directly because of the war in Ukraine.

The FSA enforced the rule through a 3-year jail sentence or a 1 million yen fine. Apart from these select instances, Japan’s approach remains lenient. After the FTX fallout, Japan planned to make it easier for cryptocurrency exchanges to list tokens.

In 2022’s end (28th of December), the body governing crypto exchanges informed companies of a new rule where they could list coins without a pre-screening unless they were completely new to Japan.

Overall, Japan will continue providing crypto firms with the freedom to operate. But as events unfold, their stance on the industry is always open to change.

Big Eyes Coin Could Be The Winning Meme-Coin In Your Portfolio

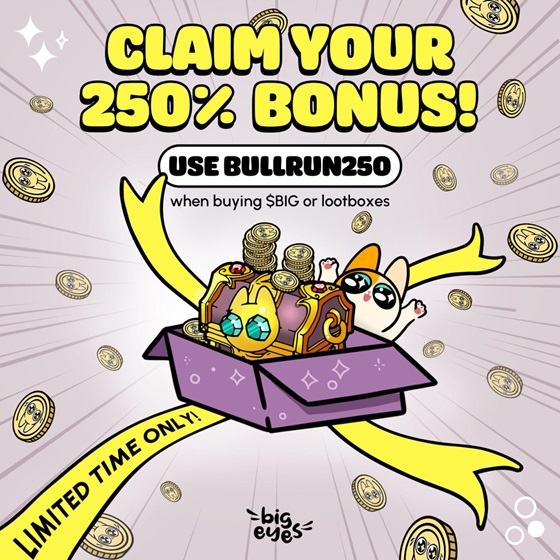

Big Eyes Coin presents a rare investment opportunity for venture capitalists, offering a well-defined ecosystem where users can buy cutesy cat NFTs, purchase loot boxes with huge prizes, and participate in environmental initiatives.

Investing in this coin allows you to preserve the ocean’s health since 5% of all tokens will be devoted to this cause. Watch out for this meme coin’s loot boxes. Purchasing one of them could improve your returns by 5000%.

For more information on Big Eyes Coin (BIG) click below:

Presale: https://buy.bigeyes.space/

Website: https://bigeyes.space/

Telegram: https://t.me/BIGEYESOFFICIAL