Co-author: John Azubuike (@jnazubuike), KEC Ventures.

Note: This article does not necessarily reflect the opinion of KEC Ventures, or of other members of the KEC Ventures team.

Introduction

In 2015, the United States freight trucking industry collected gross revenues of $726.4 billion. That accounted for approximately 82% of the total for freight carriers. The freight trucking market is so large because trucks play a critical role in moving merchandise of all kinds between points of production and points of consumption. They also move merchandise between different types of freight carriers – rail, maritime, air.

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

This post synthesizes what we have learned about the industry since Brian started becoming interested in startups trying to solve problems for the United States trucking market in the summer of 2014, and since John joined KEC Ventures a year later.

In the rest of this discussion, we will refer to “startups” as distinct from “companies”. To ensure we are on the same page;

- A startup is a temporary organization built to search for the solution to a problem, and in the process to find a repeatable, scalable and profitable business model that is designed for incredibly fast growth. The defining characteristic of a startup is that of experimentation – in order to have a chance of survival every startup has to be good at performing the experiments that are necessary for the discovery of a successful business model.

- A company is what a startup becomes once it has successfully navigated the discovery phase of its lifecycle. This is the phase during which relatively fixed organizational structures start being built in order to facilitate the firm’s work on behalf of its customers, employees, shareholders, business partners, and society.

KEC Ventures invests in early stage startups. Therefore our primary purpose in studying the freight trucking market is to gain adequate context for the instances when we might assess startups trying to solve problems in this market. We have not yet made an investment in any of the startups in this market.

In the rest of this post we;

- Describe the freight trucking market,

- Discuss its market structure,

- Describe the economics of operating within the market,

- Describe and discuss the opportunities that startups are pursuing, and finally we

- Discuss some threats such startups might encounter.

Writing this post is primarily an exercise in documenting what we know in order to identify gaps in our knowledge so that we can fill in those gaps. So if we have missed anything please let us know. If you are building a seed stage startup in this market we would love to hear from you. If there are companies we have not heard of yet, we would love to know that too. You can leave a comment in the comments section below, or you can email us directly;

- Brian – [email protected], or

- John – [email protected].

What Is Freight Trucking?

Freight trucking comprises the handling and transportation of goods of all kinds – providing an important link between producers and consumers. There is an industry adage: “If you bought it, a truck brought it.”

The market can be segmented as follows;

For-Hire: This segment of the market is made up of companies that provide freight trucking services to other companies for compensation. Participants in the for-hire trucking market are subject to state and federal regulation in the United States.

In-house: In-house freight trucking keeps freight trucking within the confines of a company’s business model rather than outsourcing that activity to a for-hire trucking company.

Truckload (TL): This form of freight trucking involves the movement of merchandise that fills an entire truck container.

Less-Than-Truckload (LTL): This form of freight trucking involves the movement of merchandise is too small to fill an entire truck. This means that a number of shipments for different customers can be combined to fill a truck, and the cost of transporting the merchandise is apportioned among the different customers. LTL can be further categorized into parcel carriers and dry van shipping. Parcel carriers carry merchandise made up of units weighing 150 lbs or less. Dry van freight involves shipping merchandise in a standard trailer that is adequate for shipping many different types of good and merchandise.

Find more statistics at Statista

General: This form of freight trucking involves the movement of any merchandise that does not require specialized equipment.

Specialized: This form of freight trucking requires specialized equipment to move merchandise. Some examples; flatbed trucks, tankers, refrigerated trucks, and hazmat trucks.

Find more statistics at Statista

Local: This form of freight trucking restricts activity to within a metropolitan area. Local trucking services are characterized by same-day trips, or by trips serving a region within a 150-mile radius of the freight trucker’s operating base.

Find more statistics at Statista

Long-Distance: This form of freight trucking provides freight services between multiple metropolitan areas, and often crossing several states. Long-distance truckers generally serve regions that are beyond a 250-mile radius of the freight trucker’s operating base.

Find more statistics at Statista

Intermodal: This involves equipment that can shift between different modes of freight transportation without the need to directly handle the merchandise that is being transported. In this case, merchandise is containerised to make it easy to move from ship to rail to truck for example. Intermodal freight trucking interacts with container ships, railways, cargo aircraft, pipelines, and barges. Intermodal freight trucking is critical in the formation of land bridges.

How Is The Trucking Industry Structured?

According to the American Trucking Association’s Trucking Trends 2015 the United States’s trucking market is characterized by the following statistics:

- In 2015, trucks moved 10.49 billion tons, or 70.1%, of all domestic freight.

- Freight trucking collected $726.4 billion in revenues, accounting for 81.5% of all freight transportation spending in 2015.

- There were 3.63 million Class 8 trucks in operation in 2015.1

- The industry employs more than 3 million truck drivers.

Approximately 80% of all trucks in the trucking market belong to fleets with 50 trucks or fewer, 97% belong to fleets of 20 trucks or less, and 90% of the market is represented by fleets with 6 trucks or less. Estimates suggest that there may be as many as 1,200,000 companies in the US trucking market. The largest 50 companies account for 40% of total industry revenues. Owner-operators represent about 10% of drivers in the trucking industry.2

About 50% of the freight trucking market operates in the for-hire segment. We assume that the vast majority of owner-operators exist in the for-hire segment. Roughly 15% of the for-hire freight market is LTL, while the remaining 85% is TL.

Brokers serve as a liaison between shippers and carriers by matching the unique needs of the shipper with a registered freight trucking carrier capable of fulfilling the shipper’s needs within established and agreed constraints. By some estimates, truck freight brokers earn as much as $50 billion or more in revenues each year.

What Are The Economics Of The Trucking Industry?

Freight trucking is a challenging business that is characterized by net margins of 7% or less, with most carriers earning margins of about 5%. The main operating expenses that carriers have to contend with are;3

- Fuel Costs: 34.2%

- Truck/Trailer Payments: 12.6%

- Repair & Maintenance: 9.3%

- Truck Insurance Premiums: 4.2%

- Permits & Licenses: 1.1%

- Tires: 2.6%

- Tolls: 1.3%

- Driver Wages: 27.1%

- Driver Benefits: 7.6%

Other cost-drivers in the trucking industry include;

- Driver shortages and workforce retention issues,

- Federal and state transportation regulations,

- Environmental regulations, and

- Technology for fleet management.

What Opportunities Are Startups Pursuing?

Startups are pursuing opportunities in the freight trucking industry for a number of reasons;

- First, it is a huge market.

- Second, industry outsiders perceive it to be highly inefficient and hence, ripe for “disruption”.

- Third, from a technologist’s perspective, there’s a lot of room to apply technology to fleet management and operations, freight brokerage, and compliance.

- Fourth, it is highly fragmented – making it an attractive candidate for the types of software platforms that have already transformed the way business is done in other markets.

Before we discuss the opportunities that startups are pursuing, it may help to get a sense of the investment landscape in which such startups are competing for capital.

Based on the data from CBInsights in the 2 charts that follow, we see that there has been a significant increase in the aggregate amount of capital investors have deployed into startups in the freight trucking market each year since 2009. We also see that this trend is reflected in the average and median deal size, respectively. The data is as of mid-November 2016.

Funding to trucking startups has steadily increased YoY since ’09 and is up more than 27% since 2015.

To put the data from CB Insights in context, a quick search on AngelList yields 149 startups described as “trucking startups” with 522 investors. A cursory inspection of that list suggests that most are based in the United States, with a few in other parts of the world such as the United Kingdon, India, Canada, the Middle East, Bulgaria, Germany, and Brazil – the opportunity is global.

Some of the more notable investors in freight trucking startups include; the United States Energy Department’s Advanced Research Projects Agency – Energy (ARPA-E), SandHill Angels, Band of Angels, Nokia Growth Partners, Intel Capital, UPS Strategic Enterprise Fund, Volvo Group Venture Capital, Institutional Venture Partners, Pritzker Group Venture Capital, Kleiner Perkins Caufield & Byers, GM Ventures, Capital One Financial, Wells Fargo & Company, Google Ventures, Index Ventures, Sequoia Capital, Harrison Metal, Accel Partners, DFJ Growth Fund, Draper Fisher Jurvetson, Andreessen Horowitz, Bessemer Venture Partners, FirstMark Capital, Fidelity Investments, SV Angel, Goldman Sachs, Lowercase Capital Benchmark, First Round Capital, Industry Ventures, Wellington Management, Founder Collective, BlackRock . . . etcetera etcetera – investors believe that big companies will emerge from the startups in this market.

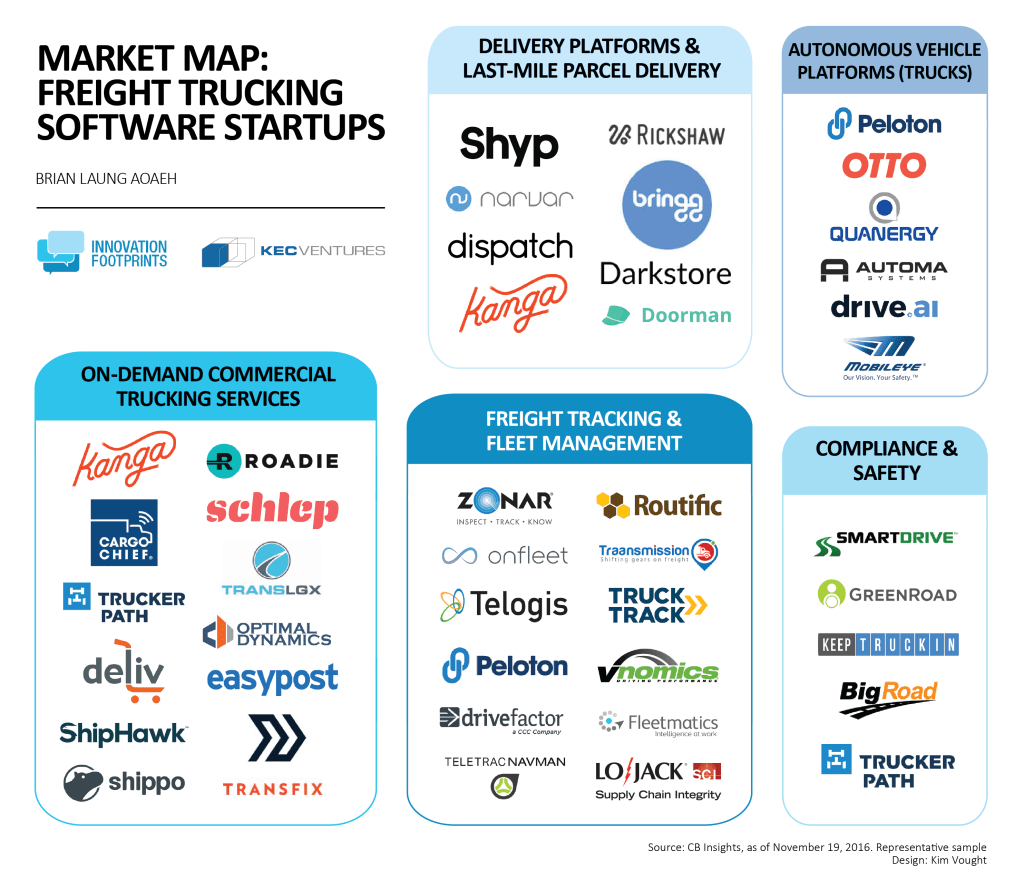

Broadly, the following categorizations can be used to discuss the areas in which startups are most active.4

- On-demand Commercial Trucking Services: These startups match shippers directly with carriers by cutting out the freight brokers who act as middlemen in the industry. Brokers can command fees as high as 40%, or more, of each transaction. Also, the process by which a broker connects a shipper with a carrier is manual and time-consuming. On-demand trucking startups build apps that promise to remove the inefficiencies that arise from dealing with a broker. Typically such startups say they are “disrupting” the truck freight brokerage market. Some of the startups in this category are; Convoy, Cargomatic, Cargo Chief, Deliv, Keychain Logistics, Kanga, Optimal Dynamics, RenRen Kuaidi, Roadie, Schlep, and Transfix.5

- Freight Tracking & Fleet Management: These startups provide telematics solutions that enable truck fleet operators to track the location of vehicles in their fleet in order to increase the overall efficiency of their operations. Some of the startups/companies in this category are; Fleetmatics, Telogis, Teletrac, Cloudmade, Drivefactor, Peloton Technology, OmniTracs, OnFleet, Convey, Supply Chain Integrity, Traansmission. The product that truckers pay for is often a bundle of hardware and software, with a monthly subscription for the software.

- Compliance & Safety: These startups provide hardware and software products that enable freight truck operators comply with state and federal regulations in the United States. The benefit to fleet operators is that these products minimize the number of times a fleet is found non-compliant. They do this through; Compliance related safety reporting and monitoring at the individual driver level, compliance related safety reporting and monitoring at the fleet-wide level, and efficient reporting and monitoring through the reduction of paper and pencil record-keeping, and the creation of electronic audit trails for safety and compliance. Non-compliance can result in the grounding of an entire fleet while the operator tries to fix the problem identified by regulators. Some of the startups in this category are; Big Road, Keep Truckin, Trucker Path, GreenRoad Technology, SmartDrive Systems. The product that truckers pay for is often a bundle of hardware and software, with a monthly subscription for the software.

- Delivery Platforms & Last-Mile Parcel Delivery: These startups build platforms for large enterprises and for small-and-medium sized businesses to enable them to offer shipping price comparisons, on-demand pick-up and delivery, and other services related to shipping merchandise and products to end-use customers. Some of the startups in this category are Darkstore, Dispatch, Kanga, Doorman, Rickshaw, Bringg, Narvar, Shyp.

- Autonomous Vehicle Platforms (Trucks): These startups develop and build automation technologies and platforms for the trucking industry with the goal of lowering costs, improving safety, and generally increasing efficiency and productivity in the freight trucking industry. Typically, a software-focused startup partners with an established truck manufacturer to build and test a self-driving system. The Chinese government is encouraging this nascent market as a means of tackling some of the problems that confront its freight trucking industry, where, for example, driver-related costs account for about 40% of operating expenses. According to CB Insights, the following startups fall in this category; Mobileye, Otto – which was acquired by Uber, Peloton Technology, Drive.ai, Quanergy Systems.

First Analysis Securities Corporation estimates that:6

- Fleet management software generates about $5.5 billion of revenue globally, with growth estimated at 21% compounded annually between now and 2023, bringing the market size to $37 billion in 2023.

- Fleet management software in the United States generates about $1.6 billion of revenue, with growth estimated at 19% compounded annually till 2023, growing to $8.6 billion.

- They estimate a theoretical global market size of $92 billion and $11 billion for the global and US markets respectively, suggesting 6% and 14% penetration in those markets respectively.

Threats

To a naive observer, the opportunities in the freight trucking market appear ripe for the taking of early stage startup companies intent on “disrupting” it. Moreover, it would also appear that incumbent players in that market are slow, lumbering, and clumsy organizations incapable of keeping up with the threat that startups pose. While some of that is true, there exist a number of threats that might take some early-stage startups and their investors by surprise. Below, a broad outline of those threats that we pay the most attention to when we encounter such startups.

Nice-to-Have or Necessity?

As a result of the thin margins earned by freight truck operators, products targeted for sale to owners of truck fleets must be seen as necessary for ongoing operations as a result of regulatory changes, or as a demonstrable catalyst for increased profitability. In the latter case, the startup that seeks to sell the product must be in a position to quickly provide a return-on-investment to a fleet operator after the decision has been made to adopt the new product. Closely related to this is the issue of ease of use; Can individual truck drivers or fleet managers learn how to use the product quickly, with little or no training? In markets that have frontline workforce characteristics similar to that of the freight trucking market, psychological lock-in to incumbent products is extremely strong. As a result, attention to UI and UX design is an important determinant of success or failure.

As an example; The Federal Motor Carrier Safety Administration (FMCSA) enacted a regulatory change in December 2015 that mandates and requires automatic electronic logging devices on all commercial vehicles. All trucks have to become compliant within 24 months of the adoption of the new rule. Industry estimates are that 125,000 – 150,000 trucks need to be brought into compliance every month during that 24-month grace period. Once the grace period ends, noncompliance will incur fines and other penalties that could go as far as the grounding of entire fleets for each incidence of noncompliance that inspectors discover.

Trustworthy or Trustless?

The insistence by early stage startups that they will “disrupt” the freight brokerage market overlooks the most important function brokers play; They are arbiters of trust between shippers and truck operators. By using a broker, the shipper outsources the headache of vetting the freight truck operator to whom the shipper’s merchandise will be entrusted while it travels between locations. Furthermore, brokers and shippers have completely aligned interests since both groups stand to suffer adverse consequences if misbehaving truck operators are allowed to remain in business without the implied threat that they stand to lose a significant amount of business. It is not clear if shippers feel that their interests are aligned in the same way, or as strongly, with the interests of truck operators.

Startups pursuing a business model predicated on eliminating freight brokers need to have thought about how they will solve this problem, or if they will solve it at all.

Truckers have a love-hate relationship with brokers. But what I learned is—brokers aren’t going anywhere anytime soon because brokers own and manage the relationship with shippers. And a point that cannot be overstated—shippers, too, have complete faith in and reliance upon their brokers.

– Jason Cahill, Why The WSJ’s “Reinventing the Trucking Industry” story got it wrong. Jason is the founder of Traansmission, a Brooklyn, NY-based startup in the freight trucking market.

By some estimates the freight brokerage market is worth more than $50 billion in annual revenues. Given the popular perception that brokers are an unnecessary part of the industry, we expect that several startups will continue trying to eliminate brokers altogether.

Will The Startup Solve The Dynamic Assignment Problem?

The dynamic assignment problem arises when customer demands for a service arrive continuously and randomly over a period of time, requiring a dispatcher to assign and send a service agent to satisfy each demand request. The number of service agents is limited relative to the potential number of random customer demands. The fulfillment of each task imposes a cost on the dispatcher, and extreme surpluses or shortages of tasks or service agents impose system-wide costs that can result in system-wide failures.

The dynamic assignment problem is a resource allocation problem. More specifically, it is a problem of allocating resources in an optimal manner, given uncertain conditions.

It should not be difficult to see why this problem arises in the freight trucking market. On one hand, shippers randomly demand freight services, to move merchandise between locations. On the other hand, freight carriers must satisfy that demand in a manner that maintains trust and meets shippers’ expectations.

The Stochastic Optimization Approach

Professor Warren Powell of the Computational Stochastic Optimization and Learning (CASTLE) Labs at Princeton University has studied the problem of optimization under uncertainty extensively. Specifically, the Transportation and Logistics Laboratory at CASTLE Labs has been working on trying to solve this problem for those markets since 1981. Their work spans stochastic fleet management in trucking, rail and air, real-time dispatching, routing and scheduling, and spare parts management, among others.

In his paper; A Stochastic Formulation of the Dynamic Assignment Problem, with an Application to Truckload Motor Carriers, he delineates the dynamic assignment problem in freight trucking into a supply management problem and a demand management problem.

The supply management problem is a capacity management problem related to serving the customer – in this case, the shipper. To solve this problem, fleet operators must;

- Assign different drivers to handle different shipping requests,

- Reposition idle drivers and trucks from one region to another in anticipation of future shipping requests,

- Determine how a load of merchandise should be handled once it has been picked up by a driver – move the load directly to its destination, hold it temporarily till a new driver can be assigned to move it to its final destination, or move it to its final destination using a relay network of drivers.

- Manage the flow and inventory of trailers that will be needed to move freight.

It should be obvious that driver management is an important dimension of the capacity management problem. This observation is further supported by the fact that driver-related costs account for 34.7% of the operating costs of a truck. Solving the driver management requires giving consideration to;

- Driver work rules,

- Driver pay,

- Returning drivers home,

- Driver skills, and

- Driver quality.

The demand management problem arises because the shipper calls the carrier, or vice versa. Prof. Powell divides shippers into 3 broad categories;

- Primary shippers – the carrier has an obligation to move any merchandise that the shipper needs moved,

- Secondary shippers – the truck operator is obligated to move merchandise for that shipper only in certain traffic lanes, e.g. only southeast freight, and

- Tertiary shippers – the carrier may accept or reject a request to move the shippers merchandise.

To solve the demand management problem, carriers must solve for 2 aspects of the fleet management problem;

- Load acceptance or rejection, based on real-time capacity constraints or fleet-balance considerations, and

- Load solicitation, to correct short-term surplus capacity in certain regions that the carrier serves.

Solving the fleet management problem requires that carriers have a means of quickly;

- Assessing the profitability of loads tendered by secondary and tertiary shippers – “spot” loads as they are known in the industry,

- Anticipate areas of surplus or shortage within the carriers’ fleet of trucks, and

- Make trade-offs between current and future demand, especially if future demand may come from a primary shipper.

Given the low-margin nature of this business, it is not difficult to see why these considerations matter. The difference between a year that ends in the black and one that ends in the red may amount to relatively no more than a few loads of merchandise.7 A product that solves the profitability problem and the optimization problem has superior chances of surviving the vagaries of this industry. This suggests that a startup that incorporates stochastic optimization into its freight trucking platform has a better chance of success over the long term than its counterparts that do not.

You can read more about the work being done at CASTLE Labs on this application of stochastic optimization in the papers listed below;

- An Approximate Dynamic Programming Algorithm for Large-Scale Fleet Management: A Case Application

- Approximate Dynamic Programming Captures Fleet Operations for Schneider National

- Sensitivity Analysis of a Dynamic Fleet Management Model Using Approximate Dynamic Programming

- Incorporating Pricing Decisions into the Stochastic Dynamic Fleet Management Problem

The Contract Theory Approach – Real Options

Professor Warren Powell’s approach is one way to solve the dynamic assignment problem. Another approach is proposed by Mei-Ting Tsai, Jean-Daniel Saphores, and Amelia Regan in Freight Transportation Under Uncertainty. This approach applies concepts from financial derivatives markets and real options theory to craft Truckload Options. A truckload option is an option to buy or sell freight services on a specific route, at a predetermined price, on a specific date.8

A truckload call option gives its holder the right to buy freight services on a specific route, at a predetermined price, on a predetermined date. The decision to exercise the call option will be made by the holder based on information available leading up to the exercise date. A shipper will exercise the option to buy freight services if the strike price of the truckload call is less than the spot price, otherwise, the truckload call is allowed to expire. The total cost to the shipper is the option premium plus the cost of shipping.

A truckload put option gives its holder the right to sell freight services on a specific route, at a predetermined price, on a predetermined date. The decision to exercise the put option will be made by the holder based on information available leading up to the exercise date. In this case, a freight carrier will exercise the option to sell freight services only if the strike price of the truckload put is greater than the spot price, otherwise, the put will be allowed to expire. While put options are possible in theory, in practice they are unlikely to be widely used.

Generally, options are less beneficial when uncertainty is low, and this is also true for truckload options when system-wide demand uncertainty is low. However, Mei-Ting et al argue that the system-wide benefit of truckload options is positive. This suggests that there may be some competitive advantage to be derived from implementing a truckload option pricing mechanism as part of an on-demand trucking services marketplace.

A Rake Too Far?

The argument may be made that expecting a startup that operates an on-demand freight services marketplace to solve the dynamic assignment problem is asking too much. After all, such marketplaces mainly target owner operators.

Based on our back-of-the-envelope calculations, owner-operators probably represent 5% of the overall freight trucking market. Given the economics of operating a truck, it seems to make sense for startups to think about how a product might eventually migrate beyond that initial customer base in order to include operators of small, medium, large fleets, and possibly freight brokers too. In other words, the minimum viable product does not need to solve the dynamic assignment problem. But, if the startup is to survive and become the big, dominant company in its market, it ultimately needs to solve the dynamic assignment problem. Doing that will eliminate, or minimize, the probability of deadheading which is a source of much of the friction in the spot market.9

Will Freight Services Marketplaces Offer Freight Factoring Services, Directly Or Through A Partner?

Given the economics and structure of the freight trucking market, it is not difficult to understand why owner-operators and some fleet operators will find services that enable them to sell their accounts receivables assets in order to meet cash needs as part of a multi-sided marketplace highly desirable. In a typical accounts receivable financing transaction the receivables are sold at a discount in exchange for certain cash. Alternatively, the accounts receivables can be used as collateral for a short-term loan.10

Typical services would include; credit checks, credit risk management, freight insurance, accounts receivables collections and management, receivables financing . . . as described above.

According to Factors Chain International, in 2015 factoring revenues amounted to $104 billion. The domestic only portion of that market was 84%.

Everything being equal, a freight services marketplace that also offers these kinds of financing options should win over its counterparts that do not.

Wrapping Things Up

Estimates suggest that the global transportation services market is worth $12 trillion annually. In the United States, that market is believed to exceed $1.0 trillion each year. As we have already stated, freight trucking accounts for more than $700 billion of that total. Thanks to the friction, inefficiency, and opacity that characterizes the market startups will continue building products to solve problems that freight truckers and their customers face. Some of the business models that these startups implement will face more threats than others as they attempt to navigate the path from discovery, to becoming big and market-dominating companies. But, the opportunity exists, and it is big, and it is global . . . and holds tantalizing promise for the startup founders and venture capitalists who succeed in solving the puzzles it presents.

Writing this post was primarily an exercise in documenting what we know in order to identify gaps in our knowledge so that we can fill in those gaps. If we have missed anything you feel is important please let us know.

If you are building a seed stage startup in this market we would love to hear from you. If there are early-stage startups we have not heard about yet, we would love to know that too. If you invest in or have invested seed-stage startups pursuing any of the opportunities we have described above, or others in the freight trucking market, we’d love to collaborate with you on future investments.

You can leave a comment in the comments section below, or you can email us directly;

- Brian – [email protected], or

- John – [email protected].

Update: November 24, 2016 at 07:30 to include data from AngelList and representative sample of investors from CB Insights.

- Class 8 trucks belong to the highest Gross Vehicle Weight Rating (GVWR) assigned by the US Department of Transportation (US DOT). ?

- Owner-operators own and operate their own trucking business. Most own 1 truck and 1 trailer. ?

- 2014 estimates, developed from American Transportation Research Institute’s An Analysis of the Operational Costs of Trucking: 2015 Update. ?

- Startups listed are obtained from CBInsights, as of Nov 15, 2016. The authors developed the categories into which the startups are grouped. With only a few exceptions, each startup is listed under the category the authors believe represents the majority of each startup’s business activity based on publicly available information. ?

- On-demand trucking apps and electronic load boards fulfill the same function, though people think of them as different. Electronic load boards aggregate carrier capacity listings, as well as shipper loads, in one web-portal that freight trucking market participants can access. ?

- Howard Smith and David Gearhart, Internet of Things/Machine-to-Machine: Fleet Management Solutions. January 2014. ?

- This is a reality I encountered in the general aviation industry, between 2008 and 2012. ?

- A derivative contract is a contract whose value is based on the value of an underlying asset. ?

- Deadheading occurs when a truck is operated while it is empty. Such a trip is described as a dead leg. ?

- Technically, accounts receivables factoring is the outright sale of the asset. Invoice discounting – assignment of accounts receivable, is using the asset as collateral for a short-term loan. ?