BlackRock, the world’s largest asset manager, has met with the U.S. Securities and Exchange Commission (SEC) to discuss its proposed spot Bitcoin ETF, according to a new filing. The company revealed more details about its product, which aims to provide investors with exposure to the actual Bitcoin cryptocurrency, rather than futures contracts or other derivatives.

According to the filing, BlackRock met with SEC staff on November 16, 2023, and presented its case for why its spot Bitcoin ETF should be approved. The company argued that its product would offer several benefits to investors, such as:

Lower costs and risks compared to futures-based ETFs, which incur higher fees, margin requirements, and rollover risks. Greater transparency and liquidity compared to private funds or trusts, which may trade at significant premiums or discounts to their net asset value (NAV). Enhanced security and custody arrangements, as BlackRock would partner with reputable third-party custodians that are regulated and audited.

Diversification and innovation opportunities, as a spot Bitcoin ETF would allow investors to access a new asset class that has low correlation with traditional markets and offers exposure to the potential of blockchain technology.

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

BlackRock also addressed some of the concerns that the SEC has raised about spot Bitcoin ETFs in the past, such as:

Market manipulation and fraud, which BlackRock claimed could be mitigated by using multiple data sources, robust surveillance tools, and independent valuation methods. Investor protection and education, which BlackRock pledged to provide through clear disclosures, risk warnings, and investor outreach programs.

Regulatory coordination and oversight, which BlackRock suggested could be enhanced by working closely with other regulators, such as the Commodity Futures Trading Commission (CFTC), the Financial Industry Regulatory Authority (FINRA), and state authorities.

BlackRock is one of several companies that have filed for a spot Bitcoin ETF in the U.S., hoping to capitalize on the growing demand for crypto-related products. However, so far, the SEC has only approved futures-based Bitcoin ETFs, which track the price of Bitcoin through contracts traded on regulated exchanges. The SEC has repeatedly expressed its reservations about spot Bitcoin ETFs, citing the lack of regulation and transparency in the underlying crypto market.

It is unclear whether BlackRock’s meeting with the SEC will sway the regulator’s stance on spot Bitcoin ETFs, or when a decision will be made. The SEC has not set a deadline for reviewing BlackRock’s application, which was filed in October 2023. However, some analysts believe that the SEC may be more open to approving spot Bitcoin ETFs in 2024, as the crypto market matures, and more regulatory clarity emerges.

U.S. Treasury Secretary says if cryptocurrency exchanges want to operate in the U.S. “they must play by the rules.” If they do not, the U.S. government will take action.” The U.S. Treasury Secretary has issued a stern warning to cryptocurrency exchanges that operate in the U.S. market, saying that they must comply with the existing regulatory framework or face the consequences.

In a speech at the Financial Crimes Enforcement Network (FinCEN) conference, the Treasury Secretary said that the U.S. government is committed to ensuring that the cryptocurrency sector does not pose a threat to the national security, financial stability, or consumer protection.

He said that cryptocurrency exchanges are subject to the same rules and regulations as traditional financial institutions, such as anti-money laundering (AML), counter-terrorism financing (CTF), and sanctions compliance.

He added that the Treasury Department, along with other federal agencies, is closely monitoring the activities of cryptocurrency exchanges and will not hesitate to take action against those who violate the law.

He said: “We want to foster innovation and responsible use of cryptocurrencies, but we also want to prevent them from being used for illicit purposes. Cryptocurrency exchanges that want to operate in the U.S. must play by the rules. If they do not, the U.S. government will take action.”

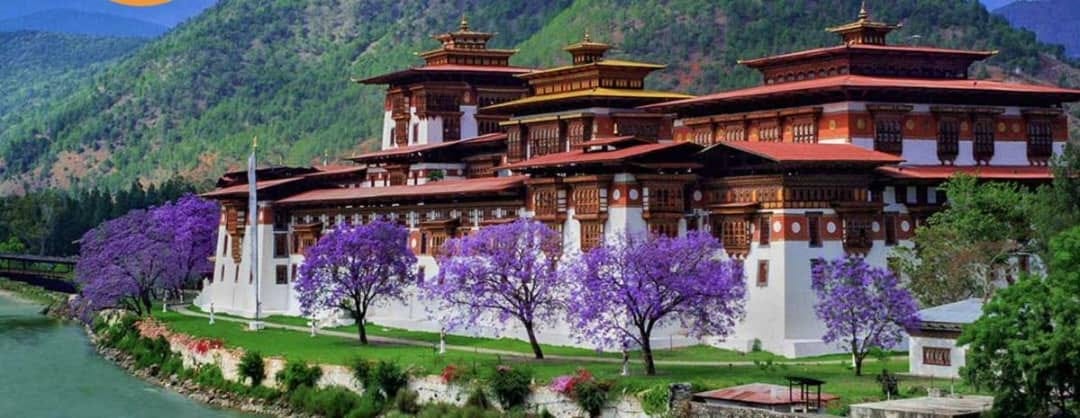

Kingdom of Bhutan spent millions building its own Bitcoin mining operation— Forbes

Meanwhile, the small Himalayan nation of Bhutan has made a bold move to embrace the cryptocurrency revolution. According to a recent report by Forbes, the Kingdom of Bhutan has spent millions of dollars building its own Bitcoin mining operation, hoping to use the profits to boost its economy and diversify its sources of income.

Bhutan is a landlocked country with a population of about 800,000 people, mostly dependent on hydropower, tourism and agriculture. However, the Covid-19 pandemic has severely affected these sectors, causing a sharp decline in the country’s gross domestic product (GDP) and foreign exchange reserves. To make matters worse, Bhutan faces a chronic trade deficit with its neighbors, especially India, which supplies most of its essential goods and services.

To address these challenges, Bhutan has decided to tap into the potential of Bitcoin, the world’s largest and most popular cryptocurrency. Bitcoin is a decentralized digital currency that operates on a peer-to-peer network of computers, without the need for intermediaries or central authorities.

Bitcoin transactions are verified and recorded on a public ledger called the blockchain, which ensures transparency and security. Bitcoin miners are the ones who perform this verification process, using specialized hardware and software to solve complex mathematical problems and earn new bitcoins as a reward.

Bhutan has invested in building its own Bitcoin mining facility, using its abundant and cheap hydropower resources to run the machines. The facility is located in a remote area of the country, away from populated centers and potential threats. The facility is also equipped with advanced cooling systems and security measures to ensure optimal performance and safety.

According to Forbes, Bhutan hopes to use the Bitcoin mining operation as a source of income and innovation for its economy. The country plans to sell some of the bitcoins it mines on the global market, generating foreign exchange and reducing its trade deficit. The country also intends to use some of the bitcoins to fund social welfare programs, such as health care, education and environmental protection.

Moreover, Bhutan aims to foster a culture of entrepreneurship and technological development among its citizens, by encouraging them to learn about and participate in the cryptocurrency ecosystem.

Bhutan’s decision to embrace Bitcoin is not without risks and challenges. The cryptocurrency market is highly volatile and unpredictable, subject to fluctuations in supply and demand, as well as regulatory uncertainties and cyberattacks. Bitcoin mining also consumes a lot of energy and generates a lot of heat and noise, which could have environmental and social impacts.

Furthermore, Bhutan may face opposition or pressure from other countries or institutions that are skeptical or hostile towards Bitcoin and its implications for the global financial system.

However, Bhutan is not alone in its quest to harness the power of Bitcoin. Several other countries, especially in Africa and Latin America, have also shown interest or taken steps to adopt Bitcoin as a legal tender or a reserve asset. These countries share some of the same challenges as Bhutan, such as economic instability, currency devaluation, inflation, corruption and financial exclusion. They also see Bitcoin as an opportunity to empower their people, enhance their sovereignty and integrate into the global economy.

Bhutan’s experiment with Bitcoin is an example of how a small country can use innovation and courage to overcome its limitations and pursue its aspirations. Whether it succeeds or fails, Bhutan’s venture will surely inspire other nations and individuals to explore the possibilities and challenges of the cryptocurrency revolution.