I noted few days ago that WhatsApp’s move into payment would cause massive dislocation in African banking. In this age of chat and social media, transactions have evolved into content, commerce and financial services. To examine the impact in Africa, let us consider what these solutions have done in India where they are already or being deployed. India has about 250 million WhatsApp users, the world’s largest (China is a WeChat nation).

In anticipation of this move, commentators had already predicted a “WhatsApp moment” in banking, whereby technology disrupts the cash-heavy, inefficient methods by which people currently settle dues in developing countries.

But before WhatsApp, there was Google Tez. I had noted that Google Tez would also cause disruption with its potential voice banking capabilities.

Voice banking will be presented as secure and convenient and will open new vistas for a really brilliant startup to set a new basis of competition in the fintech world. 2018 is the year of Voice Banking in Nigeria, and Africa. If you have the capabilities, go for it.

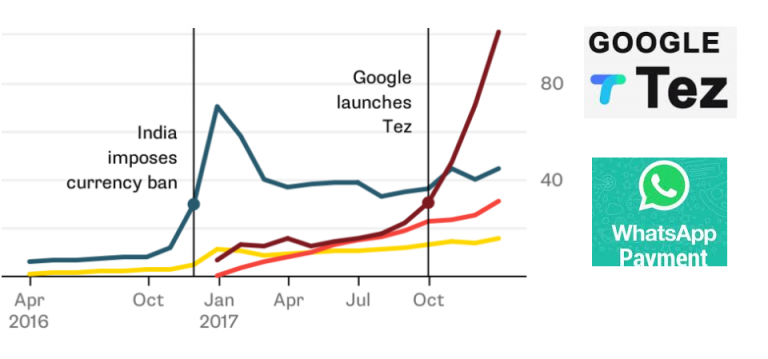

According to NDTV, Google Tez launched in India last September and quickly picked up 12 million customers, and by the end of the year, it had processed 140 million transactions. In the plot below, please note the explosion for Google Tez & co, from Oct 2017.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Tez, Google’s payments app for India that’s built on top of the country’s Unified Payments Interface (UPI), was launched in September last year. By early December – a little less than three months after the launch – the app had clocked 12 million users and 140 million transactions.

Those are impressive numbers, even if the government backed UPI app BHIM, which also launched last year, clocked 10 million users at a much faster rate – within 10 days. In terms of the number of transactions, however, Tez has completely blown past its competition.

The Challenge in Africa

Google Tez has about “70 percent share of all transactions on banks’ unified payment interface, or UPI, making it rather obvious that lenders’ own apps won’t be the dominant medium”. It took it less than three months to do this. That kind of growth for ICT utilities which never really care for profits should be a concern to African banks.

In the two months before Paytm added UPI support to its app in December last year, Google’s Tez accounted for 70 percent of transactions on the BHIM UPI platform. Whether it can sustain this kind of growth in the face of increased competition remains to be seen.

I expect the impacts of these entities in Africa to follow the same trajectory. When Google Tez and WhatsApp launch most likely in Kenya, Nigeria and South Africa later this year, we would see dislocation on many things. These entities would not make money in peer-to-peer payment. However, they would see opportunities in merchant supported payments. You always allow people to transfer free while merchants provide the profits.

Google Tez will likely lead the person-to-merchant segment while WhatsApp would take the person-to-person. Each would continue to find how to enter each other’s territories.

The challenge for Nigerian banks would emerge if people begin to warehouse their funds within the WhatsApp and Tez wallets to avoid moving them into their bank accounts. This is important as Nigerians pay fees when they withdraw their funds in their bank accounts [remember the stamp duty on digital transfers]. So, reducing that bank exposure would be strategic for many merchants. If WhatsApp and Google Tez provide the platforms to do banking with the big fees charged by banks, many would go for them.

google wallet vs android pay

Specifically on that, the Chinese banking regulator has to request that the BAT( Baidu, Alibaba and Tencent) move funds from their wallets to their bank accounts within 72 hours as local banks were having liquidity issues [yes, that does not help local banks. It only helps the banks where the BAT bank]. Indeed, what Google and Facebook are trying to do via Google Tez and WhatsApp respectively have been largely perfected in China. The BAT have built ecosystems where few leave Alibaba, WeChat and Baidu for any other place on the web. Specifically, WeChat is an operating system for business and lifestyle in China. Baidu is the window into the businesses while Alibaba enables the physical exchange.

All Together

We have entered into the era where transactions have evolved into content, commerce and financial services. You can call it social commerce. Like what happened in Kenya via MPESA where Dubai Bank, Chase Bank (Kenya), Imperial Bank, etc had issues, some of the problems could be linked to the existential impacts facilitated by MPESA. WhatsApp Payments and Google Tez would bring new bases of competition, and they are disruptive. African banks must take actions because the game has changed.

I acknowledge these sources for this piece: this and this.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube