By 2025, subscribers of mobile phone are expected to reach about 1o billion according to the International Telecommunications Union. The body cites increasing affordability of smartphones and accelerating technological adoption in sub-Saharan Africa. In Nigeria, these factors are not exceptions to the growth of mobile phone users and increase in subscribers of MTN, Glo, Airtel and 9Mobile that have been the key players in the mobile telecommunication service sector over the years.

However, the growth of the sector seems not to translate to delivering sustainable quality of service to the users across the country. Everyday, users and stakeholders are expressing mixed quality of service outcomes, calling on the concerned stakeholders to do more for users. Recently, MTN, the key player according to subscriber base, had a breakdown for days. The breakdown led to poor call connectivity and data usage among the subscribers. As the debate continues, this piece examines four quality of service metrics of the Nigerian Communications Commission. The metrics has a significant number of positive and negative performances of the four dominant brands between May, 2020 and April 2021.

The metrics include Commission Dropped Call Rate, Standalone Dedicated Control Channel Congestion, Traffic Control Channel and Call Set Up Rate.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

According to the regulatory body, “Standalone Dedicated Control Channel Congestion is used in the GSM system to provide a reliable connection for signalling and SMS (Short Message Service) messages. A dropped call is a call that is prematurely terminated before being released normally by either the caller or the called party (i.e., the call is dropped before the exchange of Released Message “RL_M” and Released Complete Message “RLC_M” in the signaling flow). Traffic Control Channels (TCCH) are responsible for transferring control information between mobiles and the BTS.”

Interconnectivity of the Measured Quality of Service

One of the surprising insights from our analysis is that the four brands performed well in 11 months out of the 12 months of data produced by the Nigeria Communication Commission. Throughout the 11 months, MTN was better than other service providers. Further analysis of the performance using average approach reveals that performance within the call set up rate and dropped call rate connected by 8.9% while 1.8% was recorded for connection between Standalone Dedicated Control Channel Congestion and dropped call rate 1.8%. It was 69.9% for traffic control channel and dropped call rate. These results indicate that the four brands struggled in their quest of providing better service to users during the 12-month period. For instance, the positive association of call set up rate and dropped call rate signifies that the more the brands prepared better call set ups for their subscribers, the more the subscribers experienced call droppings. It also suggests that subscribers had bitter experience when they replaced calling with sending messages.

Our analysis further reveals that MTN’s call set up performance seems not to help subscribers to experience quality service while calling because one percent of ensuring better call set up increased the extent to which users experienced call droppings during the period of analysis. On a surprising note, our analyst discovered that Airtel seems to have advantage over other brands in terms of the degree to which its ability to ensure and sustain call set up enhanced better calling experience [see Exhibit 1].

Exhibit 1: Place of Call Set Up Rate in Select Quality of Service Metrics

Competitive Advantage in the Midst of Quality of Service Challenge

In our experience, we found a clear manifestation of QoS strategic game among the brands. Our analysis points out that the better the MTN’s QoS, the better the Glo’s QoS as well. This is also found for Glo and Airtel, Airtel and 9Mobile. However, the better the Glo’s QoS the less was 9Mobile’s QoS. This is also discovered for MTN and 9Mobile. Clearly, MTN seems to reinforce its market leadership by competing favourably with other brands. In all the metrics, are there differences? Our analyst asked this and found mixed surprising insights.

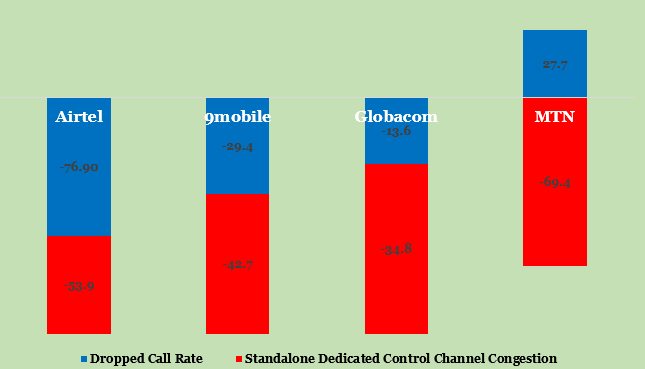

For the dropped call rate metric, there was no strong difference between MTN and Glo. A strong difference exists between MTN and Airtel. In this regard, Airtel was better than MTN in terms of less dropped calls. We also found a strong difference among MTN and 9Mobile [9Mobile is better in terms of less dropped calls], MTN and Glo [Glo is better than MTN], MTN and Airtel [MTN is better], and MTN and 9Mobile [MTN is better]. Analysis of difference for Standalone Dedicated Control Channel Congestion metric also reveals a strong difference between what MTN and Airtel recorded during the 12-months [however, Airtel is better], MTN and Glo [Glo is better], MTN and 9Mobile [9Mobile is better]. For traffic control, a strong difference exists between MTN and Airtel [however, Airtel is better], MTN and Glo [however, MTN is better], and MTN and 9Mobile [MTN is better].

As a need-driven sector, the conversation around ensuring better quality of service by the GSM brands is a continuous one between the service providers, subscribers and the regulatory body in Nigeria. This will ensure that the users have value for their hard-earned money in the course of meeting their communication needs. It is equally important that service users understand and use the service complaint framework put in place by the regulatory body. While the brands are advised to pay more attention to infrastructural deficiencies that contribute to their inability to fulfil subscribers’ telecommunication yearnings, the NCC should continue to be vigilant in ensuring that services promised by the telecommunication brands are the services delivered.