The evolution of Fintechs across several nations of the world has no doubt transformed the landscape of money transfer and international remittances, which has seen people around the globe choose FinTech services over any other.

With the advent of these Fintechs, there has been a gradual shift from the traditional banking system to online banking, which has brought about a major change in how money is transferred and received.

Leveraging cutting-edge technologies, while several of these Fintechs have launched to ensure the seamless transfer and receiving of funds, one notable thing about their emergence is how it has brought about a major improvement in personal finance.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

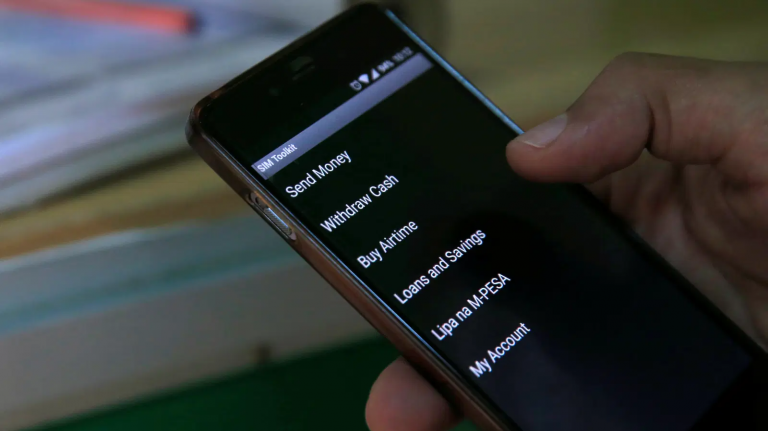

Following the roll-out of innovative platforms that can be accessed directly from a smartphone or tablet, it has become easier than ever for individuals to create and track their budgets in real-time.

These startups have changed the game by offering user-friendly platforms that allow individuals to take control of their financial lives, which has also made budgeting very easy for them.

Unlike traditional banks that often send financial statements at the end of the month, most Fintechs track users spending and give them regular updates on their financial records.

These platforms analyze users’ financial data and provide insights, budgeting tools, and investment recommendations tailored to their specific needs. By offering personalized financial guidance, individuals are forced to make informed decisions and achieve their financial goals. This has reportedly impacted users spending habits as well.

Another area where Fintechs are revolutionizing personal finance is in the area of security. Traditional payment methods such as cash and checks are being replaced by digital alternatives that offer greater convenience and security.

These startups prioritize the security of financial transactions by implementing robust encryption techniques, multi-factor authentication, and advanced fraud detection systems. They comply with industry regulations and work closely with regulatory bodies to ensure the safety of user data and transactions.

In the area of loans, because traditional loan approval processes can be time-consuming and cumbersome, Fintech startups have revolutionized this process by leveraging technology to streamline loan applications and approvals.

Through online lending platforms, borrowers can submit their applications and receive loan approvals within minutes, significantly reducing the waiting time compared to traditional banks.

Notably, knowing full well that saving money and investing wisely are crucial aspects of personal finance, this has seen the rollout of more than a dozen reputable savings, investing, and budgeting apps, now available for individuals to save their money and grow their wealth.

These apps have saved individuals the stress of going to the banking halls, to just saving money from the comfort of their homes

Some of these savings apps are;

1.) Piggyvest:

Formerly called Piggybank. This platform was the first to blaze the trail for online savings platforms in Nigeria. Its flexibility allows anyone to custom save daily, weekly, or monthly depending on their preference.

Users can save towards a specific target or choose to place a withdrawal restriction on the account. There is a limit to the amount that can be saved on one’s account at a time.

2.) Cowrywise:

One of the best online savings platforms in Nigeria. Cowrywise not only gives higher interest rates, but users can also access investment plans on the platform.

A high saving score increases the chances of getting a loan on CowryWise. Interest on savings is paid daily.

Its saving option and interest are different from other savings platforms. With the main aim of helping users achieve financial freedom. The app helps users to save money using the periodic savings plan which enables them to save daily, and monthly with 10% interest per annum.

3.) ALAT by Wema Bank:

The first fully digital banking experience, ALAT by WEMA, not only offers basic banking services but is also one of the online savings platforms in Nigeria that offers a very good interest rate.

The bank’s debit card is delivered to the account holder’s address at no cost. As with traditional banks, ALAT charges a monthly debit card maintenance fee. The interest of 4.2% is on the condition that an account holder does not withdraw more than 3 times a month.

ALAT has some saving plans that offer up to 10%; one of them allows withdrawal of 50% of savings once every 30 days while another doesn’t allow withdrawal.

4.) Carbon:

Formerly Paylater which just offered collateral-free loans in Nigeria, Carbon has now transitioned into a digital bank in Nigeria that offers multiple banking services.

Carbon offers savings plans that are suitable for anyone in Nigeria. With Carbon, you can also create a bank account, create physical debit cards, and virtual cards in Nigeria. You can also make payments from the Carbon app, keep track of your credit history with the free carbon credit report and also access loans too.

Apart from the fact that Fintechs play a pivotal role in managing individuals’ finance, they have also been helpful in the management of companies’ finances.

These startups help businesses streamline their financial processes, by providing them with real-time financial data and insights that help them make better decisions.

Some of these apps can automatically categorize transactions and create financial reports, which reduces the risk of errors. They also enable businesses to track expenses, disburse payments, create spending accounts with approved limits, and several others.

By accurately tracking a business’ finances, entrepreneurs can avoid unnecessary or unproductive spending and possibly improve profitability in the long run.

Conclusion

The emergence of Fintech apps has come a long way in not just enabling seamless transfer and receiving of funds, it has also enhanced how individuals and businesses manage money.

These startups are democratizing investment opportunities, making it easier for individuals to grow their wealth. While these startups have disrupted the financial industry, they have also complemented traditional banking services by offering innovative and user-friendly alternatives.

As fintech continues to evolve, we can only anticipate more innovative solutions that revolutionize money management and make financial well-being accessible to all.