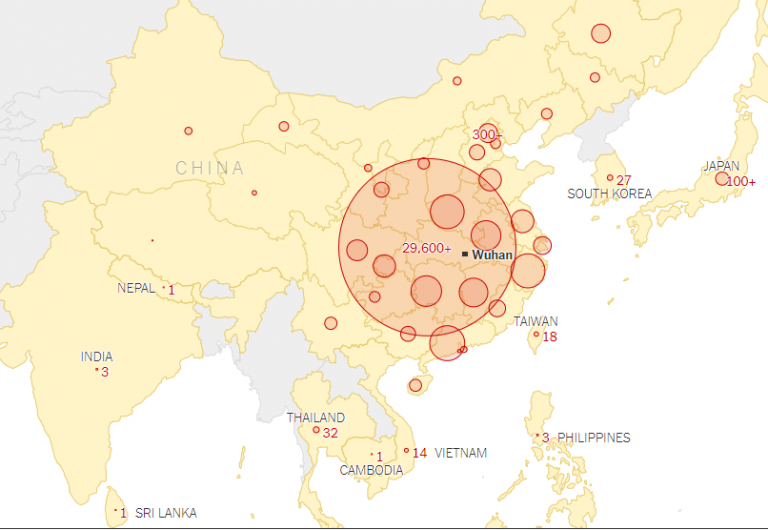

For people and businesses, the first quarter of the year 2020 is being perceived as the quarter that would make or mar the expected profitability and productivity as the new viral disease, coronavirus continues spreading across the world. A few hours ago, a report from the New York Times indicates that China recorded the death of 97 people on Sunday, superseding the number of deaths recorded for SARS in a day when it emerged a few years ago.

The coronavirus was first discovered in Wuhan, a mainland province in China late last year. In the midst of the spread of the virus, the governments of the countries that have been affected and those that have not been affected are making frantic efforts regarding the movement of people from the source to their cities and towns. In the last few days, banning of travelers through airports and land transportation has been chosen as one of the strategies of containing the spread of the disease.

Report indicates that “Investors have dumped locally-listed stocks as well as shares of non-Chinese companies that export goods and services to the country.” Already, there are indices that the earnings through stocks of most companies will come down considering the efforts of the governments and businesses. Manufacturing, materials and consumer goods companies had had their shares dipped during the last week stock trading, while healthcare shares soared.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

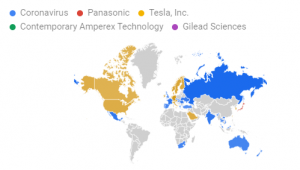

During the week (February 3 and 7, 2020), our check shows that people in 41 countries had significant interest in understanding the virus, especially how to protect themselves from contacting it and how governments, businesses and organisations are tackling the challenge. Majority sought the knowledge about the virus from 41 countries with the main interest from the people living in Vietnam, Russia, France, Mexico and Slovakia. We also discovered that Panasonic, Tesla, Contemporary Amperex Technology Limited and Gilead Sciences were the dominant brands that people wanted to know how the virus would impact their shares in various stock exchange markets. In this piece, using real time data, we explored the impact of the virus on the stock performance of the brands and predicted what would happen this week.

Understanding the Brands

Exhibit 1: Main Brands World associated with Coronavirus

Gilead Sciences is a company incorporated in the United States of America. It has interest in manufacturing biotechnological products and drug commercialization. During the week, the company was in the news because regarding its intent of testing the newly developed drug for Coronavirus in China. Despite this, another report says the company’s shares dropped, following weaker-than-expected earnings.

“Contemporary Amperex Technology Co., Limited is a Chinese battery manufacturer and technology company founded in 2011 and specialized in the manufacturing of lithium-ion batteries for electric vehicles and energy storage systems, as well as battery management systems.” Tesla is also an American company with the special interest in electric vehicle and clean energy production among others. Panasonic is an electric company based in Kadoma, Osaka, Japan.

How Big is the Virus on these Global Brands?

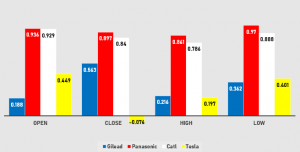

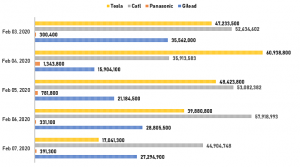

During the trading week, Tesla had the highest opening and closing prices. The company opened its share with a total $3,810.38 (5 days period) and closed with $3,898.79. It recorded $4,166.69 and $3,628.51 as total high and low prices for the week. Throughout the week, the company said 213,518,200 shares. Gilead Sciences is the next to Tesla in terms of stock prices. The open prices for the week was $339.23 and closed the week with $336.71, signifying low or dwindling price at the end of each day. The highest price was $344.33, while $330.88 was recorded as the lowest price during the week. On volume basis, the company was able to have 128,751,000 shares sold.

Contemporary Amperex Technology Co., Limited otherwise known as Catl followed the two brands in terms of prices but edged them out in terms of volume of shares sold during the week. Catl had $107.34 as its open price and closed at $111.12. It recorded $113.59 and $104.94 as the highest and lowest prices accordingly during the period. With 244,454,308 volume of shares, Catl led other brands. Panasonic opened its share with $56.12 and closed at $55.97. While trading its share, the company recorded $57.04 and $55.08 as the highest and lowest prices. Among all the brands, Panasonic sold a total of 3,148,308 shares, the lowest volume of shares [see Exhibit 3].

From the price to volume, what are the consequences of the political and business leaders’ moves on the stock performance of the brands understood by the people (especially investors and stock brokers who sought knowledge about the disease). We captured this in Exhibit 2, where we detailed the connection between the real time information seeking about the virus and stocks of the brands. Analysis shows that Coronavirus impacted the closing price of Tesla by 7.6%, while it showed no significant impact on the open price, we found a positive link with the virus (44.9%). The rest brands -Panasonic, Catl and Gilead equally had a positive connection with the virus within the open and close prices during the week [see Exhibit 2].

Analysing the global interest in the virus along with the stock prices of the companies, our model explained 87.6%, 86.4% and 20.2% variation in the open prices of Panasonic, Catl and Tesla respectively. Analysis further shows that 80.5%, 70.6% and 0.6% variation could be explained in Panasonic, Catl and Tesla’s close prices accordingly. The virus, according to our model, had significant impact on the volume of shares sold by Gilead than other brands. The virus impacted the company’s volume of shares by 40%, while it was 10.1% and 8.8% for Tesla and Panasonic respectively [see Exhibit 4].

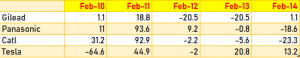

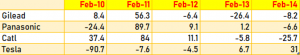

Exhibit 2: Link between Global Interest in Coronavirus and the Brands’ Stock Performance at Price Level

Exhibit 3: Brands’ Stock Volume

These links and impacts are better understood within the positive and negative narratives about the brands during the week. The first day of the week Panasonic reported a 18% reduction in its operating profit for the April-December period. According to the company, “nine-month sales fell 5.4 percent to 5.76 trillion yen ($53.04 billion) as the weakness of the Chinese market also pressured the performance of the firm’s sales in Japan. Domestic sales decreased due mainly to sluggish sales in electromechanical control equipment resulting from the deteriorating market conditions in China.”

Tesla’s shares dipped because of the company decision on the cancellation of delivering the new set of cars from its Shanghai plant located in China. As pointed out earlier, Gilead was in the news during the week on a positive note as it was reported that the company is planning to test remdesivir (GS-5734) initially developed for Ebola virus in Wuhan. Information also has it that the company is working with health authorities in China on a plan to establish a randomized Phase III trial to determine if the drug can cure the new strain.

The impact of the virus on the stock prices of Catl, Panasonic including Tesla could be more appreciated within the successful and failed strategic partnerships among the companies. During the week, Catl and Tesla struck a two-year deal. With the deal, Catl is expected to supply batteries for Tesla’s electric car production in China, starting from July 2020 to June 2022. This was a good omen for the two companies, but a bad one for Panasonic that Tesla had earlier had a relationship with on the same contract.

Exhibit 4: Degree of Influence on Prices and Stock Volume

Looking Ahead

Though, there are assurances from the companies that the virus will not have a major effect on their operations and profitability, our analysis reveals that during this week’s stock activity, the virus would have both positive and negative influences on open and close prices [see Exhibit 5 to 7].

Exhibit 5: Predicted Link between Coronavirus and the Brands’ Open Stock Price

Exhibit 6: Predicted Link between Coronavirus and the Brands’ Close Stock Price

Exhibit 7: Predicted Link between Coronavirus and the Brands’ Stock Volume