Guaranty Trust Bank (GTBank) has joined the growing number of Nigerian banks limiting and suspending international transactions on debit cards.

The bank announced in a statement sent to customers on Thursday, that it will suspend international transactions on its naira Mastercard from Saturday, December 31, 2022.

According to the statement, customers will be unable to make international automated teller machines (ATM), and point of sales (POS) transactions on their naira Mastercards.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

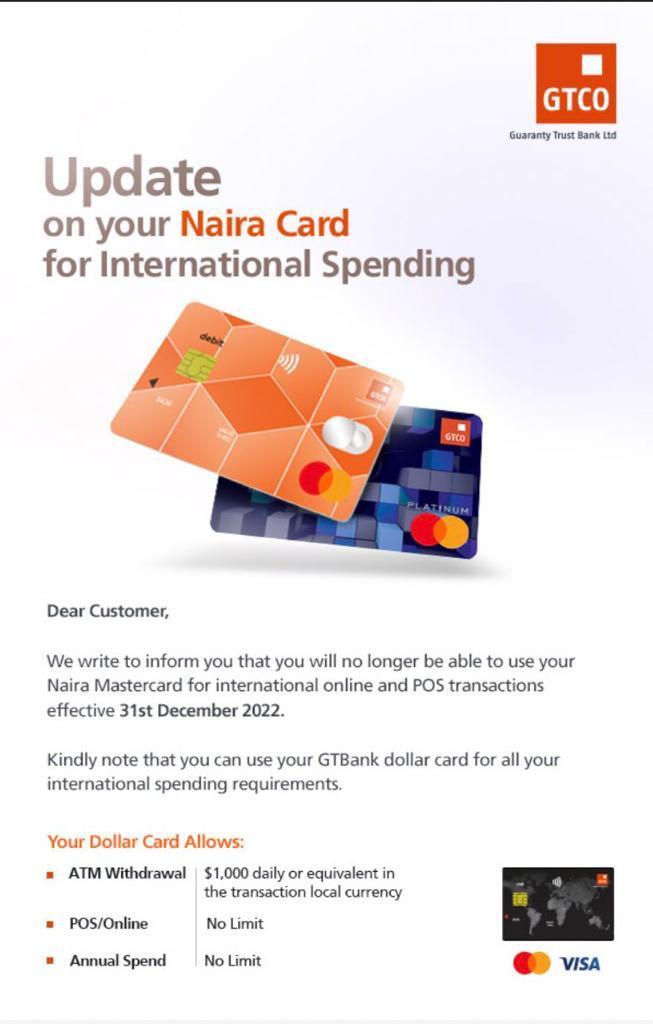

“We write to inform you that you will no longer be able to use your naira Mastercard for international online and POS transactions effective 31st December 2022,” the statement said, urging customers to get and make use of “GTBank dollar card for all your international spending requirements.”

The statement further said that the bank’s dollar card allows a daily $1,000 (or equivalent in the transaction local currency) withdrawal limit on ATM transactions. It added that there would be no withdrawal limit on “annual spend and POS transactions” for the dollar cards.

The bank’s decision is understood to be born of Nigeria’s forex crisis that has forced the Central Bank of Nigeria to initiate strict policies to protect the country’s currency, the naira. Other financial institutions have made similar moves as the situation tightens.

Following the decision of Standard Chartered Bank to suspend international transactions on its naira visa debit card in July, other financial service operators like Flutterwave, Eversend and other fintech platforms have also stopped virtual card services for international transactions.

In September, First Bank announced that it’s suspending international transactions on its naira Mastercard, citing Nigeria’s forex situation. The bank had earlier in March, reduced the international spending limit on naira cards from $100 to $20.

Earlier in February and March, Zenith Bank and the United Bank for Africa reduced the international spending limit on their naira cards from $100 to $20 a month.

As at Dec. 30, the Naira trades at N736/$1 at the parallel market, an uptick from its lowest in the year which soared above N850/$1. The backdrop has been attributed to many factors headed by insufficient dollar liquidity. Nigeria’s oil export, its major means of earning forex, has been severely stymied by oil theft and lack of functioning refineries, which has forced the country to import refined products at international rates.

With low earnings from oil export, Nigeria’s foreign reserve has depleted to zero from its $3.0 billion balance in 2014. The West African country’s push for economic diversification has yielded little success, indicating the government’s helplessness in the face of a deteriorating forex crisis.

The CBN governor Godwin Emefiele has told the banks to get involved in exports to generate forex. He said the apex bank will soon stop supplying dollars to commercial banks. With the central bank’s stringent policies targeted at stopping the naira from total collapse and lack of sufficient forex supply, the banks are increasingly halting debit cards-based international transactions.

But this means more trouble for Nigerian businesses, especially, Small and Medium Enterprises (SMEs) and individuals who depend on bank-issued debit cards to carry out international transactions.