Forum breadcrumbs - You are here:ForumTekedia Forum: Tech | Business | StrategyThe CBN's 60% Deposit as Loan Req …

The CBN's 60% Deposit as Loan Requirement

Ndubuisi Ekekwe@nekekwe

#1 · July 7, 2019, 12:17 AM

Quote from Ndubuisi Ekekwe on July 7, 2019, 12:17 AMTwo big moves from Central Bank of Nigeria (CBN):

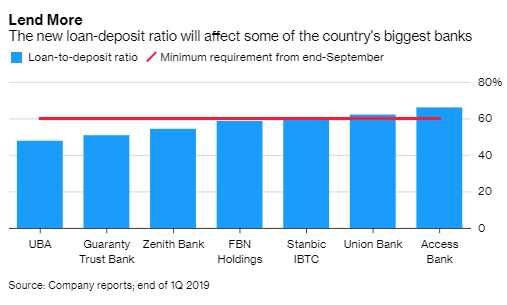

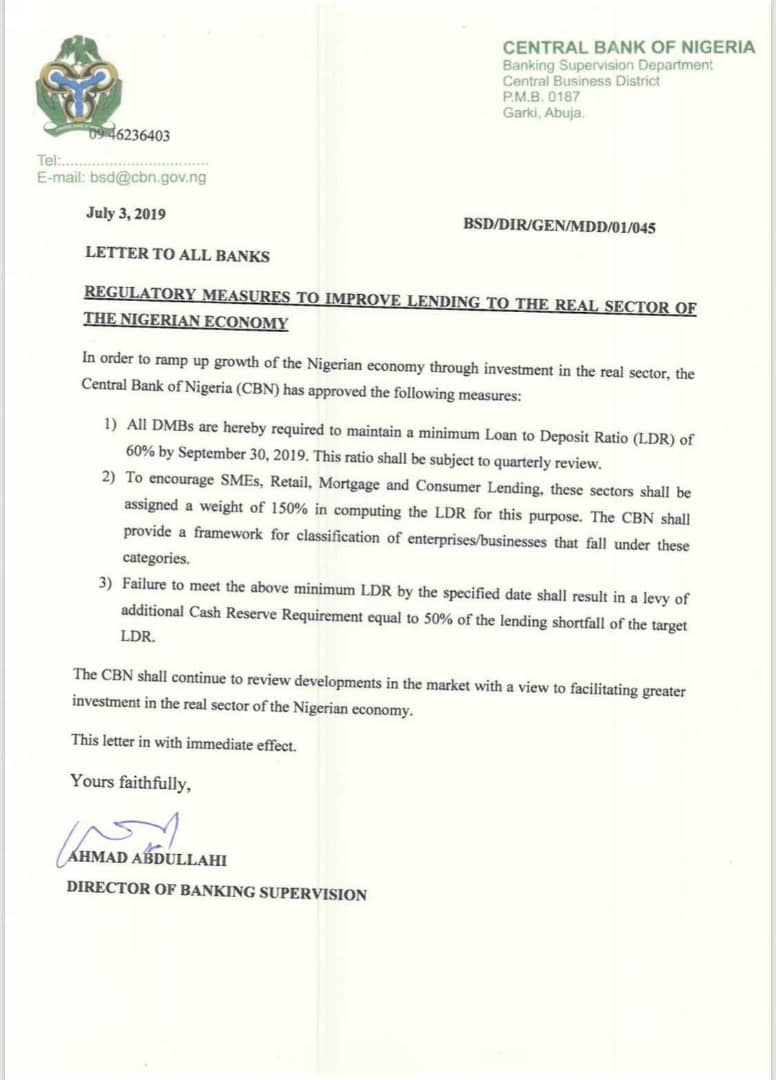

- "The Central Bank of Nigeria (CBN) has mandated deposit money banks in the country to give out 60 per cent of their deposits as loans. In a letter to banks, the apex bank warned that lenders that fail to comply with the directive would have their cash reserve ratios increased. Cash reserve ratio is the share of customers deposit that is kept with the CBN at any given time" Sun. That is a big deal as if banks do indeed comply, SMEs and startups will have funding to expand their operations. According to Bloomberg, only two banks - Union Bank and Access Bank - meet this metric at the moment.

2. "The Central Bank of Nigeria has said that Deposit Money Banks can now operate mobile money wallet services without prior approval", notes Punch. It is game on - anyone can do mobile money now and the competition has been set.

Two big moves from Central Bank of Nigeria (CBN):

- "The Central Bank of Nigeria (CBN) has mandated deposit money banks in the country to give out 60 per cent of their deposits as loans. In a letter to banks, the apex bank warned that lenders that fail to comply with the directive would have their cash reserve ratios increased. Cash reserve ratio is the share of customers deposit that is kept with the CBN at any given time" Sun. That is a big deal as if banks do indeed comply, SMEs and startups will have funding to expand their operations. According to Bloomberg, only two banks - Union Bank and Access Bank - meet this metric at the moment.

2. "The Central Bank of Nigeria has said that Deposit Money Banks can now operate mobile money wallet services without prior approval", notes Punch. It is game on - anyone can do mobile money now and the competition has been set.

Uploaded files:

Click for thumbs down.0Click for thumbs up.0

Last edited on July 7, 2019, 7:09 PM by Ndubuisi Ekekwe