Rational Bitcoin Effervescence

Quote from Ndubuisi Ekekwe on December 22, 2017, 6:44 PM

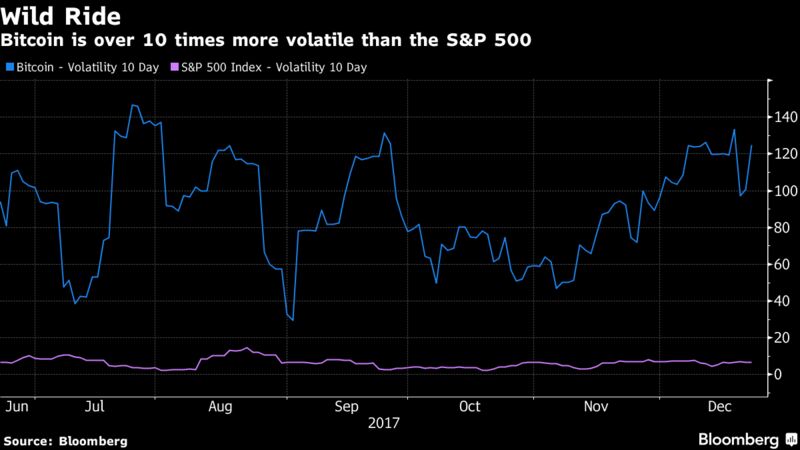

Bitcoin with the gyration on price over the last few hours is showing why it is better in casinos than in corporate boardrooms. Even the old Zimbabwean dollar had a better trajectory - it lived for decades before it ran out of monetary juice. If a currency loses 45% of its value within 24 hours for no apparent market- and economic-moving data, it means the currency is not operating in any economy.

I know the fans love that dearly because they can operate in a world that is not linked to any central power. The problem, unfortunately, is that the people still live in a world governed by laws enforced by governments. If your currency is out of bounds to government and everything else is under government control, the currency is not free. One prominent messenger, Michael Novogratz, has developed cold feet. Michael is halting his planned cryptocurrency-based hedge fund.

One of bitcoin’s most prominent bulls has gotten cautious. Michael Novogratz on Friday said that he was shuttering, for the time being at least, a highly anticipated cryptocurrency hedge fund that he had planned to start this month. The news hit the market while bitcoin was in the midst of a roughly 30% selloff. Prices fell as low as $10,800, down about 45% from the high of $19,800 set on Sunday.

Sure, this is not the end of Bitcoin. But the people may need to ask government to help put order in this game. It is an illusion to think one can create a currency that will satisfy all the complex monetary elements across all nations on earth. When Japan sneezes on a Bitcoin exchange, price moves. If China takes action, price moves. And if American regulators talk, price moves. Yet, some people think, magically, that Bitcoin is "outside" the control of government. This is an effervescence except that it is happening in silicon and not liquids.

Bitcoin with the gyration on price over the last few hours is showing why it is better in casinos than in corporate boardrooms. Even the old Zimbabwean dollar had a better trajectory - it lived for decades before it ran out of monetary juice. If a currency loses 45% of its value within 24 hours for no apparent market- and economic-moving data, it means the currency is not operating in any economy.

I know the fans love that dearly because they can operate in a world that is not linked to any central power. The problem, unfortunately, is that the people still live in a world governed by laws enforced by governments. If your currency is out of bounds to government and everything else is under government control, the currency is not free. One prominent messenger, Michael Novogratz, has developed cold feet. Michael is halting his planned cryptocurrency-based hedge fund.

One of bitcoin’s most prominent bulls has gotten cautious. Michael Novogratz on Friday said that he was shuttering, for the time being at least, a highly anticipated cryptocurrency hedge fund that he had planned to start this month. The news hit the market while bitcoin was in the midst of a roughly 30% selloff. Prices fell as low as $10,800, down about 45% from the high of $19,800 set on Sunday.

Sure, this is not the end of Bitcoin. But the people may need to ask government to help put order in this game. It is an illusion to think one can create a currency that will satisfy all the complex monetary elements across all nations on earth. When Japan sneezes on a Bitcoin exchange, price moves. If China takes action, price moves. And if American regulators talk, price moves. Yet, some people think, magically, that Bitcoin is "outside" the control of government. This is an effervescence except that it is happening in silicon and not liquids.

Register for Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.