Inequality in Companies

Quote from Ndubuisi Ekekwe on April 2, 2019, 8:10 PMThe economic inequality, 1% vs 99%, is not just about workers and people - companies are also experiencing massive inequality among them, note a new Mckinsey report: "Among the world’s largest companies, economic profit is distributed unequally along a power curve, with the top 10 percent of firms capturing 80 percent of positive economic profit". Fortune in a newsletter breaks it further:

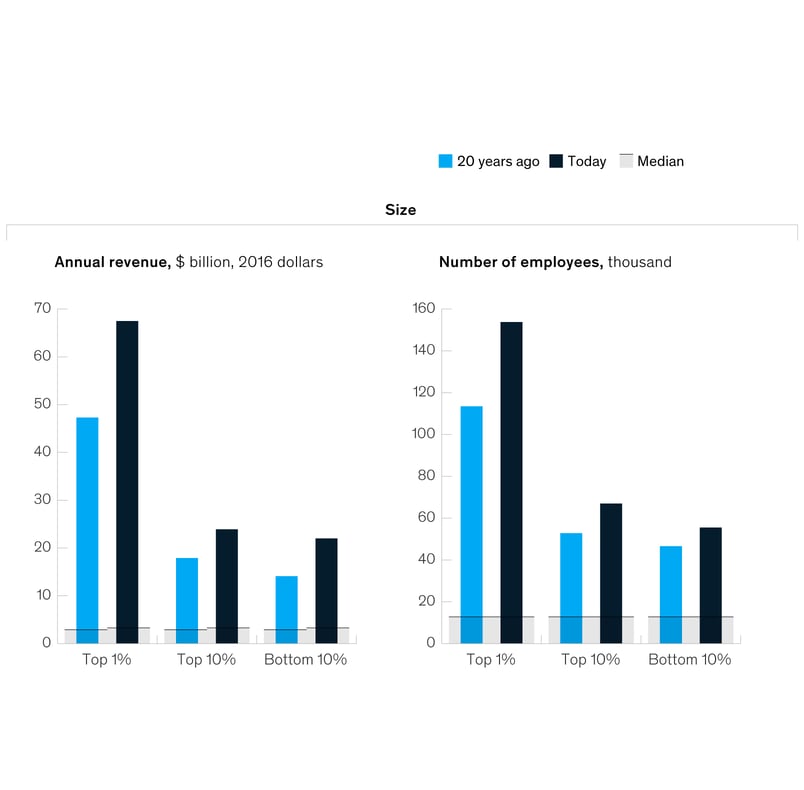

Economic inequality is not just growing among people; it’s also growing among companies. The folks at the McKinsey Global Institute studied more than 5,750 companies with over $1 billion each in revenues, and found that just 10% of them—the “superstar” companies—accounted for 80% of the economic profit. Moreover, that number was 1.6 times bigger, after adjustment for inflation, than it was two decades ago.

Meanwhile, the bottom 10% of companies destroy almost as much value as those at the top create. And that amount has grown 1.5% over the last two decades. Most companies bump along in the middle, with little or no profit, above the cost of capital, to show for it.

Partly driving this divergence is the increasing importance of intangible assets: software, patents, databases, etc. No surprise that the superstars far outspent the others on intangibles—especially R&D. The top ten percenters accounted for 70% of all R&D spending. (Fortune newsletter)

The economic inequality, 1% vs 99%, is not just about workers and people - companies are also experiencing massive inequality among them, note a new Mckinsey report: "Among the world’s largest companies, economic profit is distributed unequally along a power curve, with the top 10 percent of firms capturing 80 percent of positive economic profit". Fortune in a newsletter breaks it further:

Economic inequality is not just growing among people; it’s also growing among companies. The folks at the McKinsey Global Institute studied more than 5,750 companies with over $1 billion each in revenues, and found that just 10% of them—the “superstar” companies—accounted for 80% of the economic profit. Moreover, that number was 1.6 times bigger, after adjustment for inflation, than it was two decades ago.

Meanwhile, the bottom 10% of companies destroy almost as much value as those at the top create. And that amount has grown 1.5% over the last two decades. Most companies bump along in the middle, with little or no profit, above the cost of capital, to show for it.

Partly driving this divergence is the increasing importance of intangible assets: software, patents, databases, etc. No surprise that the superstars far outspent the others on intangibles—especially R&D. The top ten percenters accounted for 70% of all R&D spending. (Fortune newsletter)