GTBank Generated N11.59 Billion from Account Maintenance

Quote from Ndubuisi Ekekwe on March 9, 2020, 11:59 PM

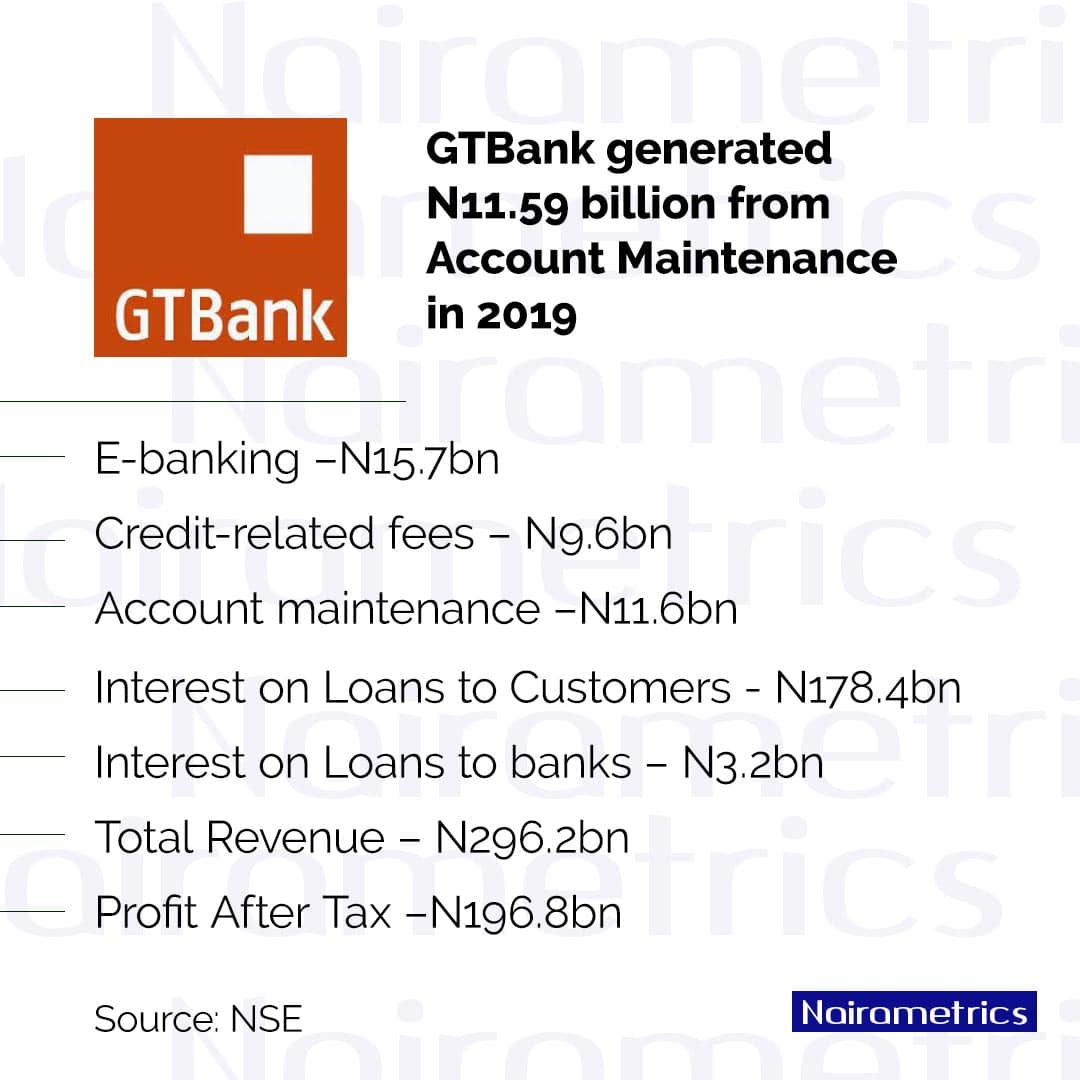

GTBank generated amazing results in 2019 as I noted a few days ago. This is the breakdown of the sources of the revenue. One has to commend GTBank for breaking these numbers like this. But going forward, there needs to be a way customers can avoid these fees: in the U.S., for some banks, if you keep a minimum of say $1,200 in your daily averages over a month, no fee is charged. Also, if you have the account setup for automatic deposit, no fees also. I am not sure there is a way a customer can avoid account maintenance fees in Nigerian banking.

Wasting N11.6 billion for the privilege of banking, in just one bank, goes against all the ordinances which the World Bank, CBN and IMF posit. The save money when you bank means nothing here! This is not a GTBank problem, it is industry-wide; I do hope the central bank finds a way to force banks to define the protocols which can make customers avoid these fees, either by maintaining a minimum balance, or pushing inflows monthly. There must be a way to avoid a fee penalty in commerce as banking is not a perpetual subscription business!

Walahi, GTBank sabi how to make money. Biko, what language do I use to explain how a bank in Nigeria took home N231 billion last year, before taxes. People, GTBank is amazing and certainly the category-king in the Nigerian banking sector. In the U.S., its stock would open tomorrow by at least 5% up. But you may be surprised, as typical in the Nigerian Stock Exchange, where there is no correlation between instant news and equities movement, nothing will happen. Of course, over time, markets equilibrate.

GTBank generated amazing results in 2019 as I noted a few days ago. This is the breakdown of the sources of the revenue. One has to commend GTBank for breaking these numbers like this. But going forward, there needs to be a way customers can avoid these fees: in the U.S., for some banks, if you keep a minimum of say $1,200 in your daily averages over a month, no fee is charged. Also, if you have the account setup for automatic deposit, no fees also. I am not sure there is a way a customer can avoid account maintenance fees in Nigerian banking.

Wasting N11.6 billion for the privilege of banking, in just one bank, goes against all the ordinances which the World Bank, CBN and IMF posit. The save money when you bank means nothing here! This is not a GTBank problem, it is industry-wide; I do hope the central bank finds a way to force banks to define the protocols which can make customers avoid these fees, either by maintaining a minimum balance, or pushing inflows monthly. There must be a way to avoid a fee penalty in commerce as banking is not a perpetual subscription business!

Walahi, GTBank sabi how to make money. Biko, what language do I use to explain how a bank in Nigeria took home N231 billion last year, before taxes. People, GTBank is amazing and certainly the category-king in the Nigerian banking sector. In the U.S., its stock would open tomorrow by at least 5% up. But you may be surprised, as typical in the Nigerian Stock Exchange, where there is no correlation between instant news and equities movement, nothing will happen. Of course, over time, markets equilibrate.

Uploaded files:

Quote from Francis Oguaju on March 10, 2020, 8:44 AMThe banking industry here is more or less about - the more you look, the less you see. There isn't really a decent one, they were cut out from the same cloth, only the tactics differ.

Some are busy resetting their ATMs to pay only N10k per withdrawal, and if you are taking out N100k; you know what it means once you hit the third round...

You are billed monthly card maintenance on a card you don't use, and when it expires, you are billed N1k for renewal, yet the same card is 'serviced' with N600 annually.

When you ask for business loan, they all turn to monsters, with litany of conditions to be met, same way organisations expect fresh graduates here to possess five years working experience...

What is clear is that our banks and their regulators derive joy in ripping people off, and they gloat while everyday people look hopeless and helpless.

One small question for them: what is the value for using banking services here? Obviously it can be for giving loans with rates the business will go under, in trying to pay, neither is it that of charges and fees that even the customers can't even keep track on what they are billed for.

It's a jungle, where might is right.

The banking industry here is more or less about - the more you look, the less you see. There isn't really a decent one, they were cut out from the same cloth, only the tactics differ.

Register for Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.

Some are busy resetting their ATMs to pay only N10k per withdrawal, and if you are taking out N100k; you know what it means once you hit the third round...

You are billed monthly card maintenance on a card you don't use, and when it expires, you are billed N1k for renewal, yet the same card is 'serviced' with N600 annually.

When you ask for business loan, they all turn to monsters, with litany of conditions to be met, same way organisations expect fresh graduates here to possess five years working experience...

What is clear is that our banks and their regulators derive joy in ripping people off, and they gloat while everyday people look hopeless and helpless.

One small question for them: what is the value for using banking services here? Obviously it can be for giving loans with rates the business will go under, in trying to pay, neither is it that of charges and fees that even the customers can't even keep track on what they are billed for.

It's a jungle, where might is right.