"Everyone is a genius in a bull market"

Quote from Ndubuisi Ekekwe on January 25, 2020, 8:07 AM

Governments typically have three main tax bases: capital, labor, and expenditure. If we automate the world, the labor (i.e. income tax) will drop! That is a concern that must be managed. Meanwhile, is there any reason to own an individual stock anymore? - "Everyone is a genius in a bull market" but Warren Buffett instructed the trustee of his estate to put 90% of the cash he is leaving behind in a "very low-cost S&P 500 index fund" and the rest in short-term government bonds (Fintech Collective).

"Don't confuse a bull market with investment prowess. Everyone is a genius in a bull market," Frederick said. "Active managers earn their pay when things get rocky."

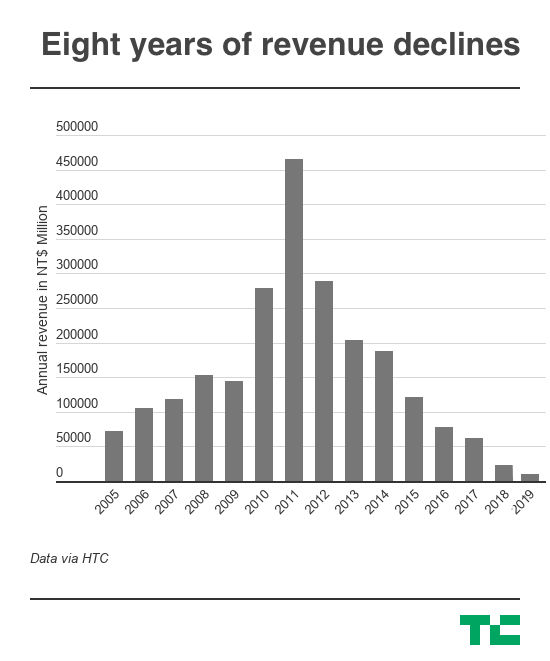

When you talk of genius,you remember the fading HTC which used to be amazing: "HTC reported revenue of 10,015 TWD ($333 million) in 2019, down 57.8% from the 23,741 TWD ($789 million) it posted in 2018, and a whopping 87% below the more than $2 billion it grossed in 2017."

Governments typically have three main tax bases: capital, labor, and expenditure. If we automate the world, the labor (i.e. income tax) will drop! That is a concern that must be managed. Meanwhile, is there any reason to own an individual stock anymore? - "Everyone is a genius in a bull market" but Warren Buffett instructed the trustee of his estate to put 90% of the cash he is leaving behind in a "very low-cost S&P 500 index fund" and the rest in short-term government bonds (Fintech Collective).

"Don't confuse a bull market with investment prowess. Everyone is a genius in a bull market," Frederick said. "Active managers earn their pay when things get rocky."

When you talk of genius,you remember the fading HTC which used to be amazing: "HTC reported revenue of 10,015 TWD ($333 million) in 2019, down 57.8% from the 23,741 TWD ($789 million) it posted in 2018, and a whopping 87% below the more than $2 billion it grossed in 2017."