Forum breadcrumbs - You are here:ForumTekedia Forum: Tech | Business | StrategyAzimo and Transferwise not author …

Azimo and Transferwise not authorized in Nigeria - CBN

Ndubuisi Ekekwe@nekekwe

#1 · December 16, 2020, 9:58 PM

Quote from Ndubuisi Ekekwe on December 16, 2020, 9:58 PM

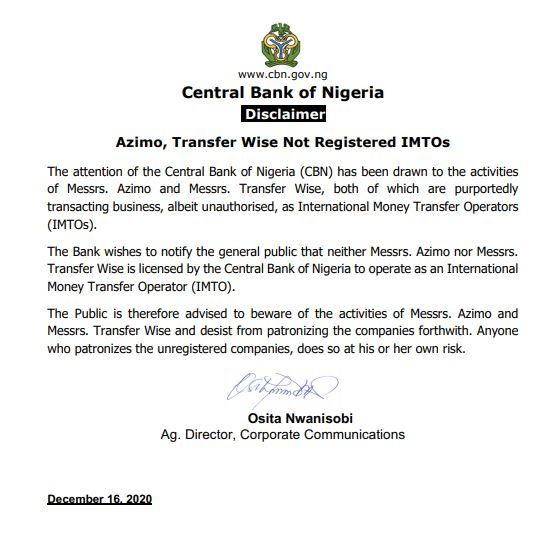

Azimo and Transferwise are not authorized as IMTO in Nigeria.

In another circular, the apex bank now "stops International Money Transfer Operators (IMTO) from sending money to Mobile Money Operators and also stopped the integration of payment services providers to IMTO accounts. It also stopped switches and processors from getting involved in foreign remittances."

- Switches and Processors should immediately cease all local currency transfers in respect of foreign remittances through IMTOs.

- All MMOs are required to immediately disable wallets from receipt of funds from IMTOs.

- Payment service providers are directed to cease integrating their systems with IMTOs going forward and must prevent comingling of remittances with other legitimate transactions.

- All IMTOs are required to immediately disclose to beneficiaries that they exercise discretion to receive transfer in foreign currency cash or directly into their domiciliary accounts.

- A central reporting portal for all foreign remittances to be managed by the Nigerian Interbank Settlement System (NIBSS) is currently under development to improve visibility of foreign remittance flows.

Azimo and Transferwise are not authorized as IMTO in Nigeria.

In another circular, the apex bank now "stops International Money Transfer Operators (IMTO) from sending money to Mobile Money Operators and also stopped the integration of payment services providers to IMTO accounts. It also stopped switches and processors from getting involved in foreign remittances."

- Switches and Processors should immediately cease all local currency transfers in respect of foreign remittances through IMTOs.

- All MMOs are required to immediately disable wallets from receipt of funds from IMTOs.

- Payment service providers are directed to cease integrating their systems with IMTOs going forward and must prevent comingling of remittances with other legitimate transactions.

- All IMTOs are required to immediately disclose to beneficiaries that they exercise discretion to receive transfer in foreign currency cash or directly into their domiciliary accounts.

- A central reporting portal for all foreign remittances to be managed by the Nigerian Interbank Settlement System (NIBSS) is currently under development to improve visibility of foreign remittance flows.

Uploaded files:

Click for thumbs down.0Click for thumbs up.0

Last edited on December 16, 2020, 10:04 PM by Ndubuisi Ekekwe