American businessman and former software engineer who served as the CEO of Google from 2001 to 2011 Eric Schmidt, has recently highlighted the growing trend among tech giants making substantial investments in Nvidia-based AI data centers.

During a talk at Stanford, Schmidt revealed that several tech companies are planning to invest heavily in Artificial Intelligence infrastructure, with costs potentially reaching up to $300 billion. He noted that a significant portion of this investment is flowing into Nvidia, a giant AI chipmaker that currently dominates the market for AI data center chips, which is about to see its stock market price surge massively.

He said,

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

“I am talking to the big companies, and the big companies are telling me they need $20 billion, $50 billion, $100 billion very very hard. If $300 billion is all going to Nvidia, you know what to do in the stock market. That’s not a stock recommendation”.

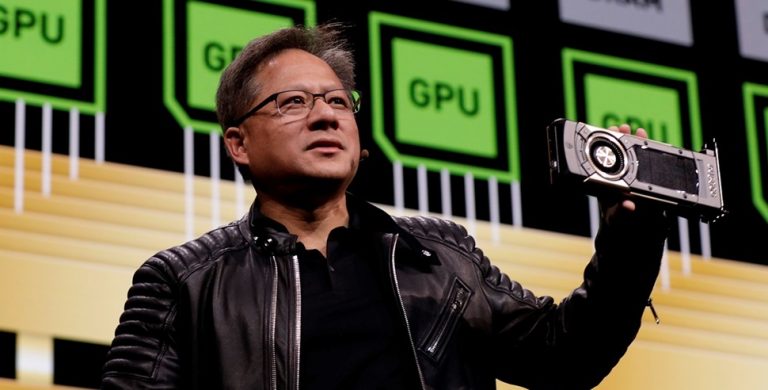

He noted that a significant portion of this investment is flowing into Nvidia, a company that dominates the market for Al data center chips. Nvidia has already experienced a revenue surge of more than 200% for three consecutive quarters, driven by soaring demand from cloud providers and leading Al model developers.

However, Wall Street is beginning to question whether the chipmaker’s top clients might be overspending on Al infrastructure. Nvidia is expected to provide further details when it reports its quarterly results on August 28. While Schmidt acknowledged that Nvidia won’t be the only beneficiary in the Al space, he pointed out that there aren’t many other clear alternatives. He believes that large companies with the resources to invest heavily in Nvidia chips and data centers will gain a technological edge over smaller competitors who can’t match their spending power.

“At the moment, the gap between the frontier models there are only three and everyone else appears to be getting larger. Six months ago, I was convinced that the gap was getting smaller, so I invested lots of money in the little companies. Now I’m not so sure.”

He added that it will be challenging for competitors to catch up with Nvidia, as many of the critical open-source tools used by Al developers are based on Nvidia’s CUDA programming language.

Lately, Nvidia is experiencing an unprecedented surge in demand, driven by significant investments from cloud companies and leading Al model developers. As artificial intelligence continues to revolutionize various industries, tech giants are increasingly relying on Nvidia’s advanced Al chips to power their cutting-edge technologies and infrastructure.

Cloud service providers, essential to the deployment and scaling of Al solutions, are heavily investing in Nvidia’s GPUs to enhance their capabilities and meet the growing needs of their clients. These investments are critical for supporting the development of Al models, which require immense computational power to process and analyze vast amounts of data.

Leading Al developers, who are at the forefront of creating sophisticated Al models, are alsocontributing to the demand for Nvidia’s technology. These models, which range from natural language processing to computer vision and beyond, depending on the efficiency and performance of Nvidia’s GPs to achieve groundbreaking results.

As Al continues to advance, the reliance on Nvidia’s hardware has only intensified, making the company a central player in the Al ecosystem, coupled with the surge in demand which has translated into remarkable financial performance for Nvidia.