Nigeria’s fintech sector is bracing for the Electronic Money Transfer Levy (EMTL), a move that has drawn widespread attention for its timing and broader implications. Fintech companies, including OPay, Moniepoint, and others, have notified their customers of the N50 EMTL deduction on inflows of N10,000 and above starting from September 9, as directed by the Federal Inland Revenue Service (FIRS).

This marks the end of an era where several fintech platforms provided free banking services, as the charges will now go directly to the federal government.

The Background of the Levy

The EMTL was introduced as part of the Finance Act 2020, designed to raise revenue from electronic transactions. At its core, the levy is an N50 charge applied to any electronic transfer of funds amounting to N10,000 or more. The idea behind the levy was to tap into the burgeoning digital payments ecosystem to generate revenue that could help fund government projects and services.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The government initially announced the regulatory guidelines, signed by then Minister of Finance, Budget and National Planning, Mrs. Zainab Ahmed, in 2022. The FIRS was appointed to administer the levy. However, the timing was particularly sensitive, as Nigerians were already grappling with economic challenges that included high inflation.

Irony of The Extension to Fintechs

The extension of the EMTL to fintechs, at a time when the government claims it is working to reduce the tax burden on Nigerians has raised eyebrows. President Bola Tinubu’s administration, which recently inaugurated a tax reform committee to reduce multiple taxation, had promised relief for struggling Nigerians. Many believe that the imposition of the levy on fintechs contradicts those promises.

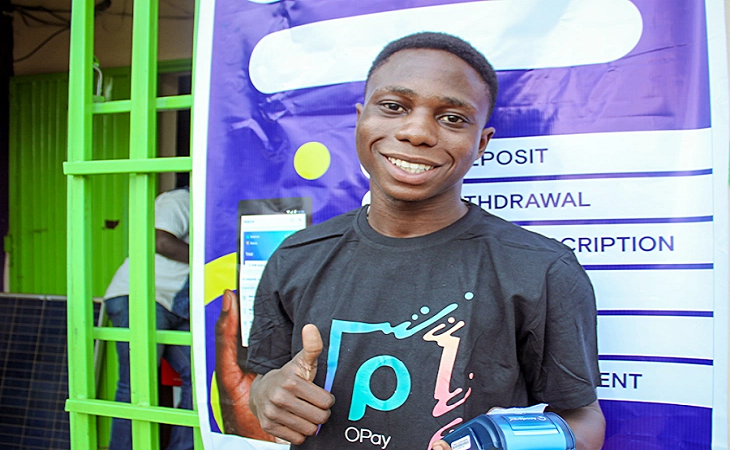

Moreover, this move is coming in the face of the Central Bank of Nigeria’s (CBN) push for a cashless economy. The CBN has spent years promoting digital payments, urging Nigerians to transition from cash to electronic platforms to enhance efficiency and reduce the cost of handling cash. Many fintech platforms, including Moniepoint and OPay, have been key players in advancing this cashless agenda by offering free transactions, thereby encouraging the adoption of electronic payments across the country.

Now, with the mandatory N50 charge on electronic transfers, critics argue that the EMTL could slow down this progress. The additional cost of making transactions might discourage people from using digital platforms, especially those who transact frequently. For lower-income individuals or small businesses that depend on several smaller transactions daily, the levy adds up, creating yet another layer of financial strain.

A Blow to Fintechs

The levy also poses a challenge to fintech companies that have built their businesses on providing seamless, low-cost, or free digital payment services. OPay, Moniepoint, and other platforms had long attracted users by eliminating or minimizing transaction fees, which set them apart from traditional banks. This business model helped fintechs capture a significant portion of Nigeria’s payments market, particularly among the underbanked and unbanked population.

With the EMTL coming into effect, fintechs will be forced to pass the cost onto their customers, which might weaken their competitive advantage. While the deduction goes to the federal government, customers are likely to associate these new charges with the fintech companies themselves. In addition, fintechs may see a decline in transaction volumes as users seek ways to avoid the added costs, either by reducing the number of transactions or reverting to cash.

Contradictions in Economic Policy

The extension of the EMTL to fintechs also reveals contradictions in Nigeria’s broader economic strategy. On the one hand, the government is looking to expand its revenue base through taxes like the EMTL. On the other hand, it claims to be committed to alleviating the tax burden on its citizens and promoting digital financial inclusion.

Experts warn that policies like the EMTL could backfire if they push more people out of the formal financial system. They say that the government risks undoing years of progress toward financial inclusion, as this levy could drive people back into cash-based transactions, undermining the CBN’s cashless policy.