Stock Market Update:

Nigeria’s equity market is currently down by 1.19%. FTSE (UK) – down by 1.77%, DAX (Germany) – down by 2.73%, CAC 40 (France) – down by 2.52% and Nikkei 25 (Japan) – down by 1.97%.

Click on the link https://bit.ly/2XrvIf9 to open a stockbroking/share purchase account and trade within 24 hours.

Oil Market Update:

The negative closing price of WTI futures price yesterday can be interpreted to mean sellers desperately paying buyers to take US crude from them. As an example, WTI is currently trading at -$6.3, it means suppliers of oil have to give $6.3 to buyers willing to take one barrel of their oil.

Why will a seller pay a buyer to take a product away? In this case of oil-storage trade, the sellers want to avoid storage costs.

In a WTI futures contract, the buyers of WTI oil are required to take physical delivery of their oil at a location called Cushing, Oklahoma in the United States. Sadly, the storage capacity of that location had been exhausted as a result of oil glut and destruction of demand by COVID-19, and buyers don’t want to take delivery of oil without a place to store it before getting a final buyer. Sellers were therefore compelled to pay buyers an incentive, the reason for the negative closing price of WTI on 20th April.

Aside from the real activities of Buyers and Sellers, Oil as a commodity is heavily traded on exchanges.

The closing price of the WTI yesterday was more of a function of the commodities trading market than underlying fundamentals, more about the activities of pure Investors than the reality on the ground. You will be right to call it panic.

WTI futures expired yesterday, meaning that pure Investors had to sell May’s contract and purchase June to avoid having to make good on their purchase and also avoid storage costs, because there was no storage capacity available in Cushing, Oklahoma.

The main takeaway here is that this challenge is peculiar to the US and the price of WTI is expected to make a comeback in no time.

As for Brent, the unprecedented crash in WTI will not crash Brent prices as Brent contracts will expire at the end of the month.

Nigeria’s Bonny Light futures prices will not be affected too, for now.

Current prices: WTI -$6.3, Brent $21.57, Bonny Light $20.88

Money Market Update:

Nigeria’s annual inflation rate rose for the seventh consecutive months to 12.26 per cent in March, the highest in 23 months from 12.2 per cent in February. The Nigeria Bureau of Statistics (NBS) disclosed this today in its Consumer Price Index Report for March 2020. Read more

At the current rate of inflation, you need returns that will take you closer to growing your wealth in real terms, we can provide that.

Our money market fund is still open and yield is currently over 11.5%, reach out to our team to grow your cash. We are digital, we are working from home, we are online and we are active. You can also do deposits with us at a starting rate of 10%.

Click to subscribe to our money market fund https://trustbancasset.com/moneymarket/

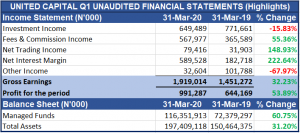

Earnings Flash: United Capital grow earnings by 32.23% and PAT by 53.89%, see highlights in the image below.

Headlines:

Headlines: