According to a report by Innovate Finance, a UK-based independent industry body, Global fintech investments, fell by 19% in the first half (H1) of 2024, amid an economic downturn.

The report states that in the first half of 2024, the total capital invested in fintechs worldwide amounted to $15.9 billion, compared to $19.5 billion in the second half of 2023.

In addition, the total number of funding rounds completed was also down with H1 2024 recording 1,566 deals compared to the 1,661 deals in H2 2023.

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

Innovate Finance states that the low funding received by Fintech firms shows that global fintech investments have reached a “cyclical low point from their 2022 peak, in parallel with the general global VC market”.

Despite the overall decline in funding, the number of deals increased by 15%, with 904 deals recorded in Q1 2024 compared to 724 in Q4 2023. This suggests that while investors remain active, they are focusing on smaller deals.

Overall, the US received the most investment in H1 2024, bringing in $7.3 billion in FinTech capital across 599 deals, while the UK came second, with $2 billion and 183 deals, followed by India with $837 million and 78 deals, China with $589 million invested across 30 deals and Germany with $462 million invested across 37 deals.

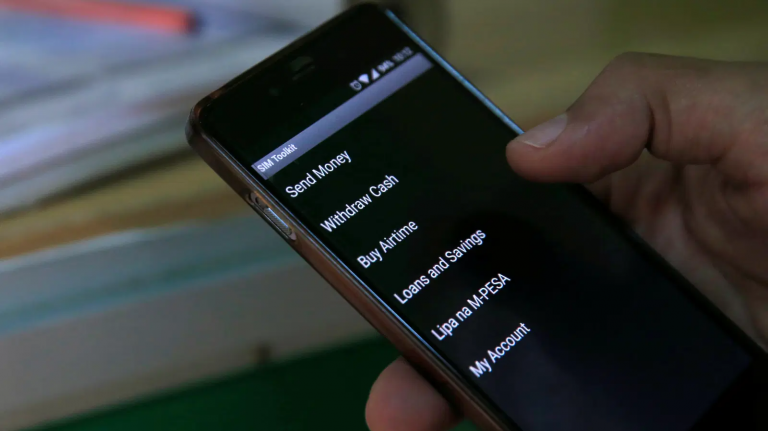

In Africa, a report by Africa: The Big Deal, revealed that the fintech sector which usually takes the major part of the funding, experienced a significant drop in investments, with $158 million of funding raised so far this year, representing only 22% of the funding raised on the continent.

The decline in Fintech funding on the continue is also attributed to the challenges of consumer inflation and local currency depreciation across key markets, which include Nigeria, Kenya, and Egypt. Total fintech funding raised across the continent in the first half of 2024 was down 70% compared to the same period last year.

Fintech, previously the dominant sector in African startup funding, saw a relative decline in investment, which saw a shift in climate tech clinch a significant portion of funding. The average fintech deal size on the continent fell from $13M a year ago to $5M so far this year. This spurred some fintech on the continent to shut down operations.

For fintechs that ceased operations for other reasons, financial constraints often revealed underlying issues like mismanagement or flawed business models. Some of these Fintechs are currently struggling to generate sufficient revenue for their operations or growth and are seeing their respective runways fast approaching critical levels.

With external funding still scarce or internal cash flow negative, many fintechs will have to explore even more severe changes to ensure their survival. However, despite the decline in funding, some African fintechs have shown remarkable resilience, continuing to make critical changes to ensure the survival of their business in an uncertain funding environment.