In microprocessor design, we engineer built-in redundancies. They waste transistors and silicon real estate. But you need them just in case. In finance, they have a different name: risk management. The world of commerce is driven by market forces for the dynamic equilibrium point. If you cannot manage risk, you have no future.

Yes, it has been 10 years since Bear Stearns collapsed. On a fire-sale to JP Morgan, it went for less than 7% of its market value from two days prior. As I noted in my First Day in America & Kindness of Diamond Bank, it was a turbulent period.

Then I started buying stocks in New York Stock Exchange and NASDAQ. One day I lost $26,700 when they nationalized Freddie Mac and Fannie Mae. I had cut-off all stock research to finish my dissertation and was not following market news. I felt bad and learnt a huge lesson – the professionals deserve their wages!

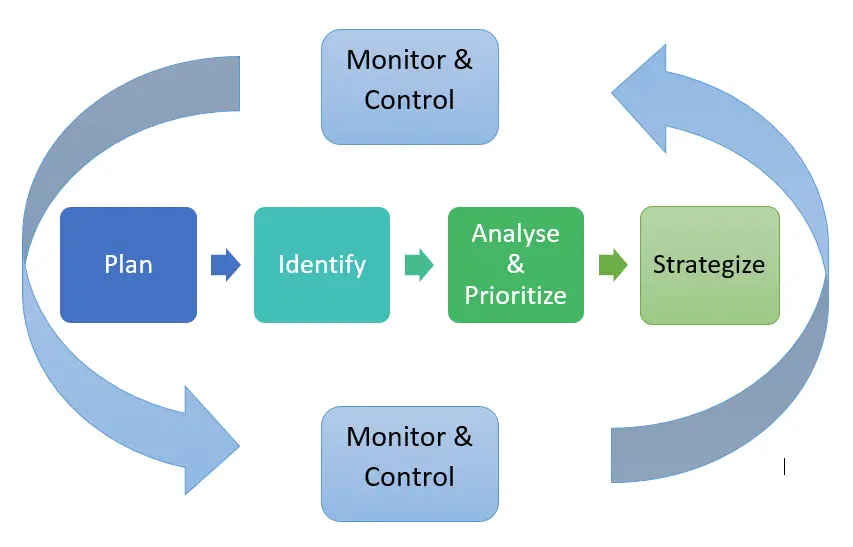

Remember this: if you have not identified 3 risks that could cause severe dislocation in your business, abandon everything this week and find them. Then, once discovered, find mitigation strategies.

Register for Tekedia Mini-MBA edition 17 (June 9 – Sept 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.

Risk is good because without risk, there would not be business. Every business exists to fix frictions in markets. Those frictions are anchored on risks – endogenous and exogenous to the participants. Fixing them demands capabilities, the very reason customers look for those, with abilities, they can pay to help them.

Discover your risks, fix them.

---

Register for Tekedia Mini-MBA (June 9 – Sept 6, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.