Credit Suisse, one of Europe’s largest financial institutions, may be history in the next few hours. I do not just see how that brand will remain, untethered to another bigger bank. The logo may remain but the “trust bank” deposit, a core indicator in the banking system, is all but exhausted through many self-inflicted and external events. In Russia Today, their central bank was telling Russians not to worry that crises in the US and European banks will not reach them. What an irony indeed on geopolitics!

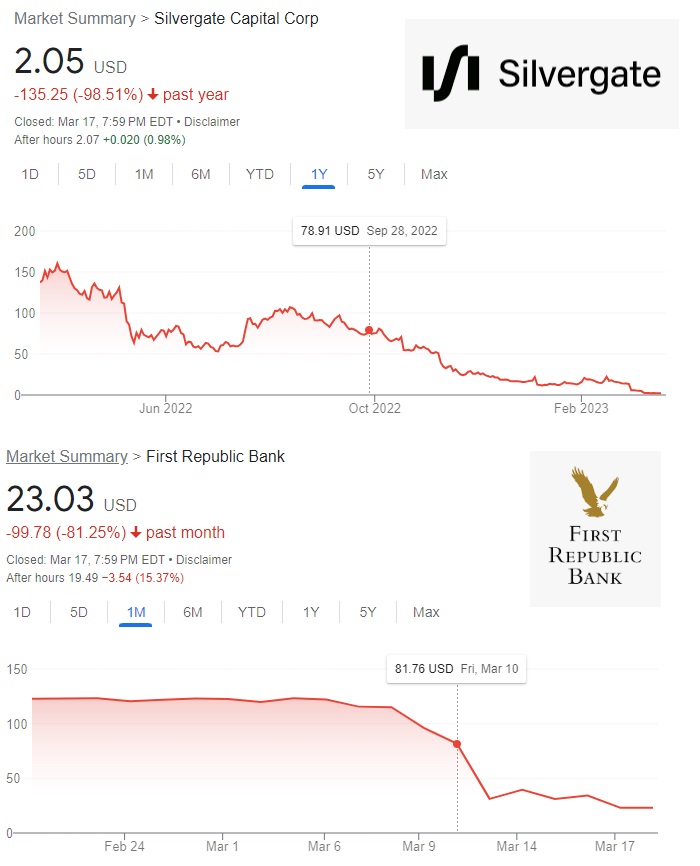

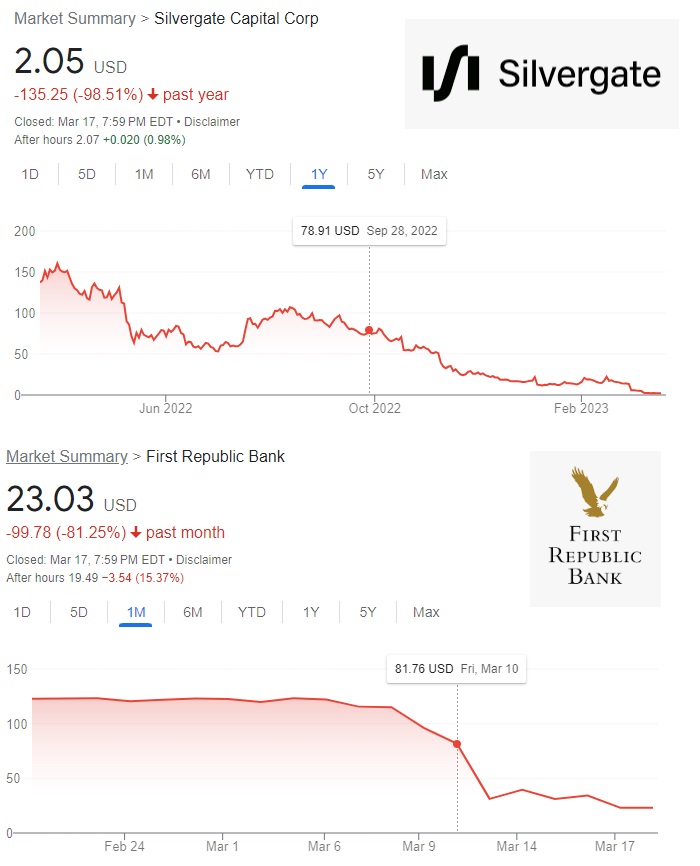

Good People,take a look at these two charts: one for Silvergate and another for First Republic Bank. Within the last 12 months, a $170,000 investment would be $2,000 now in Silvergate while a $150,000 investment is now worth $23,000 for FRB within 30 days!

The message: things happen. Those are people’s retirements and making money is not free; risks abound. But for FRB, its struggles are largely due to perception since Silicon Valley Bank collapsed. Yes, even though it may be fine, and some banks have come together to cushion it with more funds, the investing public does not care. That is a more troubling scenario: “Eleven banks deposited $30 billion at First Republic on Thursday afternoon, in a government-backed bid to bolster the ailing lender and boost confidence in the U.S. banking system”.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

UBS is considering a potential takeover of Credit Suisse, Reuters reports, citing anonymous sources, just days after the Swiss National Bank declared the lender solvent and offered it a $54 billion credit line. The Financial Times notes that a deal for a “historic merger” of Switzerland’s two biggest banks could be reached as early as Saturday. Regulators are urging the two to come to an agreement before markets open on Monday to bolster confidence in the banking system.

Shares of Credit Suisse dropped 25% through the last week despite its $54 billion lifeline.

Earlier in the week, Credit Suisse released its 2022 annual report which cited “material weakness,” worrying investors after the collapse of Silicon Valley Bank. (LinkedIn News)

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube