This weekend the Cryptocurrency industry witnessed a huge clap back owing to the the winding up of crypto friendly bank Silvergate, Crash of Silicon Valley Bank, Fed Tax introduction on Crypto Mining Electricity and Circle USDC and stablecoins like Frax and DAI losing its 1:1 peg against the US dollar. The market sentiment had been negative with many Crypto assets depreciating in value within a relatively short span.

Litecoin was trading at $66.020 by 07:38 (07:38 GMT) on Saturday, down 10.21% on the day. It was the largest one-day percentage loss since November 9, 2022.

The move downwards pushed Litecoin’s market cap down to $5.131B, or 0.54% of the total cryptocurrency market cap. At its highest, Litecoin’s market cap was $25.609B.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Litecoin had traded in a range of $66.020 to $73.740 in the previous twenty-four hours. Over the past seven days, Litecoin has seen a drop in value, as it lost 21.45%. The volume of Litecoin traded in the twenty-four hours to time of writing was $1.096B or 1.18% of the total volume of all cryptocurrencies.

It has traded in a range of $66.0200 to $91.7300 in the past 7 days. At its current price, Litecoin is still down 84.28% from its all-time high of $420.00 set on December 12, 2017.

Bitcoin was last at $20,049.5, up 0.50% on the day trading chart, Ethereum was trading at $1,447.81 on the CoinGecko Index, a gain of 2.54%.Bitcoin’s market cap was last at $395.334B or 41.96% of the total cryptocurrency market cap, while Ethereum’s market cap totaled $179.199B or 19.02% of the total cryptocurrency market value.

Over the next 6-18 months we are setting up a monster rally for $BTC. World will wake up to the reality that $BTC is the most useful bearer asset in existence and that credit assets are dangerous. Bank failures one year before halving. Could not have written a better script, Avi Felman noted.

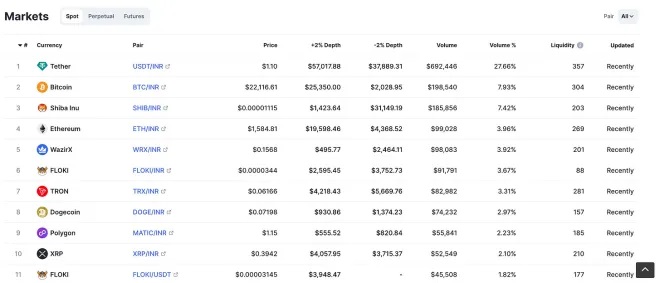

Floki is currently the third most traded cryptocurrency on India’s largest and most recognized exchange WazirX days after its listing. It is ranked after $BTC and $SHIB.

$FLOKI is also the only cryptocurrency with two trading pairs in the top 10 that is not a stablecoin.

Polygon zkEVM Hype Intensifies

Polygon has been recently hyping up its zkEVM scaling solution, something that very few teams are currently working on.

That’s because zkEVMs are notoriously hard to develop. A zkEVM stands for zero-knowledge Ethereum Virtual Machine and is considered to be the holy grail of Ethereum scaling. zkEVMs improve throughput and decrease gas prices by computation and storage off-chain and generating zero-knowledge proofs to verify the validity of off-chain transaction batches.

There are currently no zkEVMs that are deployed on Ethereum mainnet but Polygon’s co-founder Sandeep Nailwal tweeted on January 17 that the team developing Polygon’s zkEVM has set a launch date and that it’s “soon.”

On top of that, Eduardo Antuña, Polygon zkEVM’s core developer, tweeted on Thursday that Polygon has managed to increase its zkEVM’s proving time and costs. Really excited about our results on the Polygon zkEVM Prover, Batchproof 2:30 (2min soon) ~500 or ~250 ERC20 tx/batch.

On a spot m6id.metal prover’s cost: $0.064/proof ($0.0001/tx) The fastest ZK tech and the first production-ready zkEVM. The prover is no longer a bottleneck. All of this indicates that Polygon’s zkEVM, at least in theory, will soon be deployed on Ethereum mainnet. That would be an achievement like none other and potentially take MATIC to new highs.