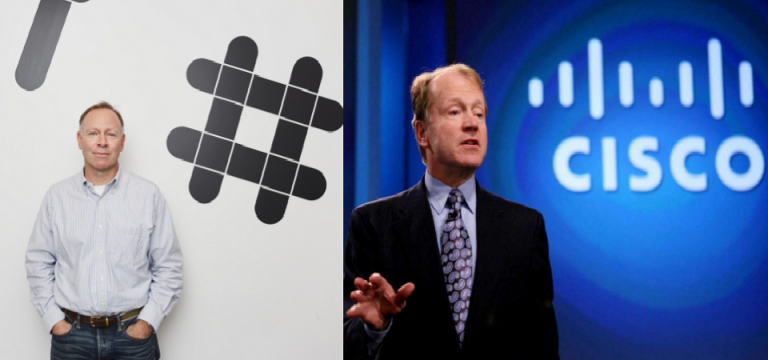

Cisco lived on a hangover for years. It wanted to sustain its highly lucrative hardware selling model into a world where “software is eating” everything. Under John Chambers, its former long-tenured CEO, the company kept the high-margin hardware party going for extended period even when the world had moved on. Mr. Chambers had a big challenge which caused the stasis: cannibalize a lucrative hardware business to participate in an emerging, and largely low-margin software one. He chose the hardware business and Cisco, over time, lost its bearing, running six quarters of declining sales.

Amazon had helped to unleash a double whammy through cloud computing for typical Cisco customers and commoditization of most server hardware. As that happened, the race trajectory was to the gross margin bottom: many companies like Facebook and Google were using off-the-shelf components to build their datacenters. Generic network equipment manufacturers like Taiwanese Quanta and Winstron brutally wounded Cisco business model with cheaper alternatives that did the work. Usually, after the generic builders have delivered, most of the companies use in-house networking software to put them to use. Over time, Cisco was totally cut-off with its premium (expensive) solutions.

Just like that, most datacenters do not rely on premium networking gears. From HP to IBM to Cisco, that transition affected many things: the cash-cow collapsed. Specifically for Cisco, it went into lost quarters where revenue declined. Mr. Chambers started to react, restructuring the business, but he was slow. Then Mr Chambers left.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Under a new leadership, a new strategy is evolving in Cisco. It is a total redesign for the pioneering networking gear company. Today, instead of focusing on the hardware element of the datacenter equipment for handling corporate networks, Cisco has gone into software. That was what it has resisted for years. It was a hangover just the same way Microsoft was slow to mobile to protect Windows. A transition from desktop to mobile was a threat to Windows and Microsoft wanted that not to happen or be delayed. Unfortunately to Microsoft, Apple and Google (through Android) did not get the memo: mobile happened without Microsoft. Cisco had the same issue: managing network was moving to software and it stood there protecting the margins on hardware.

The tech giant debuted software on … designed to make it easier for corporate customers to manage and monitor their networks. In addition to the new software, the company also introduced new data center switches with custom-made chips that are intended to make operating the software more efficient.

Customers that buy the new equipment must pay a subscription to access many of the new software features, marking a big departure for Cisco from its longtime business strategy. In the past, Cisco sold hardware that came with most services pre-installed and that customers had to pay for whether they wanted that software or not.

The new software by subscription underscores Cisco’s efforts to deal with declines in its legacy business of selling equipment for managing Internet and telecommunications networks. Businesses are increasingly buying computing resources on-demand from companies like Amazon and Microsoft instead of buying traditional data center hardware, which has hurt Cisco because of its dependence on selling data center gear.

Gearing on Software

The new CEO of Cisco, Chuck Robbins, is very bullish that this new software strategy will recover the past glories of Cisco. Cisco dominated its industry, and was one of the fastest growing companies in the tech world before market needs changed. The IT market had radically changed from the way companies like Cisco structured it. Now, the path to consistent growth will come through pay-as-you-go (i.e. subscription) business and that means Cisco has to have deeper relationships with its customers to keep their credit cards on files. Juniper Networks and other competitors in the market are also transforming their businesses along this subscription model.

This is a better strategy since no Western company can beat Huawei (within the whole nexus of telecom hardware) and the smaller ones like Quanta because they know how to make physical things at better cost models. The good news for Cisco is that by moving into software, Cisco will move from the bottom of the smiling curve to the edges and could over time command better margins. Cisco will become like Accenture instead of Foxconn in the plot below.

As the CEO noted, that is where they are going: a software-as-a-service company with focus across many related areas within connectivity, security, networking and collaboration.

Ultimately, the new software “is just the first phase of a much longer term strategy,” said Cisco CEO Chuck Robbins. Cisco plans to use the new software as a beachhead for selling customers additional services that are aimed at powering Internet-connected devices like elevators and factory equipment.

Although Cisco already sells some of its software products by subscription, the latest combines those existing products into a more easy-to-buy package. Additionally, the software bundle includes new features like the ability to spot security threats in encrypted corporate networks, a difficult task, and a service that lets IT staff manage Cisco gear without having to tweak the underlying code. Another service was designed to anticipate when a certain corporate app needs excess bandwidth so it doesn’t crash under heavy use.

Cisco Needs Slack

Cisco is not going to be alone in this sector. The competition is huge. From security to software, we have companies like HPE and Palo Alto Networks competing. Amazon will remain a key one even as Microsoft Azure and Google Cloud evolve. China has already commoditized networking gears. What remains now is integrated servicing and that means Cisco needs to know its customers more. Slack, a cloud-based set of proprietary team collaboration tools and services, is an opportunity.

Cisco’s transformation has seen the acquisition of AppDynamics which cost it $3.7 billion. Slack may cost more, in the range of 9 billion . With internet connected services at the heart of corporate systems, collaboration at work is evolving as the new paradigm. Slack would help Cisco hold that future. The march to networking software in the age of Amazon Web Services will remain extremely challenging. It is not clear how new software from Cisco will offer a better deal to companies that buy cheap generic networking gears supported by their own software or those really smaller ones that avoid all gears and depend on cloud providers. Solving that puzzle will be made easier with Slack.

Yes, Cisco must have looked at these issues for its new strategy. It may need to sell its software beyond the geeks and developers to even end users. Slack is the only solution available to help on that.

All Together

Cisco has a rare opportunity to remake its business. Generic contract manufacturers like Quanta would continue to challenge its hardware business and companies like Amazon through their cloud services will make its new software solutions penetration very limited. The big tech firms like Facebook and Google use generic gears in their data centers while using in-house networking software to link them together. Smaller companies depend on AWS, Microsoft Azure and Google Cloud. This means that Cisco is cut-out of the loop since its premium networking gears are finding lower number of customers. The company has to think how to sell software, not just to developers and geeks but also corporate end-users. That is why Slack will make sense. And Cisco should acquire Slack.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube