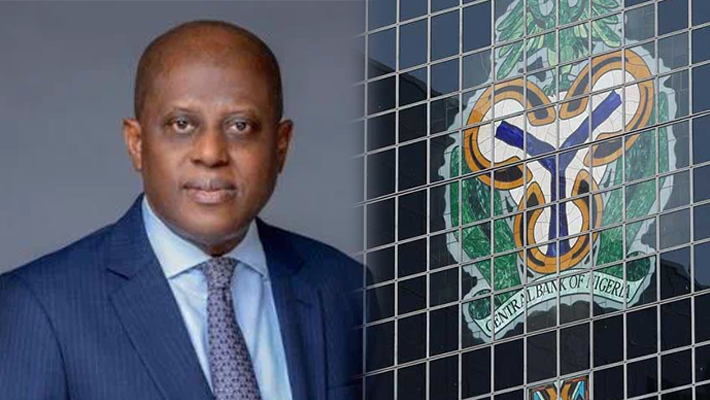

Olayemi Cardoso, the governor of the Central Bank of Nigeria (CBN), has attributed Nigeria’s economic challenges to a combination of macroeconomic factors, including the lingering impacts of the COVID-19 pandemic and the ongoing Russia-Ukraine war.

He made these remarks during the “Cowries to Cashless” lecture and launch event held in Abuja.

Represented by Mr. Mustapha Haruna, the Director of Banking Supervision, Dr. Cardoso highlighted the economic difficulties that the country is facing due to the combined effects of the pandemic and geopolitical tensions.

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

Dr. Cardoso also mentioned the significance of the book titled “Cowries to Cashless,” noting that it captures the evolutionary journey of the CBN, particularly focusing on the remarkable transformation of the Nigerian payment system over the last two or three decades.

He emphasized that this transformation has been further advanced through the implementation of the cashless policy.

Is the CBN still pushing blame?

Nigerians have expressed concern that the new central bank governor is towing the path of his predecessor, Godwin Emefiele, who had notoriety blaming people and events for Nigeria’s economic pitfalls tied to the CBN’s monetary policies.

Nigeria’s current economic woes are highly tied to the poor performance of the naira, the country’s currency, which has fallen miserably in the FX market – stoking inflation up to 26.72% as of September.

Experts say that the solution lies in increased FX liquidity, which has significantly tanked in the past eight years against the backdrop of poor oil revenue.

The Nigerian oil sector, which accounts for more than 90% of the country’s total revenue, has been grappling with oil theft and vandalism – resulting in low oil output.

In September 2023, Nigeria’s crude oil output rose to 1.35 million barrels per day, marking the highest production level for the year thus far. Data sourced from the Nigerian Upstream Petroleum Regulatory Commission in October revealed that this output was approximately 14% greater than the production recorded in August 2023.

Nonetheless, it is important to note that Nigeria’s output still falls significantly short of the OPEC-approved quota, which stands at approximately 1.8 million barrels per day for the country.

Against this backdrop, the federal government has taken to borrowing to boost FX inflow, in the hope of strengthening the naira. Finance Minister Wale Edun announced last month that Nigeria is anticipating $10 billion of inflows in “the coming weeks”, as part of an upfront cash loan against proceeds from a limited amount of future crude oil production. The strategy has been deployed recently by the federal government to secure loans.

Experts have urged the central bank governor to concentrate on clearing the backlog of some of its FX obligations. Last week, the news that the CBN is clearing its outstanding matured FX forwards with banks, stirred the naira to unprecedented performance.