There is one thing that happens with Lawmakers … and to be fair, that’s lawmakers everywhere, not just the US. That is the zeal with which they rush to legislate on new technologies is sadly not matched with their understanding of it.

As a world, legislative containment can’t even curb the worst of what can happen with FIAT economies – inflation, stagflation, recession, quantitative easing, fractional reserve banking (non exhaustive list)… and FIAT currencies are thousands if not tens of thousands of years old…

So how can we expect lawmakers and regulatory authorities to put in place sensible legal frameworks for the operation of cryptocurrencies and other blockchain value instruments?

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Well, it seems, we can’t!

I’ve written at length about how the Ethereum Ecosystem is vulnerable to regulatory and judicial interference in the US.

There are two aspects to this – Firstly, the core of Eth itself, after it moved to PoS (Proof of Stake) – Majority Stakeholders are now known and an open record, so regulatory authorities can directly target them and hold them accountable for whatever crazy new requirement they dream up.

Secondly, and more importantly – Any businesses who have created themselves off different types of EVMs or scaling systems – examples, Binance, Polygon etc are extra vulnerable.

Why? because these are just regular companies with a lot of off-chain data. They have ‘smart contracts’ but they don’t have a blockchain in the sense that Ethereum is a blockchain, or Bitcoin is a blockchain.

So… the SEC can do the heavy on them… key investors can do an SBF on them… or they can simply go bankrupt.

Things keep on getting stranger –

Illinois court has come out with a decision that’s impossible to implement in some blockchains. They have empowered courts to be able to order a blockchain transaction that is executed via a smart contract to be altered or rescinded.

The act would apply to any “blockchain network that processes a blockchain transaction originating in the State’

Six Months ago in the post:

.I related how it was reported by Sam Kessler of Coindesk that Stanford researchers had created two new Ethereum token protocol formats – ERC20R and ERC 721R – the ‘R’ standing for REVERSIBLE.

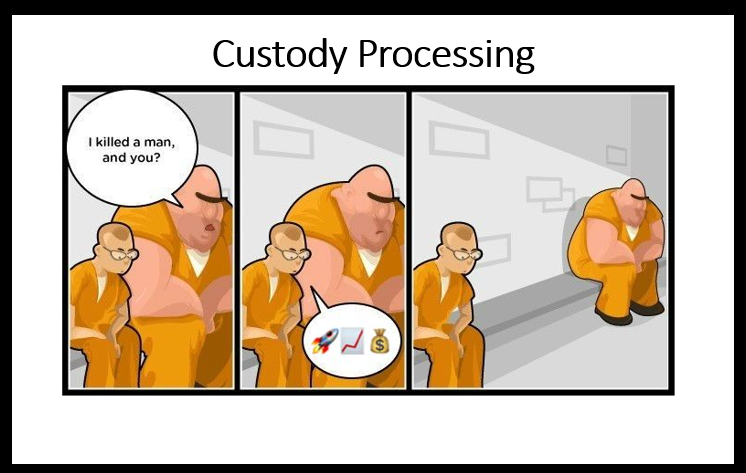

In addition to this, the SEC has now decided that the use of three particular emoji’s – the rocket, the financial chart, and the moneybag, all constitute ‘Financial Advice

So you think, ok leave US and make something off Ethereum based somewhere else? Well… if too many companies do this, and the Ethereum ecosystem in general isn’t working in IRS benefit, then SEC can just come down on the Eth. core.

Because of the PoS status, and the weighting of just a few investors to have control over the staking, they can pretty much disable it.

This week, SEC has taken shots at Binance on both Paxos and Voyager issues. Last week Binance was taking heat for transferring $400m to Merit Peak, a company managed by Chanpeng Zhao.

Polygon is amid layoffs.

Pulling the Eth core out from under systems working off Eth but registered outside the US could conceivably result in the biggest state sponsored rug pull ever!

9ja Cosmos is here…

Get your .9jacom and .9javerse Web 3 domains for $2 at:

All reference sites accessed between 26-28/02/2003

cointelegraph.com/news/unworkable-bill-to-ban-blockchain-immutability-is-introduced-in-illinois

reuters.com/business/finance/paxos-engaged-constructive-discussions-with-us-sec-over-binance-stablecoin-2023-02-21/

blockonomi.com/sec-takes-another-shot-at-binance-us/

msn.com/en-us/money/markets/federal-judge-rules-that-emojis-count-as-financial-advice/ar-AA17Sgai

tekedia.com/as-ethereum-goes-proof-of-stake-has-uncle-sam-via-his-sec-just-got-a-new-tool-to-spank-binance-and-chinas-rising-crypto-experts-and-what-does-this-mean-for-ethereums/

coindesk.com/tech/2022/09/28/stanford-proposal-for-reversible-ethereum-transactions-divides-crypto-community/

reuters.com/technology/crypto-giant-binance-moved-400-million-us-partner-firm-managed-by-ceo-zhao-2023-02-16/