BlackRock, the world’s largest asset manager, has filed an application with the U.S. Securities and Exchange Commission (SEC) to launch a spot Bitcoin ETF. The proposed fund, named BlackRock Bitcoin Trust, will track the performance of Bitcoin based on the CME CF Bitcoin Reference Rate.

Unlike futures-based Bitcoin ETFs, which invest in Bitcoin derivatives contracts, the spot Bitcoin ETF will hold actual Bitcoin in custody and allow investors to gain direct exposure to the cryptocurrency.

The CME CF Bitcoin Reference Rate is a daily benchmark price that reflects the value of one Bitcoin in U.S. dollars, based on data from several major cryptocurrency exchanges. Unlike futures-based Bitcoin ETFs, which invest in Bitcoin derivatives contracts, the spot Bitcoin ETF will hold actual Bitcoin in custody and allow investors to gain direct exposure to the cryptocurrency.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

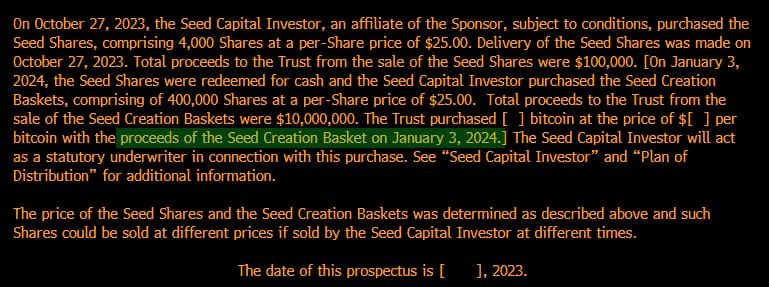

According to the filing, BlackRock plans to seed the fund with $10 million of its own capital, which will be used to purchase Bitcoin from various sources. The fund will charge a 0.95% annual fee, which is lower than the 1% fee charged by most futures-based Bitcoin ETFs.

The fund will also use third-party service providers to ensure the security and integrity of the Bitcoin holdings, such as Fidelity Digital Assets Services, LLC as the custodian and Coin Metrics, Inc. as the index provider.

BlackRock’s move to launch a spot Bitcoin ETF is a significant development for the cryptocurrency industry, as it signals the growing interest and acceptance of institutional investors in Bitcoin. BlackRock is not only the largest asset manager in the world, with over $9 trillion in assets under management, but also a leader and innovator in the ETF space, with over $3 trillion in ETF assets.

By offering a spot Bitcoin ETF, BlackRock could potentially attract more investors who prefer to invest in Bitcoin directly rather than through futures contracts, which entail additional costs and risks.

Moreover, BlackRock could also pave the way for other asset managers and financial institutions to follow suit and launch their own spot Bitcoin ETFs, creating more competition and diversity in the market.

The approval of a spot Bitcoin ETF by the SEC is still uncertain, as the regulator has repeatedly rejected or delayed such applications in the past, citing concerns over market manipulation, fraud, and lack of regulation.

Some other Bitcoin ETFs that are currently available or pending approval are:

ProShares Bitcoin Strategy ETF (BITO); The first U.S.-listed Bitcoin ETF that invests in CME Group’s monthly bitcoin futures contracts. VanEck Bitcoin Strategy ETF (XBTF): Another futures-based Bitcoin ETF that invests in CME Group’s monthly bitcoin futures contracts.

Valkyrie Bitcoin Strategy ETF (BTF): A futures-based Bitcoin ETF that invests in CME Group’s monthly bitcoin futures contracts as well as cash-settled options on those contracts. Simplify Bitcoin Strategy PLUS Inc ETF (MAXI): A hybrid fund that invests 15% of its assets in CME Group’s monthly bitcoin futures contracts and 85% in equity securities of companies that are involved in or benefit from blockchain technology.

Global X Blockchain & Bitcoin Strategy ETF (BITS): A hybrid fund that invests 80% of its assets in equity securities of companies that are involved in or benefit from blockchain technology and 20% in CME Group’s monthly bitcoin futures contracts.

Grayscale Bitcoin Trust (GBTC): A private placement trust that holds actual bitcoin and issues shares to accredited investors. It is not an ETF, but it trades on OTC markets like an ETF.

WisdomTree Physically Backed Bitcoin ETP (BTCW): A physically backed bitcoin exchange-traded product (ETP) that is listed on SIX Swiss Exchange and holds actual bitcoin in cold storage. It is not an ETF, but it is similar to one.

However, some analysts believe that the chances of approval have increased recently, as the SEC has approved several futures-based Bitcoin ETFs in October and November, indicating a more favorable stance towards Bitcoin-related products. Additionally, some SEC commissioners, such as Hester Peirce and Elad Roisman, have expressed support for a spot Bitcoin ETF, arguing that it would provide more choice and transparency for investors.

BlackRock’s spot Bitcoin ETF is expected to launch in early 2024, subject to regulatory approval and other conditions. If approved, it will be the first of its kind in the U.S., and potentially a game-changer for the Bitcoin market.