This is a Short Note.

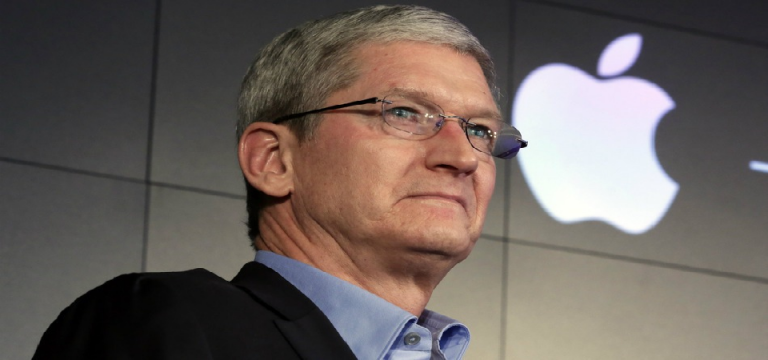

Apple wants to have a plan B on its business relationship with Samsung Electronics. It is working with Bain Capital to buy Toshiba’s flash memory business which is on sale. Toshiba is selling the business to help it manage debt stemming from its investments in the US nuclear sector which went terribly bad.

The iPhone maker is in talks with Bain Capital to bid for the Tokyo-based company’s unit, in competition with a group that includes KKR & Co. and Western Digital Corp., according to people familiar with the matter. Bain had previously submitted a 2.1 trillion yen ($19 billion) offer with another group of backers that included state-backed Innovation Network Corp. of Japan and Development Bank of Japan.

Apple depends on flash memory from Toshiba in its iPhones and iPods, and wants a continued supply so it’s not dependent on rival Samsung Electronics Co. “There are supply shortages of that type of memory,” Michael Walkley, an analyst with Canaccord Genuity. “They’re always looking to work closely with key suppliers and lock in long-term supply agreements.”

What Apple is planning makes sense because Samsung is clearly its main smartphone competitor. By sending the money to Samsung, for supplies of chips, it is arming the opponent. I see three ways why this deal is good for Apple:

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

- Apple will be the new Toshiba flash business main customer. That means Apple is buying a business where it will be the biggest customer. That is a good strategy especially when that means not sending money to Samsung, a competitor

- In the short-time, this is a huge capex, but over time, Apple will benefit. The price of flash memory will likely come down when Samsung knows that Apple is no more in the market to source. So in a scenario where the new Toshiba flash business cannot meet Apple’s demand in volume, Apple could end up buying from Samsung at a more competitive rate. Samsung cannot sell to Apple at more than market rate, by law, even though Apple is a competitor.

- Apple has billions of dollars stocked outside United States. It does not want to pay taxes on this fund and continues to leave them outside U.S. The implication is that it can use some of those funds and do this deal.

Yet, it is not likely that Apple/Bain Capital will get this business. It is not certain Western Digital will give up as it continues to fight for this prized asset.

Western Digital Corp’s (WDC.O) CEO apologized to his counterpart at Toshiba Corp (6502.T) for strained ties after the U.S. firm sued to keep their chip joint venture from being sold to rival bidders, according to an Aug. 11 letter

The embattled Japanese conglomerate has put its chip unit, – worth between $17 billion to $18 billion, up for sale as it scrambles to cover liabilities at its bankrupt U.S. nuclear unit. Relations between Western Digital and its chips partner quickly frayed, however, as Toshiba entertained other bids.

While the Western Digital consortium can fight, to get the business, it is not clear that Japan will like to see Toshiba flash business disappear in this way. So, it is possible the government could mount a bailout.

All Together

Generally, the lesson is this: it does not make sense for any person to fund an army that will attack it. Apple has funded Samsung, providing the cash which continues to make the company better through innovation and scale. As that happens, Samsung is empowered, challenging Apple the more. If Apple begins to find a way out of that, it could be the factor that may decide who wins the smartphone market. Most have seen this from the smartphone angle, but what is happening goes beyond iPhone and Galaxy. Sure, Apple has its exclusive hardware massively differentiated by its software, unlike Samsung Galaxy, which is based on the open source Android. There are may ways the basis of competition diverges. Yet, without Apple, Samsung will not be as financially sound as it is, and without Samsung, Apple may not have had the supply chain efficiency it has enjoyed in chip sourcing. But if Apple breaks this relationship, at least partly, that is when the competition will begin.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube