Thirty-six hours ago, I made a post focusing on the speech of Kenya’s Ambassador to UN Martin Kimani. In it I made a somewhat delicate plea to Vladamir Putin. Just a small voice along with a lot of louder and stronger voices that were out there. None have been heeded. My thoughts are with the Ukrainian people, and even too, many of the Russian youngsters who are forced to shoulder a war they don’t want.

This post is now about business impacts, some of which are for Nigeria.

In statement by European Commission President Ursula von der Leyen:

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

‘we will target strategic sectors of the Russian economy by blocking their access to technologies and markets … weaken Russia’s economic base … freeze Russian assets … aligned with … the United States, the United Kingdom, Canada,…Japan and Australia.’

Von der Leyen also announced readiness to create reverse flow of gas from EU into Ukraine to cushion the effects of its uncoupling of energy links with Russia.

This is what precipitated the price of Brent Crude jumping overnight to its highest point since 2014.

While this seems good news for Nigeria and other oil producing African countries, it is important to understand that this is a ‘sentiment’ reaction from the market.

‘Sentiment’ reactions anticipate something that seems likely, but has not yet happened. There are simply two types of sentiment – a perception of future supply, or a perception of future demand. If the sentiment is proven accurate then the price should stay stable (the sentiment has already priced in the rise).

On the other hand if the sentiment fails to translate, or some other actors bring something to the table (such as ME countries dumping a load of product into the market to cool it), then the price will recede again.

High oil prices are also not universally good news for Nigeria. As per the famous discussion with Bill Gates and Mo Ibrahim, Aliko Dangote pointed out that while O&G sector is Nigeria’s main source of foreign currency, and where FGN makes majority of its income from, it is only 8.8% of the Nigerian Economy.

Since the sectors the masses are ‘feeding’ from comprise 91.2% not O&G, then should oil prices go up, but FGN remove the subsidy on the downstream products, while the Federal system enjoys bigger budgets, further hyper-inflation would ensue plunging the masses further into poverty.

Then again, the issue in Europe relates to natural gas. Crude oil is not the same thing. Though there is also such an issue as ‘sentiment transference’ When this happens, it is the products/services that most resemble the primary target of the sentiment get impacted first.

Bitcoin fell 8% to a one-month low and other cryptocurrencies crash, wiping $150B in the crypto market in the last 24 hours (Arjun Kharpal/CNBC)

Cryptocurrencies are already banned in 10 Countries… Algeria, Bangladesh, Egypt, Iraq, Morocco, Nepal, Nigeria, Qatar, Tunisia and China

Prior to this conflict Russia seemed leaning towards outrightly banning crypto (source Jeff Benson Jan 20, 2022 for decrypt.co), on LinkedIn, Philip Weights reports Vladamir Putin doing a ‘U turn’ on this in a matter of weeks.

The market ‘sentiment’ here would be since the main global centres of the world are going to shut down ‘traditional’ liquid asset movement vehicles for Russia, Russia will resort to using crypto to transact. But the same actors shutting down Russia will be prepared for that also, and so a large global consensus of multiple sovereign states will shut down crypto, not because of any dislike for crypto specifically, but simply because it is a transaction medium vulnerable to being used by Russia to circumvent the other restrictions imposed.

There are many raw materials and agricultural products in which Ukraine is in the top three suppliers in the world.

On the equity front, a week ago, Kiera Rawlings (Reuters) said: ‘Worries over a potential Russian invasion into Ukraine could fuel stock weakness over the short-term, but most U.S. market fallout related to geopolitics is likely to be short-lived, if history is any guide.’

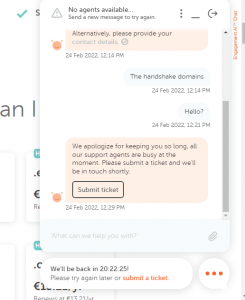

The medium term factor that might most affect Nigeria may be access to various customer and technical remote services.

There are a few countries in the world that have a strong foothold in remote telephone, online and OTT support services. They offer round-the-clock support that range from customer services to billing enquiries, basic sales enquiries, and technical support. The clients they represent range across conventional banking, telecoms, electricity and utility providers, crypto exchanges, web hosting companies, DeFi providers, and a wide range of other services.

The strongest geos for these services are India, The Philippines, and…

UKRAINE

The Ukrainian operators are especially competent at technical proficiency.

Ukraine citizens have centuries of technological development excellence and their engineers and scientists have been pivotal to the former Soviet Union in the space and nuclear races with the US of bygone times.

There was an old saying: ‘If you want technological intelligence from the Soviet Union, you go to Kiev, because that is where Moscow keeps its brain!’

As cyber-attacks from Russia intensify, then any global actors that have Ukrainian nodes on their global datacentre networks and cloud solutions are especially open to breach.

But as conscription begins, and support officers swap their headsets for guns in the field, the true impact on service dependency will be unknown.

Again, my thoughts are with Ukraine.

Please visit www.johnmckeown.eu

All URLs accessed 24/02/2022

www.linkedin.com/posts/sarang-pokhare-iim-calcutta-digital-marketing-expert_ukraine-cyberattacks-all-you-need-to-know-activity-6902557395789205504-WBiT

www.linkedin.com/posts/european-commission_russias-aggression-against-ukraine-press-activity-6902542894180507648-NLtZ

ec.europa.eu/commission/presscorner/detail/en/statement_22_1322

decrypt.co/90886/bank-russia-wants-bitcoin-ban-how-other-countries

www.linkedin.com/posts/philipweights_vladimir-putin-rejects-ban-on-crypto-mining-activity-6894177763025125376-FW6z

www.reuters.com/markets/europe/markets-churn-over-russia-ukraine-conflict-history-shows-fleeting-impact-2022-02-14/

johnmckeown.tiny.us/ukraineafrica-mypush

johnmckeown.tiny.us/decadepredictions-mypush