This is a borderline short for me on Tekedia. I was thinking it was too simplistic and maybe just deserved direct to LinkedIn, but, here we are!

I had recently contributed online to a post by a recruiter, Inez Willeboordse holistically serving the African Market. The issue pertained to start-ups.

This caused me to divert to considering the thought processes individual investors go through when considering where, and with who, and what, to invest with.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Clearly there are obvious things, such as whether they intend to be an active or passive investor, and if active, how the prospect sits within their own expertise.

I then began to think about a program called ‘Dragons Den’ which is a global franchise with different versions running in different countries. The one I seem to get to see most regularly is the UK based one.

One theme that seems to surface again and again, is when ‘Dragons’ find there has been investors that got in earlier and more ‘cheaply’.

I’m copying a fairly ‘calm’ episode here, but there have been previous episodes where Dragons have used the word ‘insulted’ to describe situations where ‘early investors’ have got ‘more for less’, or so it may seem.

The reality is however that investment is consummate with reward/ROI timetable and risk.

It isn’t reasonable to compare the risk taken by ‘wing and a prayer’ angel investors, with ones that are later supplied with some level of data around revenue and market traction.

Peter Jones: You’ve already given these guys 15% for 75k (pounds)!

Entrepreneurs: That was at the very first stages… we have significantly de-risked it since.

Albeit that the Dragons Den program is to some extent similar to things like X Factor and The Apprentice, (50% reality but 50% theatre) but at the end of the day, investors are still playing with their own money.

But we all know there is a difference between seed/pre-seed, angel, series A series B and other types of investors.

It is important that investors understand the stage of development a business opportunity is at, regardless of whether on or off camera. They should not try to compare themselves with investors that entered during different ’rounds’, with different data, and less convincing data to support the case for investment.

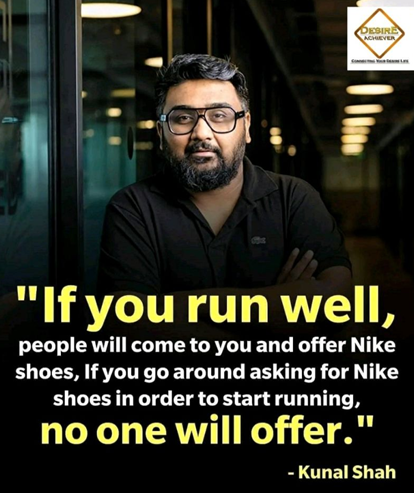

The illustration by Kunal Shah says it all. Just substitute ‘Nike Shoes’ with ‘Investment’