Looking at all trajectories Aliko Dangote is getting poorer despite doing more! It is a paradox because technically Dangote has improved his asset quality over the last seven years, as Dangote Group evolves to become an industrialized conglomerate.

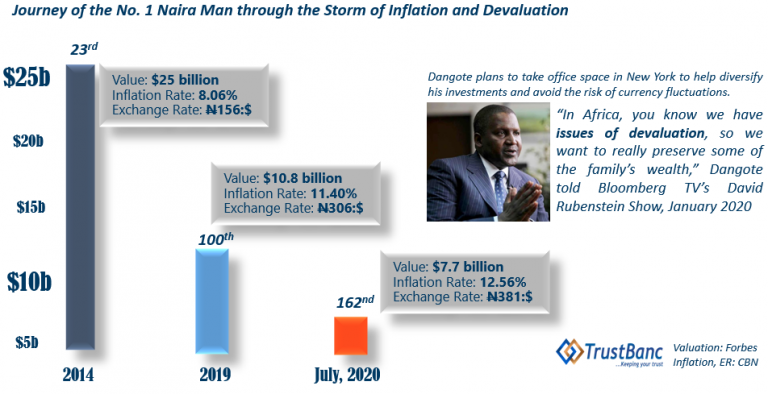

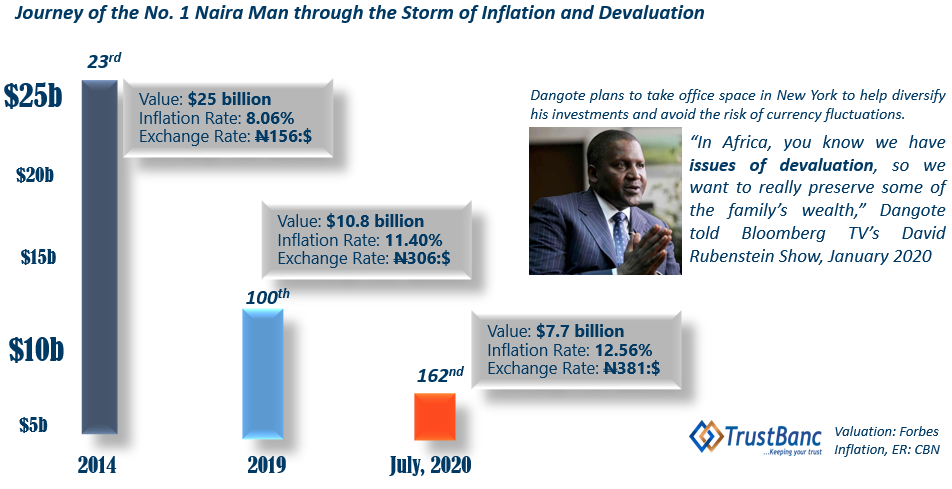

He was worth $25 billion in 2014, becoming the world’s 23rd richest person. In 2019, he became the world’s 100th at $10.8 billion. Today, Dangote is worth $7.7 billion as the 162nd richest person on earth. Understand that what is happening to Dangote is “technical value erosion”: he is still accumulating more Naira but currency deterioration and devaluation have decimated his global standing.

I expect naira to hit N502 per dollar, from N381 today, by May 2023, and if Dangote does not follow through, he could be off the billionaire club. Of course, he has a plan when he said on Bloomberg: “In Africa, you know we have issues of devaluation, so we want to really ‘preserve’ some of the family’s wealth.” Dangote plans to ship some wealth to New York to diversify out of Africa!

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

His products are largely for local consumption, so whatever affects the local currency in his domain of operations affects his net worth too. You don’t produce cement to be sold in New York or Berlin, it’s still within your local market. Same is applicable to the refinery, if demand for oil products starts dropping in the coming years as result of diversification of energy sources, the valuation of conglomerate will drop further.

Aside from policy regime, there’s really nothing keeping an industrial conglomerate from vanishing at any point, because its products have been commoditized, so no differentiation or unique selling point that keeps demands high.

What is clear here is that the entities we think are really strong or resilient might not be, so it’s time we start looking for alternative corporations that can keep Nigeria’s flag flying at the global stage.

We need something we create here that can be sold across the globe at scale, we do not have any right now.

GE, Exxonmobil and some big banks used to run the show, when it comes to world’s most valuable companies. But today they are going down in valuations, tech companies have dominated the top echelon; so we need to know where value is headed and adjust accordingly.

I couldnt agree more with you

What will happen if the exchange rate move to 1000 naira per dollar??

Then we are doomed….and there is every tendency that it’s gonna rise to that extent……our govt. Is such a shame

Indeed, it’s almost at 1000naira per dollar

Think out from Nigeria.. Sure, the system is just odd.if he is willing to stay rich and get richer, he should split his company and invest out off Nigeria. You can hardly manage a company in a country without a system. Yea, you get rich and then fall real fast. Best wishes to Dangote family

Ay Nigerian business that doesn’t earn revenue in USD will gradually fizzle our because the fiscal policies around here are not necessarily sound. It’s more of shooting from the hip where we sight an enemy and just shoot without really doing an in-depth analyses of the enemy. That’s what CBN has been doing.

Thank you very much.

We have missed out on several opportunities to create a global selling commodity.

I see an opportunity in regulated Marijuana. Here’s an excerpt from a piece:

“Nigeria is ‘Green’.

We can take the centre stage as a World Leader.

We have the capacity to be its world’s largest producer.

We have the strategic positioning to be its largest exporter.

We have the market and are already one of its largest consumers.

Cannabis is the new ‘crude’ waiting to be tapped.

The world is waking to the realisation of the great socioeconomic, sociopolitical and sociocultural importance of legal cultivation, production and consumption of recreational and medical Cannabis under proper state regulation.

We already cultivate it pretty good so much so that we maintain top 10 producers, despite destroying tons, annually.

We produce plenty unhealthy derivatives laced with highly toxic contaminants that still get consumed by our teaming youths craving ‘just a little more high’. Our entertainment industry is largely driven by creatives who use Cannabis recreationally.

The world over, Cannabis is growing into a mega industry. It has found its way into food and beverages with THC enriched wines and soda, hemp rich cakes and confectionery.

It is gaining grounds in pharmaceuticals with Cannabinoid preparations entering our shelves daily.

Our ethical concerns are founded but most of the ills are as a result of the illegalities around Cannabis that Uruguay, Canada and more recently South Africa have proven in the beautiful figures and impressive results month after month post legalisation of Cannabis.

We can sit back as always and let this economic tide pass-by, leaving us at the bottom of the food chain as good consumers or seize the opportunity and own the stage.

I call on our visionary members of the National Assembly with foresight, to sponsor the bill to legalise and regulate Cannabis in Nigeria, I volunteer to be of service in any way I can.

Nigeria is ‘Green’.”

Awesome commentary

I think dangote need to work on his comparative advantage by ensuring his product can scale to international market, thought with the refinery coming on board I expect his wealth to increase tremendously.

Create a product that’s totally dependent on local inputs and sell to the local market. That way, you’ll have no need for foreign inputs or patronage. You’ll then have a currency that’s stable.

He should be better off in the coming days. With the completion of the refinery and inflow in dollars for the sale of petroleum products, he would have enough cash to deal with the valuation issue. However, the issue will be the ability to convert the cash to assets that can be valued and added to his net worth.

I don’t think gathering naira is the issue. I think it should be the price of his stock. If dangote stock falls then it will affect his net worth cause networth is not based on cash at hand or in bank, it is only included. It his his overall asset including his stock which the junk of his money sprung from.

You are correct. The reference to “cash” is to note that the fundamentals have not changed. Yes, Dangote is still generating revenue in his business. The paralys is not related to lost of steam in his core business and ability to generate cash or grow but things beyond his control: currency. So, even if he does well and stocks marginally appreciate, the currency will affect everything when looked in USD.

I think Dangote will pick up immediately after his huge refinery project start.

So Dangote can also find himself in the position of 2014 by the grace of Almighty

One would think what Dqngote should be chasing after is global Billoniare rating more than the basic fact of meeting the consumer needs of African people.

He could as well abandon his local dominance and move his base to China so as to mentain the global rating ambition.

If one has to be recognized as a billionaire of international repute, his /her assets has to be denominated in internationally acceptable currencies. To achieve this, the products that generates those billions has to be sold at the International markets. I am yet to see Dangote cement sold in Home Depot or Lowe’s; in other words, exportable to advanced economies. He needs tons of naira to make it back to where he was in the billionaire club yesteryears.

Wisdom – a multinational industrialized conglomerate.

Nigeria is a high risk business environment with a junk ratings. Today we focus on Dangote but the reality is that virtually all businesses have been impoverished through currency devaluation. The stock exchange had plummeted in value. Savings and investment had plummeted in real value. Manufacturing sector has been paralysed thanks to currency devaluation. Dangote cannot compete globally because Nigeria is his comfort zone with lots of political patronage and support. Secondly, global market is currently in favour of technology driven products and services that requires high level of innovation and research, which is not dangotes strength. However, he can diversify his portfolio by investing in Google. Microsoft and other technology etc.

I wish him and the rest of industrialist in Nigeria good luck.

I think most times we seem not to understand the difference between economies of scale and cashflow economics. first we must understand that they is different between industrial ecosystem and the tech ecosystem and this will affect the national economy in unbound ways, let me explain, what I mean is that, you cannot scale a cement factory with zero cost but you can scale a tech product with zero cost, the dynamic are different, industrial ecosystem operates with the fundamental principle of cashflow and profit but the tech ecosystem operates on perception value, that is why a company with no profit, little or no asset will be worth more than 10x of a company with an establish revenue model, cashflow and profit system paying dividends to its shareholders. you see the like of Netflix, twitter, + others, no profit but market cap is something else, the same principle applies to the currency ecosystem also, naira is weak, very weak, dollar is strong very strong, why, naira cannot be scaled ( is not or cannot be traded or use worldwide due to value frictions) while the dollar on the other is being traded and used worldwide. so how do all these relate to dangote, the great industrial giant, has not lost revenue, neither profit or its cashflow but his wealth seems to have eroded because 1. he operates a business that cannot be scaled with zero margin 2. because he operates with currencies that are unscaleable (low value) dangote group would certainly be worth much more if it was founded and operated in America, ( hope you get the point). thou the great giant is trying to change that dynamic with the refinery, but as far as the world (developed countries) is concern that dynamics might not be as rewarding in the next 20years because autonomous electric vehicles would be shaking the oil market, however Africa is still there sha!!! so what can we learn from the great industrialist, 1. profit is king but we must build with the world in mind. if we are to remain relevant, locally and internationally we must adapt, change and create products and processes that have scalability and profit (not just revenue) systems. the truth be said dangote group is a great blessing to Africa, there are many things we can learn from it systems, great things –>especially the nigerian and africa tech guys, in case you don’t know even amazon learnt “accumulated capability construct” from dangote. before you eat me raw!!! please ask the great professor, I belief he can share more insight, however for the African giant to remain increasingly relevant on the world stage it must adapt, not by focusing on building more cement factories, but rather by building an hybrid ecosystem that is highly scalable and profit making. it must be ready to go into other scalable domain by diversifying into tech domains especially ecommerce, fintech, cryptech (dacoin) and other scalable domains, connecting the entire African continent to the world. dangote has the capacity, resources and grit to transform Africa and become the powerhouse that empowers Africans. to remain relevant, it is either you adapt or die!!!

Actually, you made great points. Warren Buffett was totally out of tech but today he is a fan of tech. There are not just many opportunities in this world outside of tech. The Indian richest man is having party everyday and he is the biggest tech investor in India. Dangote needs to look at tech.

you are absolutely right sir, opportunities in the industrial sector is becoming depressed on all metrics, including logistics, policies (especially with carbon emissions and the effort to protect planet earth), human resources ( the best guys are being absorbed by tech platforms and companies), just to say a few, the industrial age is living on borrowed time, technology is the new wave of power(data) and cash(paid value), therefore if the industrial giant of Africa is to remain relevant, it must upgrade it vision in line with the MARKET OF THE FUTURE, as the good book says” the place where there is no vision the people they perish”. reading the story of reliance jio, which is owned by India richest man, is but a case study, however the market is different, nonetheless dangote group has the capacity to use its global and local connections to bring about the transformation of Africa technology landscape, through leadership and its direct investment in tech systems and startups, which would definitely increase it marketcap in the global market. dangote group needs to become the ALIBABA OF AFRICA, or better!!! to remain relevant in the NEW Global Economy. the tech economy is the new wave it is either you swim or drown!!!