Starlink (and phones)

I’ve seen a lot of articles hailing Starlink as a panacea for all Africa based communication links, and drama about it disrupting the business of companies like MTN. Here is why they are often wrong, or at least an incomplete perspective.

Starlink, as the name suggests, is a satellite service. Satellite services support long distance transfer of data of many different types, such as audio and video streams, phone calls, Enterprise CRM and ERP systems, interbank data, internet services, and App platform services.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Satellite is not the only solution for data transfer. Initially, it happened over old copper networks only used for phone calls. Modern networks include Fibre, and Terrestrial Microwave Radio.

Traditional satellites are high orbit. The journey from the ground to the satellite takes about 550 milliseconds (ms). This is a round trip of 1100 ms (up and back down again). This time is called the ‘latency’ (sometimes ‘ping time’).

Much content we access online are different even though they may appear to have similarities.

Remote Procedure Calls (RPCs)

RPCs are used by a device like a laptop or phone, to ask for remote content. If a streaming service is a single stream, the device asks once, and the stream is initiated. The ‘latency’ of the connection is hardly noticed.

Modern Websites and Social Media however, are not single content entities. What may appear as one block has many sections in it, and each must receive a request separately. Many RPCs must happen to call up what may appear to be one single piece of content. While 1100 ms may not seem like a lot of time, when the use of RPCs scale to call up complex content, the type of content matters. Using transport media with lower latency matters hugely with complex content.

Tier 1 providers (aka internet ‘mirrors’) and ‘silos’.

Tier 1 providers (aka internet ‘mirrors’) are at the top of the food chain for sourcing internet content. They are all over the world, with the U.S. having more of them than any other country. They maintain copies of the internet in real time.

They have a peer arrangement between each other.

- They don’t pay to have their traffic delivered between them as they constantly update.

- Their peering relationship provides internet downstream through other providers and eventually to individual users.

- They peer on multiple continents. An RPC initiated by a device will pick the shortest route their providers service plan can offer.

- There is no Tier 1 on the continent of Africa.

Examples: AT&T, Arelion, NTT, Verizon, Tata, Telestra, Colt, Deutsche Telekom, CenturyLink, GTT, Orange Open Transit and Zayo.

‘Silos’ are separate datacentre content reservoirs owned by large social media or other operators that have closed systems with a lot of content relative to their services. They include Meta, Amazon, Google, Apple, Microsoft, and X (fka Twitter).

An RPC initiated by a device will pick content held by a ‘silo’ at a regional location if it is the shortest route to getting it. There is some silo content at various locations on the African continent.

Connectivity types and what Starlink is:

Traditional Geostationary Satellites have a roundtrip latency of 1100 ms as said. Fibre is much faster, and from an ‘average’ African location will complete roundtrip service with the nearest Tier 1 in about 300 ms. Microwave Radios are often used for extension across terrain where fibre is not workable for a variety of reasons. It’s also often used as a last mile solution. Microwave Radio will add an extra 20-40 ms roundtrip to the solution.

Starlink is a LEO (Low Earth Orbit) satellite.

Starlink’s satellites orbit about 550km above Earth. With much less distance to cover when sending and receiving signals, the latency is drastically reduced.

Negative considerations of LEO:

One geostationary satellite can cover up to 1/3rd of the earths surface. This depends on the band frequency. Examples are Ku band, Ka band, C band and L band. LEO low height means the footprint is tiny, and many satellites are needed for global coverage. As of August 2024, there are 6,350 Starlink satellites in orbit, of which 6,290 are working. LEO satellites are ‘point to multipoint’ in a ‘mesh’ network. This means information packets can travel from a satellite to closest available one(s), in addition to travel across connections with the ground. Starlink calls these ‘Inter-Satellite Link’ (ISL).

With none of the Tier 1’s (think Internet Mirrors) in Africa, the latency would be still better than geostationary satellite doing multiple ISL hops, but nowhere near fibre. Starlinks ideal environment to scale adoption, is where vast open spaces with no fibre exist, Tier 1’s are regionally available, and disposable income of citizenry is above global averages.

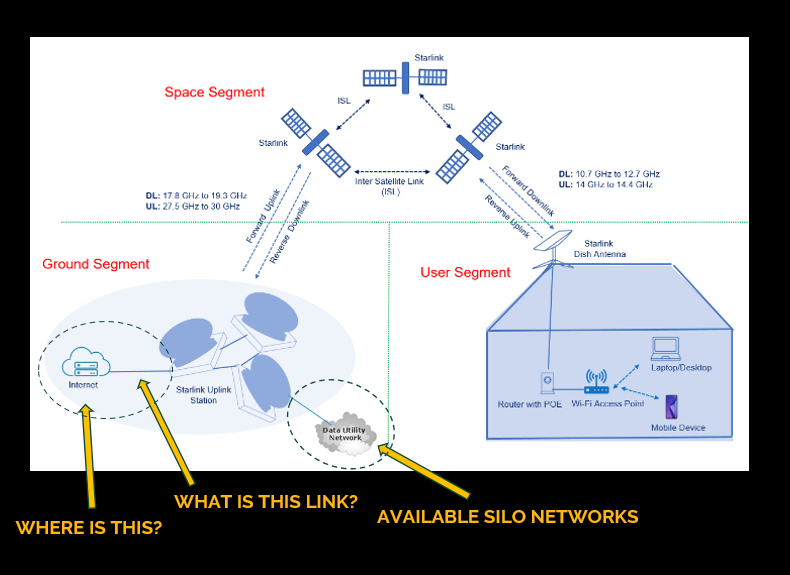

Generic Starlink Architecture – Segment Links

Securing BACKHAUL services from other data transport infrastructure owners.

In the generic architecture above, the Ground Segment is misleading. We have no idea what the link to the ‘internet’ is, and what is represented by the ‘internet’ cloud. In an African country, with no regional Tier 1, and variable access to ‘Silo Networks’ it’s unclear if performance will be anything like those broadly bantered about.

It’s quite possible in some climbs, the backhaul includes the same submarine cable services chosen by regional customer-end networks, and Telcos, and layering Starlink on top. When you examine that model, it can’t pay for Starlink.

Pricing seems to be focused on growth and market capture rather than profit.

Facing competition from Hughesnet and Viasat in one geography Starlink recently temporarily lowered its equipment prices from a steep $599 to $299. That’s lower than equipment costs from Hughesnet ($400 to $550) and essentially the same costs as equipment from Viasat ($300).

Equipment is proprietary.

I previously ‘owned’ a small project to refit an earth station at AUN (American University of Nigeria) in Yola. The project also needed to reposition the earth station, and provision it with a different (geostationary) satellite service provider. Starlink equipment will only work with Starlink. If the provider is changed the hardware is worthless. This would also be true of a phone service.

High Provision and maintenance cost.

While Starlink sattelites are relatively cheap, there are a lot of them there, and they cost a lot to launch. Being lower, they are subject to stratospheric and atmospheric elements. Having a very finite footprint, with thousands spread globally, they can’t all be launched from a single ‘best balance’ launch point and moved into position.

Community Gateways

Community Gateways are for large shared groups but they are a product alternative at the user segment end, and don’t mitigate where the other segments bring challenges for some climbs.

Starlink Community Gateway

Future Starlink Phones

Phones represent an alternative device solution at the User Segment end. They do not impact on the nature of the Space Segment or the Ground Segment in how they impact on both performance and cost of sales in different Geos.

If the service was in Lagos, it will either achieve ISL multi-hops or backhaul over submarine fibre – nearest Tier 1 for peering – Portugal. If the service was in Nairobi, it would either achieve ISL multi-hops or backhaul first over regional fibre backbone to Mombasa, and then over submarine fibre – nearest Tier 1 for peering – India.

Availability of Silo Networks may be different at both locations.

While the performance and cost of sales would be different, they are unlikely to offer users something better, unless again, they are focused on growth and market capture rather than profit.

Again if the provider is changed the phone is worthless. It cannot work as the way a handset using MTN can also be used for Airtel or Globacom.

A user in the US, Europe, Canada, Australia or India for example would have higher performance, and lower cost of sales, because a Tier 1 internet mirror would be located locally or regionally, within fibre backbone reach.

Other articles and posts about Starlink.

Many third party articles appear from time to time brining their own technical opinion fused with those of technojournalists, and the Starlink site. Most of them fail to expose granular data on the Ground Segment, which can have a huge impact on performance, and cost of sales, and can massively vary from one location to another, most especially across different African geos.

This situation would work equally for phones as it would for premises services.

It’s important to understand any market prices kept artificially uniform by Starlink, cannot do so indefinitely and at some point will have to become a function of cost of sales.

No nitty gritty geo contrasts on ‘cost of sales’ appear in articles.

Parallels with Bouquet Content Services (example Multichoice DSTv) in Africa and Netflix

As an aside, articles comparing these similar services for the market, frequently focus only on the relationship between the cost of content to providers and the charge to users.

This is also an incomplete comparison. Why?

The cost of internet is metred in Africa and shows high variances. Though there are some exceptions there is a general trend for East Africa to be cheaper to source internet than the West.

A user with Netflix will additionally have to pay for internet, and may even have such poor bandwidth it severely impacts the user experience. Services like DSTv however have their own carrier media bundled in the subscription price. This is rarely highlighted in comparisons, and on the rare occasions it is, it lacks sufficient detail for the comparison to be valid.

Conclusion

Dig very deep on costs and comparisons. Ask for a trial if possible. Seek price continuity information on Starlink, and explore hardware buy-back options you may be able to persuade a vendor to undertake. Ensure you get full contractual terms agreed in writing.