I recently read an interesting piece by Prof Ndubuisi Ekekwe on the record profit margin enjoyed by Airtel Nigeria even as ARPU dropped after adopting a new business model which effectively outsourced its infrastructure to partners whilst investing in customer service and experience.

For mobile operators, the Radio Access Network (RAN) accounts for 60% of its CAPEX while the electricity cost at the Base Stations accounts for 41% of the OPEX incurred per year. Hence, shifting this burden to partners is no doubt a good move for Airtel Nigeria and strongly highlight the need for telcos to keep innovating and developing new business models to stay ahead in this era of disruptive technologies.

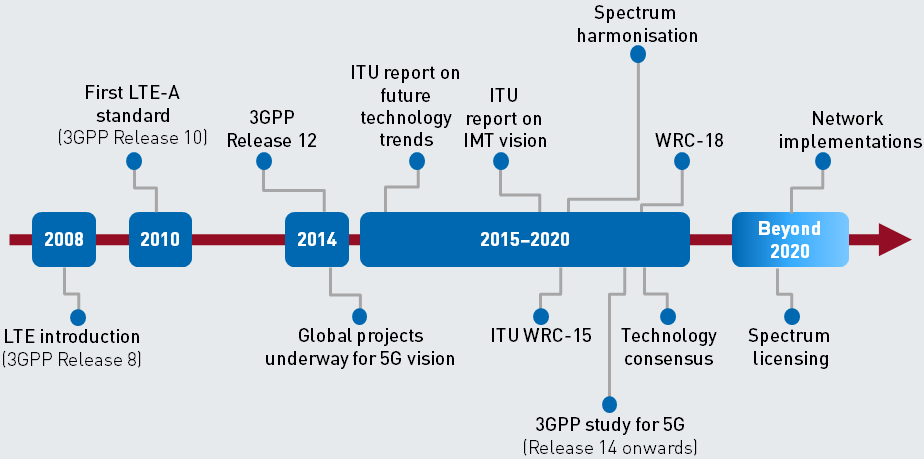

The World Radio Congress (in 2019) will soon be upon us and the world awaits the flurry of early launches, tests, prototypes and spectrum debates. The race is on to ascertain which country will be the first to deploy 5G connectivity and some misconception are beginning to arise that the first country to deploy 5G will gain a global superior advantage. While this may not be true, China seems to be taking the lead as a result of its ‘Made in China 2025’ program.

Register for Tekedia Mini-MBA edition 17 (June 9 – Sept 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.

On the other hand, this is good news for equipment vendors as the 2018 market for telecoms infrastructure was projected to decline; 5G can certainly help change these predictions.

For telcos, the profit margins from consumer technologies no longer justify the huge investment needed to leap onto a newer generation. This sums up the notion that 5G would represent a shift from consumer technologies to industrial technologies. Verticals (in health care, factories, automotive industry etc.) thus represents a new market opportunity for telcos.

Network Slicing, Virtualization and Cloudification are being introduced within networks to cater for the different needs of the verticals and open up the potential for outsourcing models e.g. Network as a Service, Radio as a Service. Some telcos have expressed unwillingness in adopting outsourcing models as they would like to fully control their network but this may change in the future. These models however mean that the networks are becoming software based and may yet become another cloud service; hence it’s important for telcos to improve their capabilities in this regard;

Even though verticals represent new business opportunities, there are so many unresolved issues that need to be ironed out before telcos can justify the investment in 5G. Different verticals have different requirement and are in different digitization stages. The most obvious use case for 5G has been the automotive industry. But it is not sure if Car makers would be satisfied with slices of MNO networks or perhaps own and control their own network. Latency is a key requirement here as it becomes very dangerous if the car is waiting around and looking for the best signal reception to make a decision regarding collision. Standards, regulations, Global Harmonization of Bandwidth, Transparency, Security and Privacy concerns etc. have to be dealt with before any major deployment. According to ABI research, the automotive industry is nowhere ready to deploy 5G. In fact, Retail, Health care and Government etc. are the most promising sectors. This shows the lack of disconnect between service providers and the industries they intend to serve.

One thing is clear, presently, verticals do not represent a quick win for telcos. And there is no magic bullet regarding the choice of business model to implement. The best business model will need to be innovative, flexible and adaptable in response to the agile environment presented by disruptive technologies.