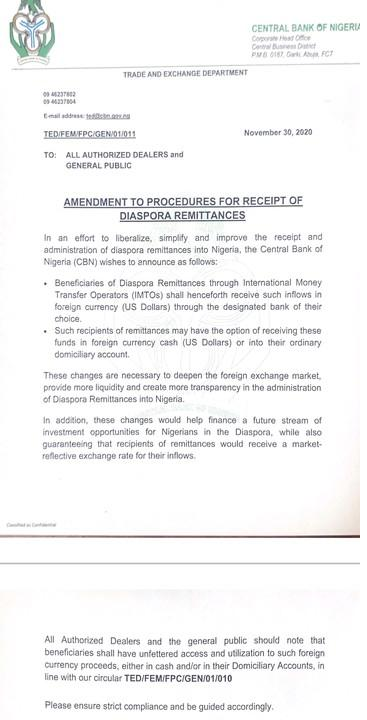

The Central Bank of Nigeria (CBN) has updated its policy and we need to commend the apex bank. In a memo dated Nov 30, 2020 (see below), the bank reversed its policy, making it possible that remittance can be wired into a domiciliary account in Nigeria, with the recipient having access to the money in the foreign currency (say US dollars).

In an earlier directive, the bank had removed that flexibility, pegging it around N388 per US$1, and that necessitated an uncommon rally against the Naira in the global currency market, hitting close to N500 per dollar. What happened was simple: people moved out of the formal system, and went informal and that pulled tons of supply in the local market.

“Please be advised that the applicable exchange rate for the disbursement of proceeds of IMTOs, for the period Monday, November 30th to Friday, December 14, 2020, is as follows.

-

IMTSOs to banks – N388/1USD

-

Banks to CBN – N399/1USD

-

CBN to BDCs – N390/1USD

-

BDCs to end-users Not more than N392/1USD

-

Volumes of sale for each market is USD10,000.00 per BDC”, from a Central Bank of Nigeria (CBN) circular.

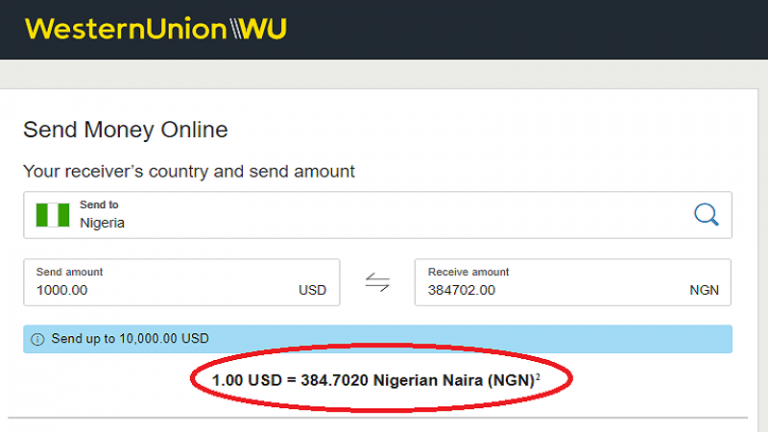

But CBN has done the right thing; now, Western Union and others need to update. As I write, Western Union is still offering N385 per US dollar with no option for the recipient receiving in foreign currency in Nigeria. I am not sure it has a market opportunity under the new policy from the apex bank.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

When we write here sometimes, some take it as criticizing governments. No way, we are just offering opinions, giving back feedback on how their policies are affecting We The People. If you read deeper with an open mind, there is no animosity or agenda: we just want a working Nigeria. If we do not provide feedback, governments may even struggle to know how their policies are affecting our lives.

For members asking for the implication of the new Central Bank of Nigeria (CBN) policy, this comment explains everything. Simply, CBN has made it possible to increase the supply of dollars, moving the equilibrium point in the supply and demand of the US dollars.

Prof, the directive on remittance on flexibility to receive cash or get lodged in DOM account is entirely a reversal of an old policy enacted around 2015 or so.It is actually a massive move now.What they reversed from recent pronouncement is flexibility for export proceeds owners and owners of balances in DOM account to use funds as they so wish.

I believe Naira will land at 390-395 eventually at the parallel market.

What the new policy on remittance did was to create millions of sellers feeding the parallel market in combination with export proceeds inflow element that has traditionally met demand in that market.

Banks will feel the impact of this IMTO remittance tweak and new remittance start ups operating on Naira settlement model for arbitrage may be unable to pay in dollar, hence may just die off.

Good policy changes for the FX market in my view.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

The previous policy was shortchanging people at an alarming rate, the differentials are sometimes closer to N100, that’s a lot of money to part with; such level of extortion is legendary. But in a country where you have policies without conscience, anything can get a pass.

As for people reacting differently to what we do here, well, here is a fusion of boardroom, classroom, markets, public policy, the masses; so anyone struggling to come to terms with all of these, we may not be able to help his/her emotions.

Those in government read here, and they are expected to adjust, after reading.