It is very hard to setup a technology startup, in Africa. One reason is the dearth of investors with capacities to make visions become realities. Across most African cities, technology-enabled entrepreneurs continue to struggle, without capital to scale. They look for investors, they rarely find them.

It is well established that some of the richest men in Africa did not make money through technology. The implication is that most do not understand that sector. So, they are cautious to put money in areas they do not have good domain expertise. You do not blame them – they cannot play chess games with their resources.

There is also the fact, in some countries like Nigeria where some politicians and ex-military men are extremely rich, but yet fearful to invest in companies, because they could be asked to show the sources of their funds. (One evidence against Olisa Metuh, former PDP spokesman, in his trial, was an investment.) To avoid that beaming of high voltage searchlight in their lives, they simply “bury” the money in their yards or build houses no one can afford to rent.

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

So without much support from home, African entrepreneurs begin the journey of looking for capital in North America and Western Europe. After all, they do read how companies have raised capital and they are certain, they have got great business plans to compete. Unfortunately, informally, 99% fail because at that level, there is really nothing to invest in. from the angle of the investors.

Nature of Global Venture Capital

One of the most challenging sectors in the world is the VC sector.It looks easy from the outside – get money from rich people, distribute same through investments to smart people building companies. Then follow-up and then wait for the value to be created. Sooner or later, everyone is rich! It is largely a sweet world, except that is not really what happens.

The VC industry is merciless. Most doing it fails miserably. And that makes them so fearful to invest in unknown entities or markets like Africa, with no largely demonstrated records of generating huge value.

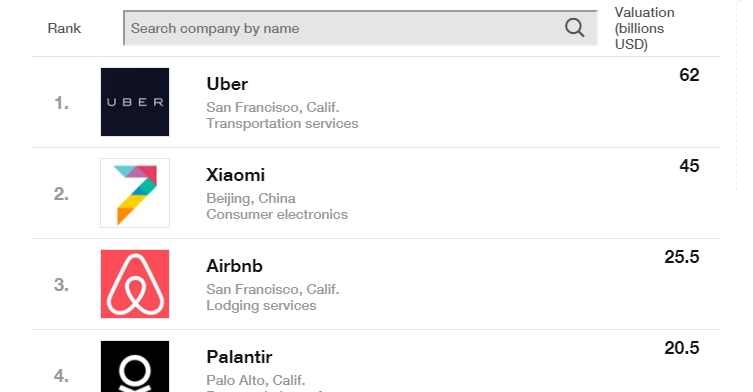

If you visit the Fortune Magazine’s The Unicorns List, you can see a very interesting trend – nothing of huge interest happens outside of the top 20 companies; the top 20 unicorns account for more than 50% of the entire list of 121 companies. (A unicorn is a tech-enabled private company with a valuation of at least $1 billion.)The top five or so (Uber, Xiamio, Airbnb, Palantir, Didi Kuadi) take more than 20% of the entire list.(I removed Snap which had since gone public in the list). In other words, the value in most private companies are concentrated in the top 20. Though I have focused on using the Fortune unicorn list which tracks technology private companies with valuations of at least $1 billion, the trajectory is correct because that list is global.

Some unicorns in Fortune Unicorns List

A power curve of the whole 121 unicorns shows that is concentrated at the top 20

If you take those valuations into a power curve, the trend becomes more visible, as noted in the plot above.. So, anyone that is outside the top 20, as an elite VC, is not doing well. Since a VC will not likely invest in all of them, the play is to make sure that it is in one. They have this feeling that they do not want to miss out, so all efforts are concentrated at the top, because that is where the value is created.

Uber’s valuation is largely the same as the GDP of Kenya.. This means that you cannot necessarily be having Uber in Kenya. (Sure, this statement can be challenged since Uber is asset-light and can be born in Kenya. Yet, even if Uber was made in Kenya, they could have considerred the size of the home market in its valuation.) But the fact is: while will an elite VC pursue opportunities in Kenya, if it can get into top companies like Uber, where that is possible? With these mindsets, they can take Africa as a secondary market which becomes like a backup when the sources of great returns, usually in America, are out of reach.

Besides, most times, it is winner-takes-all. Most times the unicorns dominate their areas and domains. Once they have taken control, no one around the world and especially Africa will be of relevance in that category. It is that mindset that makes it challenging to breakthrough when you want to raise money from foreign investors. By the network effect in most technology areas, the number of potentially great companies are limited. You have few great ones and then all-rans because one, the category-king, the winner, had locked the value, in a category.

The African Challenge

We have a really challenging issue because top VCs have the methodologies to win big or lose big. The greatest VCs lose, most times, the most money, but they also win BIG. That winning big compensates for all the misses. For example, you can invest $10 million and lose it but another $10 million investment can turn into $500 million. An average VC will not bet like that, being so cautions not to lose that $10 million. However, it rarely has the opportunity to make that $500 million, also. Owing to this scenario, what matters is the market size. If they do not see how the size of the market can justify that winning big, they do not show interests. It simply means, win, they lose, and loss, they lose, since even what you may think is winning may not be enough for them. Owing to that, they show no interest to business plans addressing small markets or market segments.

So, what happens – you are now left with lower tier VCs who cannot get into the left-hand side of the power curve where the game is played and where most of the value is created. Unfortunately, those lower tier VCs are extremely cautions – they hate to miss a strike. That is their inherent characteristics. The implication is that they waste your time, and at the end, you get the message that they cannot invest.

The market makers that hit big and lose big need to show interests for us to get our moments. Until we get their attentions, the struggle will continue. We need people who can take risks, not overly cautious investors that largely add marginal value, who always want you to be post-revenue, when it is obvious you cannot execute without capital.

Making Them To Come

I do think governments across Africa must offer tax-holiday on VC capital over ten years to get them interested in Africa. We need to offer something to unlock capital so that we can build our future companies. The money invested will not be taxed along with the proceeds from exits. If we do so, Africa will see massive growth in the VC sector.

Rounding Up

Africa will continue to struggle in attracting investments in technology-enabled companies until we can attract a new category of investors that really want to win big. At the moment, we are getting attention of over-cautious investors who are not necessarily the elite. The elites play hard and also win or fail hard. They make category-kings possible because they invest in things most have never invested on. In other words, they know how to take risks. They do not over analyse scenarios and run due diligence for months, hoping during that time, you might have magically succeeded only for them to join the party. People like Peter Thiel, Andreessen Horowitz and John Doerr are desperately needed to show interests in Africa. They are people that can catalyze the local entrepreneurs to take more risks and also unlock the untapped opportunities in Africa by giving them resources. Without such investors, African will continue to struggle in scaling great ideas in our continent. I recommend for African Union to lead a 10 year tax-holiday on VC capital and associated proceeds in Africa.

image credit: allaboutunicorns

---

Register for Tekedia Mini-MBA (Feb 10 - May 3, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.

[…] In this video, I explain why Africa needs to stimulate its VC sector with tax incentives. The supporting article is here. […]

[…] of Agriculture in Nigeria to support digital companies. Government could even do it better: offer free tax to Venture Capital firms for 10 years to enable them come and help us build the businesses of the […]