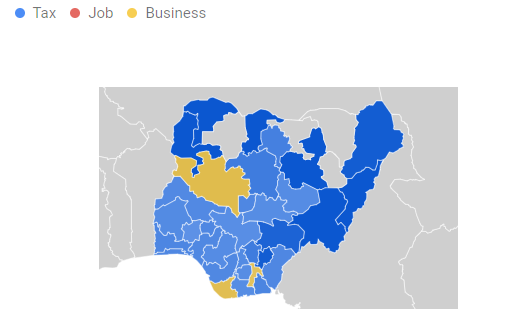

As Nigeria navigates significant reforms across sectors, a look at the nation’s search trends reveals a telling narrative of public priorities. A heatmap of Nigerians’ search interests over the last 90 days highlights three critical themes: tax, jobs, and business. Dominated by tax (blue), punctuated by business (yellow) in select southern regions, and barely touched by jobs (red), this map reflects the anxieties, aspirations, and regional disparities shaping the lives of millions. These insights hold powerful implications as Nigeria transitions into 2025.

Source: Google Trends, 2024

The Tax Dominance: Widespread Anxiety or Increased Engagement?

The dominance of tax-related searches across Nigeria signals a collective reckoning with the government’s drive to expand its revenue base through taxation. With the gradual decline of oil revenues, the federal government has ramped up tax reforms, introducing measures to expand the tax net and enforce compliance. While this strategy may secure much-needed revenue for development, it also places significant pressure on citizens and businesses, especially in a struggling economy.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

For individuals, the surge in tax-related searches likely stems from confusion or apprehension about new policies and compliance requirements. Many Nigerians, particularly in the informal sector, are unfamiliar with digital tax systems or are wary of their implications. For businesses, especially small and medium-sized enterprises (SMEs), these concerns are magnified. Compliance costs, fears of punitive measures, and uncertainty about how taxation will impact profitability are driving the heightened interest.

Implications for 2025

The government must prioritize large-scale awareness campaigns to demystify taxation processes. Simplifying compliance and addressing public concerns will foster trust and voluntary participation. Citizens are more likely to embrace taxation if they see tangible benefits from their contributions. The government must transparently demonstrate how tax revenues are being utilized for the public good. Policies must carefully balance revenue generation with economic stimulation. Overburdening businesses or individuals risks stifling entrepreneurship and productivity.

Business: A Southern Story of Resilience and Opportunity

The regions highlighted for business-related searches—predominantly in southern Nigeria—reflect the country’s commercial nerve centers. Lagos, the epicenter of economic activity, and its surrounding states have long been hubs for entrepreneurship and innovation. Despite inflation, currency devaluation, and other macroeconomic challenges, Nigerians remain committed to building businesses as a means of self-reliance and wealth creation.

This focus on business also emphasises regional disparities. The absence of significant interest in northern and interior states highlights unequal economic opportunities. Structural challenges, including poor infrastructure, insecurity, and limited access to capital, continue to stifle entrepreneurial growth in these regions.

Implications for 2025

The government must address regional imbalances by promoting economic activities in underdeveloped areas. Incentives for investors and improved infrastructure can help bridge the gap. Providing affordable access to credit, reducing bureaucratic hurdles, and offering mentorship programs can further bolster entrepreneurial success, particularly in high-potential regions. As Nigeria’s economy increasingly digitalizes, investing in technology for business growth—such as e-commerce platforms, digital payment systems, and training—can unlock opportunities for a broader population.

Jobs: The Quiet Crisis

The near-absence of job-related searches on the map is a striking observation, considering Nigeria’s persistently high unemployment rates. This silence could mean two things: either Nigerians are disillusioned with formal employment opportunities, or they have shifted focus toward entrepreneurship and informal work as alternative pathways to survival.

Nigeria’s youth, who represent a significant portion of the unemployed population, face particular challenges. The disconnect between the skills they possess and the demands of the job market continues to widen. While government programs aimed at reskilling and job creation exist, they have yet to yield visible results at scale.

Implications for 2025

Targeted programs to equip young Nigerians with market-relevant skills will be critical. Apprenticeships, vocational training, and partnerships with private sectors can create pathways for employment. Beyond traditional roles, government and private sectors must invest in emerging industries like technology, renewable energy, and creative arts to absorb Nigeria’s growing labour force. Policies must reduce barriers to employment, such as restrictive labour laws, and incentivize companies to hire locally.

A Pathway to Shared Prosperity

The interplay between these three themes—tax, business, and jobs—reveals the complexity of Nigeria’s socio-economic landscape. It also presents an opportunity for the government and stakeholders to align reforms with the aspirations of the people. As Nigeria enters 2025, these are the key takeaways for policymakers:

Nigerians are increasingly engaged with policies affecting their lives. Transparent governance, equitable resource distribution, and consistent communication will build the trust needed for successful reforms. Economic policies must consider the diverse realities across regions. By addressing structural barriers and providing tailored support, the government can ensure no region or group is left behind.

With the informal economy dominating Nigeria’s labour force, supporting this sector is crucial. Formalizing businesses, offering tax incentives, and providing access to markets can yield significant economic benefits. Education, skills development, and healthcare are foundational to sustained growth. Strategic investments in these areas will prepare Nigerians for a competitive global economy.

Charting the Course for 2025

The heatmap of search interests is more than just a snapshot of curiosity—it is a mirror of Nigeria’s present struggles and future potential. As the nation moves forward, political leaders must recognize that taxation, entrepreneurship, and employment are not isolated issues but interconnected threads of a larger narrative. Addressing these priorities holistically, with a focus on equity and inclusion, will not only stabilize the country in the short term but also set it on a path to prosperity.

The road to 2025 is both challenging and promising. By listening to the voices behind the data, Nigeria can craft policies that resonate with its citizens’ needs and aspirations, building a future where opportunity is accessible to all.