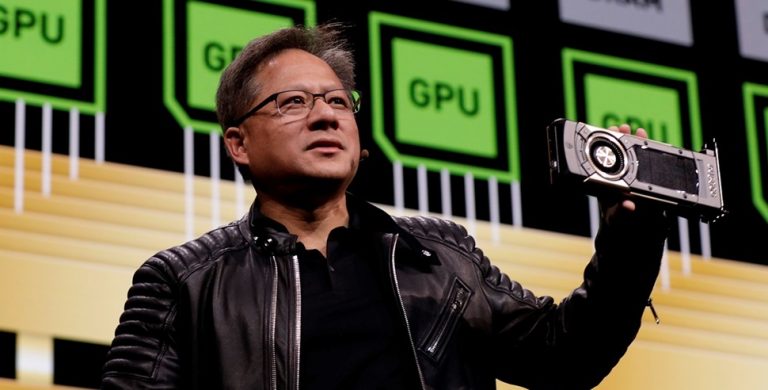

The CEO of Nvidia Jensen Huang, during the company’s shareholder meeting on Wednesday, disclosed the strategy it plans to use to maintain its AI market leadership amid its recent stock decline.

During the meeting, Huang attributed Nvidia’s advantage in Artificial Intelligence (AI) chips to strategic decisions and significant investments made over a decade ago. He highlighted the company’s early commitment to AI technology, which included billions of dollars in investments and a dedicated team of thousands of engineers.

These remarks are coming after Nvidia stock surged 200% over the last year, driven by Wall Street’s admiration for the company’s dominant position in the AI chip market. Recall that earlier this month, the company achieved a remarkable feat, after it surpassed a $3 trillion valuation, briefly holding the title of the world’s most valuable public company.

Tekedia Mini-MBA edition 15 (Sept 9 – Dec 7, 2024) has started registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

However, despite these achievements, the company reported a 13% decline in its stock price, after falling three times in a row which sparked broader market concerns. The company shares fell 6.7% on Monday which wiped $430 billion off its value, that saw the company move back to third place globally, behind Microsoft and Apple which have a market cap of $3.33 trillion and $3.19 trillion respectively. Also, the chip maker’s losing streak saw it become the fourth-biggest loser in the S&P 500 on Monday.

Addressing this as well as competition concerns, Huang outlined Nvidia’s strategy to maintain its market dominance amid rising challenges from traditional chip makers. He emphasized the company’s transformation from a gaming-centric company to a data center-focused enterprise. This shift is designed to explore new AI markets, such as industrial robotics, and forge partnerships with major computer makers and cloud providers.

According to Huang, Nvidia’s AI chips offer the lowest total cost of ownership, implying that while competitor chips might be cheaper upfront, the company’s solutions are more cost-effective in terms of performance and operational expenses.

In response to one shareholder’s question about the company’s plans for quantum company’s plans for quantum computing, he stated that he thinks practical quantum computing is still a couple of decades away, and that when it arrives, computing algorithms will be a combination of accelerated and quantum approaches.

Asked about how Nvidia is addressing the tight market for semiconductor manufacturing capacity, he said the company has the expertise and scale to develop a resilient supply chain. Huang added that the company could enter long-term supply agreements or prepay for manufacturing capacity to ensure it can meet customer demand.

Ultimately, Huang said Nvidia had achieved a virtuous circle, a term in the technology industry that refers to when a platform has the most users, which allows it to make the improvement it needs to attract more users. CNBC reports that the company’s shareholders were pleased with the performance and approved a non-binding vote on executive compensation called “Say on Pay”.

Notably, several analysts are however bullish on Nvidia’s stock price, predicting a massive surge before the end of the year. Citi Research analyst Atif Malik boosted his price target on Nvidia to $150 from $125, maintaining a buy rating on the stock. He highlighted the potential for AI models that not only respond to requests but can make decisions and act autonomously to drive a new wave of demand for Nvidia’s chips.

Also, Research founder Ray Wang who spoke on CNBC’s Squawk Box on Monday said Nvidia’s upward trajectory is going to continue for the next 18-24 months, further disclosing that the decline in the company’s stock and share price is the perfect time to buy the dip.

Despite Nvidia’s dip in stock price, the company’s strategic foresight, substantial investments, and focus on expanding its AI market reach and partnerships are poised to sustain its leadership position in the AI chip market.