Hedge fund manager Eric Jackson has made a bold prediction regarding Nvidia’s stock performance, forecasting that it will reach $250 per share by the end of the year.

This projection implies a potential upside of over 100% from its current trading levels, positioning Nvidia to achieve a remarkable $6 trillion valuation. Jackson, who utilizes a proprietary AI and machine learning-driven algorithm at EMJ Capital to pick long and short tech equities, believes Nvidia’s historic rally will continue throughout the year.

Nvidia shares have been at the forefront of the market rally this year, soaring over 150% year-to-date. The company executed a 10:1 stock split this month, with shares closing at $123.99 on June 27. This stock rebound follows a significant price correction earlier in the week that saw Nvidia lose over $400 billion in market value due to a 16% drop. Despite this setback, Jackson maintains that Nvidia is trading cheaply based on its valuation metrics.

Tekedia Mini-MBA edition 15 (Sept 9 – Dec 7, 2024) has started registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

Jackson highlighted Nvidia’s price-earnings (P/E) multiple trends over the past five years, noting that the average forward P/E multiple has been 40 times. Following the recent correction, the forward P/E was 39 times. Historically, Nvidia’s P/E multiple has exceeded 50 times on three occasions and approached 70 times twice, indicating potential for further growth.

“We just haven’t seen that euphoria yet,” Jackson told CNBC, suggesting that investor excitement could propel Nvidia’s valuation closer to its historical peaks.

Understanding the P/E Ratio

The P/E ratio is a widely used measure to value a company’s stock, calculated by dividing the share price by the earnings per share.

A higher P/E multiple generally indicates that the company is overvalued, meaning investors are paying more for each dollar of earnings. Jackson believes that as investors focus on Nvidia’s future earnings potential, particularly for 2024 and 2026, the stock’s P/E multiple could rise significantly.

“This is a high flyer,” Jackson noted. “Expectations can reset on a bad earnings report, but they can also get equally overhyped on good news. Despite the enormous run the stock has had, the euphoria hasn’t yet caught up in terms of the go-forward multiple.”

This sentiment suggests that Nvidia’s stock could see substantial gains if investor enthusiasm aligns with strong earnings reports.

Nvidia’s Historic Rise

Nvidia recently stunned the world by emerging as the most valuable company in the world, surpassing tech giant Microsoft. This monumental achievement marked a significant milestone for Nvidia, which has been consistently pushing the boundaries of innovation in the tech industry.

On June 2, Nvidia and leading computer manufacturers introduced a new lineup of systems powered by Nvidia’s Blackwell architecture. These systems are designed to build AI factories and data centers to drive generative AI breakthroughs.

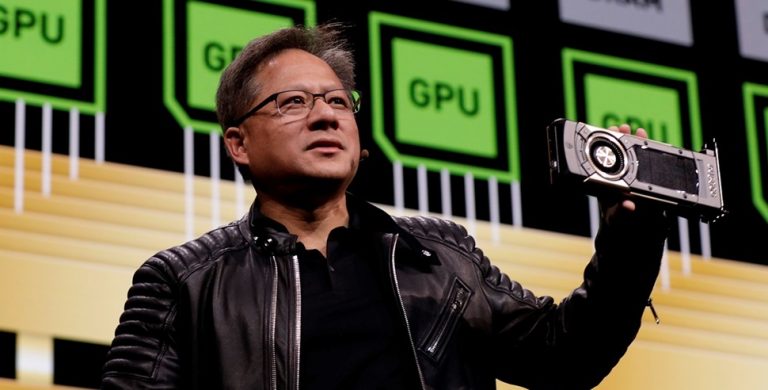

“The next industrial revolution has begun. Companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center—AI factories—to produce a new commodity: artificial intelligence,” Nvidia CEO Jensen Huang stated.

Nvidia’s Blackwell products will leverage the Nvidia MGX modular reference design platform to enhance performance for large language model (LLM) inference and data processing. Nvidia MGX aims to meet the faster computing needs of data centers, offering computer manufacturers a reference architecture that enables the quick and cost-effective design of over 100 system configurations.

Jackson believes that as the market recognizes the success of Blackwell chips in the second half of the year, coupled with favorable gross margins and the anticipation of upcoming Rubin chips, investor euphoria will drive Nvidia’s valuation higher.

“I think we’ll start to see that euphoria reflected in a lofty go-forward price-earnings multiple, and if that happens, this thing can go to a $6 trillion market cap,” he asserted.

Nvidia’s Competitive Edge

Jackson noted Nvidia’s significant advantage over its rivals, dismissing comparisons to Cisco during the dot-com bubble as unfounded.

“This is not Cisco in the dot-com era,” Jackson remarked. “Back then, Cisco’s go-forward P/E multiple got to a peak of something like 136 times. Again, we’re below the mean for the last five years. So even though the stock has done so well, it is still relatively cheap compared to where it was trading in the past.”

Despite Wall Street analysts’ bullish long-term outlook on Nvidia, Jackson acknowledges that positive sentiment does not shield the company from share price corrections. The recent 16% drop in Nvidia’s stock price serves as a reminder of the volatility and potential risks in the market.

Nonetheless, Jackson’s confident projections suggest that Nvidia’s journey towards a $6 trillion valuation is far from over, provided that investor enthusiasm and favorable earnings reports align in the coming months.

The Path to a $4 Trillion Valuation

Jackson is not the only one who has expressed this confidence about Nvidia. Numerous analysts and investors have expressed optimism that Nvidia will be the first company to hit the $4 trillion valuation threshold. This ambitious target is driven by Nvidia’s dominant position in the AI and data center markets, where its advanced technologies are becoming increasingly essential.

The company’s ability to innovate and adapt to the evolving tech landscape has solidified its reputation as a market leader.

Nvidia’s commitment to advancing AI technologies is evident in its recent product launches and strategic partnerships. The introduction of Blackwell chips and the development of AI factories represent significant steps toward leading the tech industry. These innovations are expected to drive substantial growth and profitability for Nvidia, further supporting its valuation targets.